Hyundai 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _5049_Hyundai Motor Company Annual Report 2003

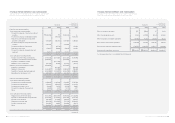

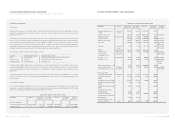

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2003 AND 2002

TOGETHER WITH INDEPENDENT PUBLIC

ACCOUNTANTS’ REPORT

REPORT OF INDEPENDENT PUBLIC ACCOUNTANTS

(English Translation of a Report Originally Issued in Korean)

To the Shareholders and Board of Directors of

Hyundai Motor Company:

We have audited the accompanying consolidated balance sheets of Hyundai Motor Company and its subsidiaries as of

December 31, 2003 and 2002, and the related consolidated statements of income, changes in shareholders’ equity and cash

flows for the years then ended, all expressed in Korean won. These financial statements are the responsibility of the

Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. In

2003 and 2002, we did not audit the financial statements of certain subsidiaries, which statements reflect total assets of

11,732,826 million ($9,795,313 thousand) and 10,105,983 million ($8,437,121 thousand), respectively, and total revenues of

15,172,943 million ($12,667,343 thousand) and 19,235,200 million ($16,058,774 thousand), respectively. Those statements

were audited by other auditors whose reports have been furnished to us, and our opinion, insofar as it relates to the amounts

included for those entities, is based solely on the reports of other auditors.

We conducted our audits in accordance with auditing standards generally accepted in the Republic of Korea. Those

standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes assessing the accounting standards used and significant

estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our

audits provide a reasonable basis for our opinion.

In our opinion, based on our audits and the reports of other auditors, the financial statements referred to above present fairly,

in all material respects, the financial position of Hyundai Motor Company and its subsidiaries as of December 31, 2003 and

2002, and the results of their operations and changes in the shareholders’ equity and their cash flows for the years then ended

in conformity with financial accounting standards in the Republic of Korea (see Note 2).

The translated amounts in the accompanying financial statements have been translated into U.S. dollars, solely for the

convenience of the reader, on the basis set forth in Note 2.

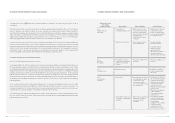

As discussed in Note 1, in 2003, the Company added two domestic companies including Aju Metal Co., Ltd. and four overseas

companies including Hyundai Motor Company Australia (HMCA) to its consolidated subsidiaries. These changes in the scope

of consolidation increased the Company’s consolidated assets and revenues by 2,795,891 million ($2,334,189 thousand)

and 528,692 million ($441,386 thousand), respectively, and decreased consolidated shareholders’ equity and consolidated

net income by 299,582 million ($250,110 thousand) and 368,162 million ($307,365 thousand), respectively, as compared

to the results using the previous scope of consolidation.

Anjin & Co

14th Floor, Hanwha Securities Building

23-5 Yoido-dong, Youngdeungpo-ku

Seoul 150-717, Korea

Yoido P.O.Box 537

Tel 82(2) 6676-1000, 1114

Fax 82(2) 785-4753, 786-0267

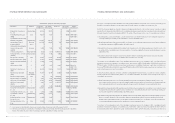

As explained in Note 2, the Company prepared its 2003 financial statements in accordance with the Statements of Korea

Accounting Standards (“SKAS”) No. 2 – “Interim Financial Reporting”, No. 4 – “Revenue Recognition”, No. 5 – “Tangible Assets”,

No. 8 – “Investments in Securities” and No. 9 – “Convertible Securities”, which are effective from January 1, 2003. For

comparative purposes, certain accounts in the 2002 financial statements were reclassified. Also, the statement of income for

the year ended December 31, 2002 was revised in conformity with SKAS No. 4. These reclassification and revision do not

affect the net assets and net income but resulted in the decrease of sales and cost of sales in 2002 by 3,703,293 million

(US$3,091,746 thousand) compared with the results based on the previous method.

Accounting principles and auditing standards and their application in practice vary among countries. The accompanying

financial statements are not intended to present the financial position, results of operations and cash flows in accordance with

accounting principles and practices generally accepted in countries other than the Republic of Korea. In addition, the

procedures and practices utilized in the Republic of Korea to audit such financial statements may differ from those generally

accepted and applied in other countries. Accordingly, this report and the accompanying financial statements are for use by

those knowledgeable about Korean accounting procedures and auditing standards and their application in practice.

Anjin Deloitte LLC

Seoul, Korea, April 4, 2004

Notice to Readers

This report is effective as of April 4, 2004, the auditors’ report date. Certain subsequent events or circumstances may have

occurred between the auditors’ report date and the time the auditors’ report is read. Such events or circumstances could

significantly affect the accompanying financial statements and may result in modifications to the auditors’ report.