Hyundai 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _8483_Hyundai Motor Company Annual Report 2003

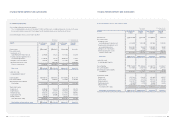

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

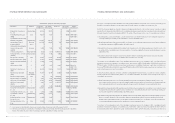

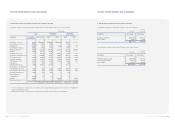

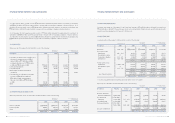

Companies Acquisition Book value Book value Ownership

cost percentage(*2)

KT ICOM Co., Ltd. (formerly I-COM) 18,000 18,000 15,028 1.00

Cheju International Convention Center 500 500 417 0.59

Kyongnam Shinmun Co., Ltd. 20 3 3 0.28

Daewoo Commercial Vehicle 40 2 2 0.05

Daewoo Motor Co., Ltd. 2,213 - - 0.02

Space Imaging LLC 5,319 5,319 4,441 -

Machinery Insurance Cooperative 8,188 8,188 6,836 -

Other 15,544 14,832 12,381 -

281,712 262,543 $219,188

(*1) The equity securities of these affiliates were excluded from using the equity method since the Company believes the

changes in the investment value due to the changes in the net assets of the investee, whose individual beginning balance of

total assets or paid-in capital at the date of its establishment is less than 7,000 million (US$5,844 thousand), are not

material.

(*2) Percentage ownership is calculated by combining the ownership of the Company and its subsidiaries.

(5) Held-to-maturity debt securities as of December 31, 2002 consist of the following:

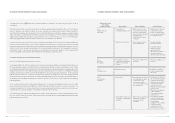

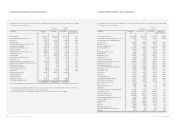

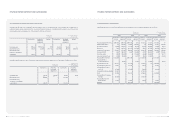

7. LEASED ASSETS:

The Company and its subsidiaries have entered into lease agreements for certain machinery and equipment. The capital lease

obligations are included in long-term debt in the accompanying balance sheets. Annual payments on these lease agreements

as of December 31, 2003 are as follows (won in millions):

Korean won

(in millions)

U. S. dollars

(Note 2)

(in thousands)

Lease Interest Lease Lease

payments portion obligation payments

2004 75,573 10,049 65,524 42,953

2005 62,479 5,240 57,239 22,385

2006 61,937 4,640 57,297 8,950

2007 38,376 2,512 35,864 6,325

Thereafter 105 10 95 23,651

238,470 22,451 216,019 104,264

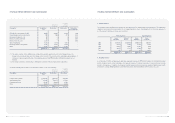

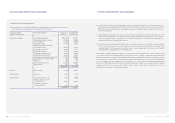

8. INSURED ASSETS:

As of December 31, 2003, certain property, plant and equipment are insured for 10,929,715 million (US $9,124,825 thousand)

and the Company and its certain subsidiaries carry general insurance for vehicles and workers’ compensation and casualty

insurance for employees. In addition, the Company and Kia carry products and completed operations liability insurance with

a maximum coverage of 234,211 million (US $195,534 thousand) with Hyundai Marine & Fire Insurance Co., Ltd.

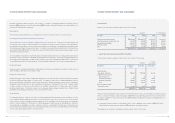

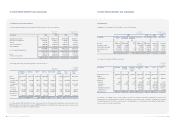

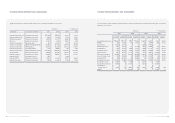

Financing leases Operating leases

Description Acquisition Book value Book value

cost

Foreign currency bonds 167,293 163,962 $136,886

Subordinated bonds 237,450 210,371 175,631

Private placed bonds 68,110 49,950 41,701

Other 38,845 35,874 29,950

511,698 460,157 $384,168

Korean won

(in millions)

U. S. dollars

(Note 2)

(in thousands)