Hyundai 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

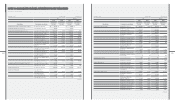

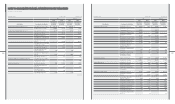

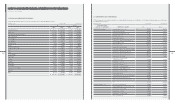

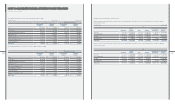

Company providing Amounts of Translation into

Consolidated Subsidiaries guarantee of indebtedness guarantee $ (Note 2)

Hyundai Rotem Company The Export-Import Bank of Korea SGD 6,409 5

TWD 31,870 1

CNY 69,820 11

OMR 9,997 25

EGP 15,000 3

TND 2,000 1

BRL 6,000 4

KRW 1,155 1,014

Korea Exchange Bank KRW 3,463 3,041

INR 6,287 1

USD 399 1

EUR 4,064 5

SGD 2,662 2

VND 9,633,725 1

BNP Paribas USD 7,620 8

ANZ Bank NZD 40,893 32

Hyundai Card Co., Ltd. Seoul Guarantee Insurance Company KRW 5,166 4,536

Hyundai WIA Corporation The Export-Import Bank of Korea USD 1,990,000 1,990

JPY 135,000,000 1,656

Shinhan Bank EUR 10,000,000 13,290

USD 428,500 429

Kookmin Bank EUR 3,728,400 4,955

USD 4,246,540 4,247

JPY 253,444,000 3,109

Woori Bank USD 4,424,831 4,425

Machinery Financial Cooperative KRW 75,756,640 66,517,376

Korea Defense Industry Association KRW 131,304,430 115,290,570

Seoul Guarantee Insurance Company KRW 38,755,169 34,028,597

Autoever Systems Corporation Seoul Guarantee Insurance Company KRW 1,241 1,090

Korea Software Financial Cooperative KRW 28,015 24,598

M & Soft Co., Ltd. Seoul Guarantee Insurance Company KRW 503 442

Hyundai Capital Services, Inc. Seoul Guarantee Insurance Company KRW 204,560 179,612

(continued)

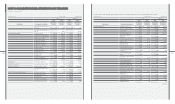

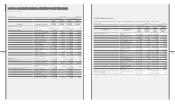

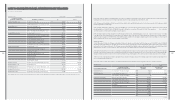

Hyundai Motor Company [in thousands of US$]

December 31, 2010 and 2009

Company providing Amounts of Translation into

Consolidated Subsidiaries guarantee of indebtedness guarantee $ (Note 2)

Haevichi Country Club Co., Ltd. Seoul Guarantee Insurance Company KRW 151 133

Hyundai METIA Co., Ltd. Seoul Guarantee Insurance Company KRW 2,661 2,336

Kyungnam Bank JPY 700,000,000 8,587

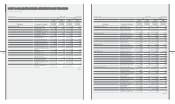

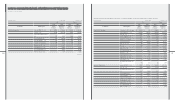

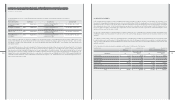

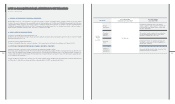

(8) The Company made an agreement with its European sales subsidiaries and agents for them to be responsible for projected costs for dismantling and

recycling vehicles sold in corresponding countries to comply with European Parliament directive regarding End-of-Life vehicles (ELV).

(9) In 2006, the Company sold 10,658,367 shares of Hyundai Rotem Company to MSPE Metro Investment AB and entered into a shareholders’ agreement. MSPE

Metro Investment AB is entitled to put option to sell those shares back to the Company in certain events (as dened) in accordance with the agreement.

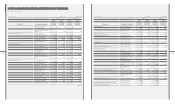

(10) Hyundai Capital Services, Inc., a domestic subsidiary of the Company, made a credit facility agreement on a US$ 1,000 million renewable one-year

revolving credit facility up to 3 years to be provided by General Electric Capital Corporation (the “GECC”) to Hyundai Capital Services, Inc. on January 13,

2009. Under the terms of such agreement, Hyundai Capital Services, Inc. shall pay commitment fee of 3M Euribor+631bp for the usage of facility and 28bp

for the remaining. Also, the maturity of individual draw-down is within 1 year from the time of withdrawal and in case of termination, the maturity for previous

withdrawals can be extended to 1 year from the time of termination. In addition, Hyundai Capital Services, Inc., GECC and the Company made a support

agreement on credit facility agreement on the same date of the credit facility agreement. According to the support agreement, when Hyundai Capital Services,

Inc. cannot redeem in a year after the withdrawal, GECC has the right of debt-to-equity swap for the relevant draw-down and has the put option that GECC

can sell converted stocks to the Company within the ownership of the Company. In this case, the amount which the Company pays to GECC is the amount of

withdrawal for debt-to-equity swap multiplied by the ownership of the Company. Also, the Company has the call option that it can buy converted stocks from

GECC on the same condition of put option when the GECC does not exercise the put option. According to the support agreement, Hyundai Capital Services,

Inc. will pay 15bp commission to the Company based on the amount on which the credit facility agreement was established multiplied by the ownership

percentage of the company.

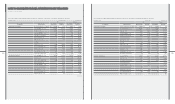

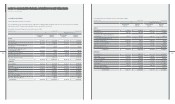

Hyundai Motor Company [in thousands of US$]