Hyundai 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hyundai Motor Company Annual Report 2003 _6463_Hyundai Motor Company Annual Report 2003

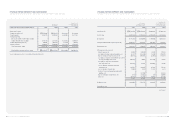

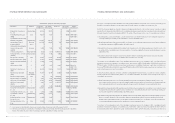

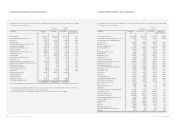

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

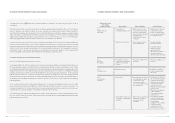

Subsidiaries Business Korean won U.S. dollars Shares (**) Percentage Indirect

(in millions)(*) (in thousands) ownership (**) ownership (**)

Beijing Mobis Transmission Manufacturing 44,214 36,913 - 60.00 Kia 30.00%

Co., Ltd.

World Marketing Group LLC Sales 10,624 8,870 - 100.00 HMA 50.00%,

(WMG) KMA 50.00%

Hyundai Motor Manufacturing

Alabama, LLC (HMMA) Manufacturing 277,561 231,726 - 100.00 HMA 100.00%

Hyundai Motor Finance Financing 235,738 196,809 750 100.00 HMA 100.00%

Company (HMFC) service

Hyundai Auto Canada Captive

Insurance Incorporation Insurance 2,206 1,842 100 100.00 HMA 100.00%

(HACCII)

Sevenwood Property Inc. Real estate rent (421) (351) 4,088,071 100.00 HMA 100.00%

Hyundai de Mexico, S.A. de C.V. Manufacturing 4,437 3,704 9,996 99.96 HT 99.96%

(HYMEX)

Kia Japan Co., Ltd. (KJC) Sales 25,821 21,557 85,800 100.00 Kia 100.00%

Kia Motors America Inc. (KMA) 17,745 14,815 1,000,000 100.00 Kia 100.00%

Kia Motors Deutschland GmbH 6,326 5,281 - 100.00 Kia 100.00%

(KMD)

Kia Canada, Inc. (KCI) (373) (311) 6,298 100.00 Kia 82.5%,

KMA 17.5%

Kia Motors Polska Sp.z.o.o. (6,532) (5,453) 15,637 99.60 KMD 99.60%

(KMP)

Kia Motors Europe GmbH Managing 55,316 46,181 25,000 100.00 Kia 100.00%

(KME) subsidiaries

Kia Motors Belgium (KMB) Sales 937 782 1,000,000 100.00 KME 100.00%

Kia Motors Czech s.r.o. (KMCZ) 1,493 1,246 106,870,000 100.00 KME 100.00%

Kia Motors (UK) Ltd. (KMUK) 35,242 29,422 17,000,000 100.00 KME 100.00%

Kia Motors Austria GmbH 3,985 3,327 2,107,512 100.00 KME 100.00%

(KMAS)

Kia Motors Hungary Kft (KMH) 4,074 3,401 30,000,000 100.00 KME 100.00%

Dong Feng Yueda Kia Motor Manufacturing 122,037 101,884 - 50.00 Kia 100.00%

Co., Ltd.

Hyundai Pipe of America, Inc. Sales 4,786 3,996 250,000 100.00 HYSCO 100%

Hyundai Hysco Vietnam Manufacturing (10,003) (8,351) - 100.00 HYSCO 100%

Co., Ltd.

Bejing Hyundai Hysco Steel Manufacturing 6,396 5,340 - 100.00 HYSCO 100%

Process Co., Ltd.

Kia Heavy Industries U.S.A., Sales (1,898) (1,585) 1,200 100.00 WIA 100.00%

Corp.

(*) Local currency is translated into Korean won using the Bank of Korea basic rate at December 31, 2003.

(**) Shares and ownership are calculated by combining the shares and ownership, which the Company and its subsidiaries

hold as of December 31, 2003. Indirect ownership represents subsidiaries’ holding ownership.

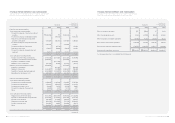

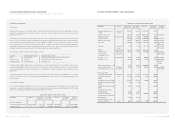

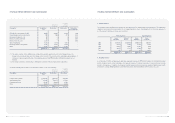

Shareholders’ equity As of December 31, 2003 Among the consolidated domestic subsidiaries, Kia and Hyundai HYSCO have been listed on the Korea Stock Exchange, and

Bontek Co., Ltd. and AJU Metal Co., Ltd. are under composition with creditors according to the Composition Act.

In 2003, the Company added two domestic companies including Hyundai Card Co., Ltd. and four overseas companies including

Hyundai Motor Company Australis (HMCA) to its consolidated subsidiaries and excluded two companies including Hyundai-Assan

Otomotiv Sanayi Ve Ticaret Anonim Sirketi (HAOSVT). The details of these changes in the scope of consolidation are as follows:

(1) Hyundai Card Co., Ltd. and AJU Metal Co., Ltd. are included in the consolidation mainly due to the holding and acquisition of

ownership enabling the Company and its subsidiaries to exercise substantial control.

(2)World Marketing Group LLC are included in 2003 consolidation since its individual total assets at the end of the preceding year

exceeded the required level of 7,000 million ($5,844 thousand).

(3)Hyundai Motor Company Australia (HMCA), Beijing Mobis Transmission Co., Ltd., Beijing Hyundai Hysco Steel Process Co., Ltd.

are included in the consolidation due to the new acquisition of ownership enabling the Company and its subsidiaries to exercise

substantial control.

(4)Hyundai-Assan Otomotiv Sanayi Ve Ticaret Anonim Sirketi (HAOSVT) and WISCO, which had been included in the 2002

consolidation, are excluded in 2003 consolidation due to the disposal of ownership.

The inclusion of the individual accounts of the subsidiaries mentioned above in the Company’s 2003 consolidated financial

statements increased the Company’s consolidated assets and revenues by 2,795,891 million ($2,334,189 thousand) and

528,692 million ($441,386 thousand), respectively, and decreased consolidated shareholders’ equity and consolidated net

income by 299,582 million ($250.110 thousand) and 368,162 million ($307,365 thousand), respectively, as compared to the

results using the previous scope of consolidation.

In 2002, the Company added two domestic companies including Daimler Hyundai Truck Co., Ltd. and ten overseas companies

including Hyundai Motor Europe GmbH (HME) to its consolidated subsidiaries. The details of these changes in the scope of

consolidation are as follows:

(1) DongFeng Yueda Kia Motor Co., Ltd. (formerly Hyundai-Kia-Yueda Motor Company) and Daimler Hyundai Truck Co., Ltd.

whose equity securities had been accounted for using the equity method in 2001 are included in the consolidation mainly due

to the holding and acquisition of ownership enabling the Company and its subsidiaries to exercise substantial control.

(2)Hyundai Motor Europe GmbH (HME) and Autoever, which had not been included in the consolidation nor accounted for using

the equity method in 2001, are included in 2002 consolidation since its individual total assets at the end of the preceding year

exceeded the required level of 7,000 million ($5,844 thousand).

(3)Hyundai Motor Manufacturing Alabama, LLC (HMMA), Kia Motors Europe GmbH (KME), Kia Motors Belgium (KMB), Kia Motors

Czech s.r.o. (KMCZ), Kia Motors (UK) Ltd. (KMUK), Kia Motors Austria GmbH (KMAS), Kia Motors Hungary Kft (KMH) and

Hyundai Auto Canada Captive Insurance Incorporation (HACCII) are included in the consolidation due to the new acquisition

of ownership enabling the Company and its subsidiaries to exercise substantial control.

The inclusion of the individual accounts of the subsidiaries mentioned above in the Company’s 2002 consolidated financial

statements increased the Company’s consolidated assets, shareholders’ equity and revenues by 698,043 million ($582,771

thousand), 29,926 million ($24,984 thousand) and 1,094,755 million ($913,971 thousand), respectively and decreased