Hyundai 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

2000 Annual Report •Hyundai-Motor Company

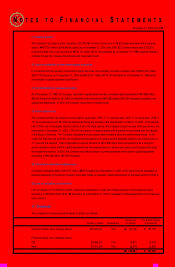

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

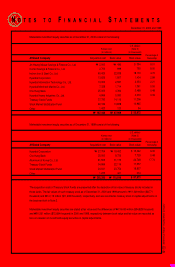

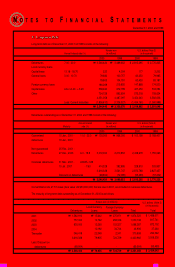

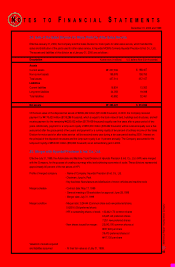

The computation of the proposed dividends for 1999 is as follows:

Common shares, net of treasury shares

Preferred shares, net of treasury shares:

Old

New

₩102,395

14,050

23,132

₩

₩139,577

$ 81,285

11,154

18,363

$ 110,802

10%

11%

12%

204,789,049

25,545,671

38,553,865

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)Dividend rateNumber of Shares

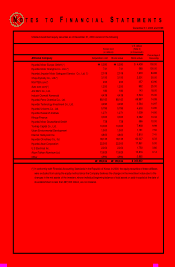

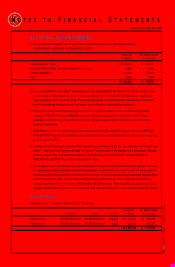

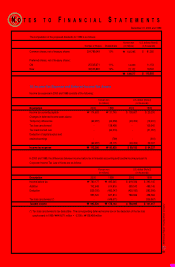

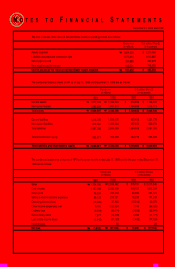

18. Income Tax Expense and Deferred Income Tax Assets

Income tax expense in 2000 and 1999 consists of the following:

Description

Income tax currently payable

Changes in deferred income taxes due to:

Temporary differences

Tax loss carryforward

Tax credit carried over

Deduction of capital surplus and

retained earnings

Income tax expense

2000

$ 138,607

(49,454)

-

-

-

(49,454)

$ 89,153

1999

$ 25,200

(19,241)

109,945

(51,057)

(610)

39,037

$ 64,237

1999

₩31,745

(24,238)

138,498

(64,316)

(769)

49,175

₩

₩80,920

2000

₩174,603

(62,297)

-

-

-

(62,297)

₩

₩112,306

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

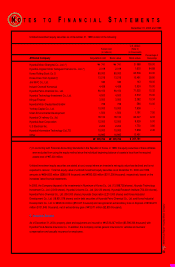

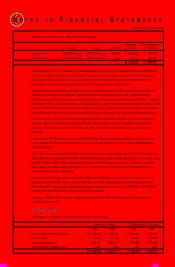

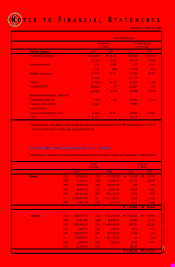

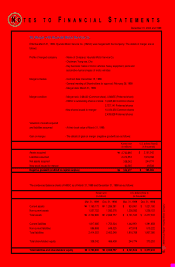

In 2000 and 1999, the differences between income before tax in financial accounting and taxable income pursuant to

Corporate Income Tax Law of Korea are as follows:

Description

Income before tax

Addition

Deduction

Tax loss carryforward (*)

Taxable income

2000

$ 619,336

589,543

(420,183)

788,696

-

$ 788,696

1999

$ 393,145

488,145

(382,906)

498,384

(356,967)

$ 141,417

1999

₩495,245

614,916

(482,347)

627,814

(449,671)

₩

₩178,143

2000

₩780,177

742,648

(529,305)

993,520

-

₩

₩993,520

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

(*) Tax loss carryforward is tax deductible. The corresponding deferred income tax on the deduction of the tax loss

carryforward in 1999: ₩449,671 million ×0.308 = ₩138,498 million