Hyundai 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _7069_Hyundai Motor Company Annual Report 2003

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

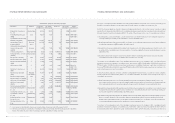

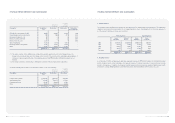

securities are valued at fair value, with unrealized gains or losses included in current operations. Available-for-sales securities are

also valued at fair value, with unrealized gains or losses included in capital adjustments, until the securities are sold and if the

securities are determined to be impaired, the lump-sum cumulative amount of capital adjustments are included in current

operations. However, available-for-sales securities that are not traded in an active market and whose fair values cannot be reliably

estimated are accounted for at their acquisition costs. For those securities that are traded in an active market, fair values refer to

those quoted market prices, which are measured as the closing price at the balance sheet date. The fair value of non-marketable

debt securities are measured at the discounted future cash flows by using the discount rate that appropriately reflects the credit

rating of issuing entity assessed by a publicly reliable independent credit rating agency. If application of such measurement

method is not feasible, estimates of the fair values may be made using a reasonable valuation model or quoted market prices of

similar debt securities issued by entities conducting similar business in similar industries.

Securities are evaluated at each balance sheet date to determine whether there is any objective evidence of impairment loss. When

any such evidence exists, unless there is a clear counter-evidence that recognition of impairment is unnecessary, the Company

estimates the recoverable amount of the impaired security and recognizes any impairment loss in current operations. The amount

of impairment loss of the held-to-maturity security or non-marketable equity security is measured as the difference between the

recoverable amount and the carrying amount. The recoverable amount of held-to maturity security is the present value of

expected future cash flows discounted at the securities’ original effective interest rate. For available-for-sale debt or equity security

stated at fair value, the amount of impairment loss to be recognized in the current period is determined by subtracting the amount

of impairment loss of debt or equity security already recognized in prior period from the amount of amortized cost in excess of the

recoverable amount for debt security or the amount of the acquisition cost in excess of the fair value for equity security. For

non-marketable equity securities accounted for at acquisition costs, the impairment loss is equal to the difference between the

recoverable amount and the carrying amount.

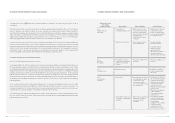

If the realizable value subsequently recovers, in case of a security stated at fair value, the increase in value is recorded in current

operations, up to the amount of the previously recognized impairment loss, while for the security stated at amortized cost or

acquisition cost, the increase in value is recorded in current operation, so that its recovered value does not exceed what its

amortized cost would be as of the recovery date if there had been no impairment loss.

When transfers of securities between categories are needed because of changes in an entity’s intention and ability to hold those

securities, such transfer is accounted for as follows: trading securities cannot be reclassified into available-for-sale and held-to-

maturity securities, and vice versa, except when certain trading securities lose their marketability. Available-for-sale securities and

held-to-maturity securities can be reclassified into each other after fair value recognition. When held-to-maturity security is

reclassified into available-for-sale security, the difference between the book value and fair value is reported in capital adjustments.

Whereas, in case available-for-sale security is reclassified into held-to-maturity securities, the difference is reported in capital

adjustments and amortized over the remaining term of the securities using the effective interest method.

Equity Securities Accounted for Using the Equity Method

Equity securities held for investment in companies in which the Company is able to exercise significant influence over the operating

and financial policies of the investees are accounted for using the equity method. The Company’s share in the net income or net

loss of investees is reflected in current operations. Changes in the retained earnings, capital surplus or other capital accounts of

investees are accounted for as an adjustment to retained earnings, capital surplus or capital adjustments.

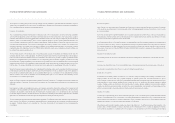

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are recorded at cost, except for assets revalued upward in accordance with the Asset

Revaluation Law of Korea. Routine maintenance and repairs are expensed as incurred. Expenditures that result in the

enhancement of the value or extension of the useful lives of the facilities involved are treated as additions to property, plant

and equipment.

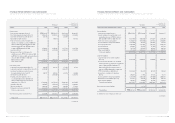

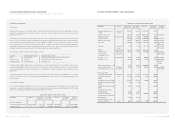

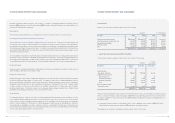

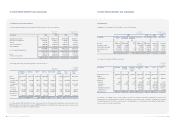

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follows:

Useful lives (years)

Buildings and structures 2 – 60

Machinery and equipment 2 – 20

Vehicles 2 – 10

Tools, dies and molds 2 – 10

Tools 2 – 10

Other equipment 2 – 10

In 2003, the Company has applied Statement of SKAS No. 5 – “Tangible Assets”, which provides more clarifications of

accounting method of tangible assets including definition, scope, recognition, amortization and valuation.

Intangibles

Intangible assets are stated at cost, net of accumulated amortization. Subsequent expenditures on intangible assets after their

purchases or completions, which will probably enable the assets to generate future economic benefits and can be measured

and attributed to the assets reliably, are treated as additions to intangible assets.

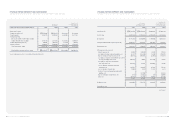

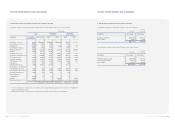

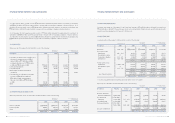

Amortization is computed using the straight-line method based on the estimated useful lives of the assets as follows:

Useful lives (years)

Goodwill (Negative goodwill) Within 20 years

Development costs 3 – 10

Other 3 – 40

If the recoverable value of intangible assets is lower than book value, book value is adjusted to the recoverable value with

impairment loss charged to current operations.

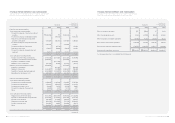

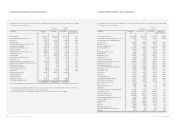

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrowings) and other similar

loan (borrowing) transactions are stated at present value, if the difference between nominal value and present value is material.

The present value discount is amortized using the effective interest rate method. Effective interest rate for long - term

accounts receivable in 2003 and 2002 is from 8.25 percent to 10.00 percent.