International Paper 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 International Paper annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22%

PERCENTAGE OF

TOTAL REVENUE

PRINTING PAPERS

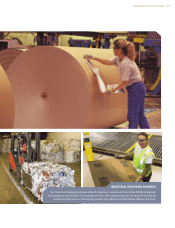

International Paper produces some of the best-known and highest quality paper

brands in the world, including Hammermill®, Chamex®, Rey®, and Svetocopy®, as

well as numerous private labels. International Paper’s Printing Papers businesses

offer nearly every form of uncoated paper used in home offices and businesses,

as well as envelopes, file folders, and tags. The Printing Papers business spans

North America, Latin America, Europe, Russia and India. Within this business,

International Paper also produces fluff and market pulp for a variety of uses around

the globe including diapers and personal hygiene products.

2012 was a significant year for the Printing Papers business as we strengthened

our long-standing tradition of excellence and positioned the business for even

greater success. In 2012, the cumulative growth in our worldwide printing papers

volume across all of our segments and geographies outpaced the global growth

rate of the uncoated free sheet market. While uncoated free sheet demand is in

manageable secular decline in North America, demand for our uncoated free

sheet is growing at faster rates in emerging markets than the declines seen in

North America. IP Russia, which anchors our European Papers business, achieved

a record earnings year. In Brazil, where International Paper is the number one

uncoated free sheet supplier, our Printing Papers business has realized continued

margin and mix growth. As demand continues to expand in the vibrant Latin

American market, Brazil is well-positioned to capture opportunities to grow with

customers across the continent and further improve mix and margin.

International Paper has the right people, the right assets and the right strategy to

win with customers in the Printing Papers business. By pursuing global growth,

optimizing our global acquisitions and finding ways to reduce costs, International

Paper’s Printing Papers business is well-positioned for continued profitability

with better than cost-of-capital returns and strong free cash flow generation.

INTERNATIONAL PAPER’S PRINTING PAPERS

BUSINESS OFFERS NEARLY EVERY FORM OF PAPER

USED IN HOME OFFICES AND BUSINESSES

PRINTING PAPERS

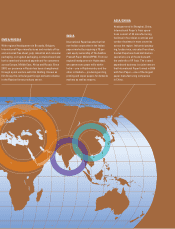

44%

North

America

1%

Asia 3%

India

22%

Europe &

Russia

18%

Brazil

12%

Market

Pulp

PRINTING PAPERS

REVENUE MIX