Hyundai 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

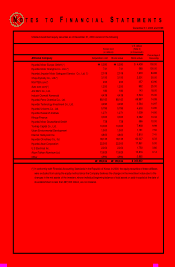

Income Tax Expense

The Company recognizes deferred income tax. Accordingly, income tax expense is determined by adding or deducting the

total income tax and surtaxes to be paid for the current period and the changes in deferred income tax debits (credits).

Earnings Per Share

Primary earnings per common share is computed by dividing net income, after deduction for expected dividends on preferred

stock, by the weighted average number of common shares outstanding during the year. The number of shares used in

computing earnings per common share is 199,249,370 in 2000 and 102,021,024 in 1999. Earnings per diluted share is

computed by dividing net income, after deduction for expected dividends on preferred stock and addition for the effect of

expenses related to diluted securities on net income, by the weighted average number of common shares plus the dilutive

potential common shares. The number of shares used in computing earnings per diluted share is 202,736,308 in 2000 and

106,331,915 in 1999.

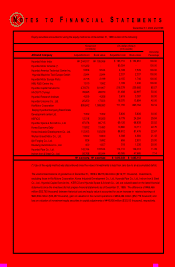

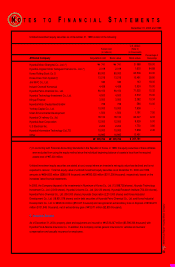

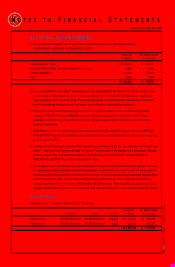

3.Inventories

Inventories as of December 31, 2000 and 1999 consist of the following

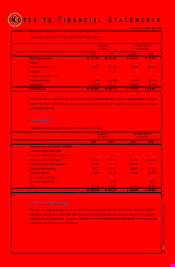

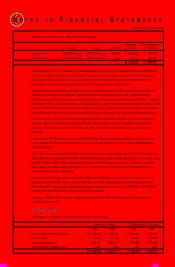

4. Marketable Securities and Investment Securities

(1) Marketable securities are stated at fair value and consist of beneficiary certificates of ₩129,917 million ($103,133

thousand) and debt securities of ₩54,573 million ($43,323 thousand) as of December 31, 2000 and beneficiary certificates

of ₩244,747 million ($194,290 thousand) and debt securities of₩61 million ($48 thousand) as of December 31, 1999.

(2) Investments securities as of December 31, 2000 and 1999 consist of the following:

Debt securities as of December 31, 2000 consist of convertible bonds of ₩33,903 million ($26,914 thousand), foreign currency

notes of ₩59,267 million ($47,049 thousand) and government bonds of ₩65 million ($51 thousand), which are all held-to-

maturity and stated at cost.

Debt securities as of December 31, 1999 are all held-to-maturity convertible bonds and are stated at cost.

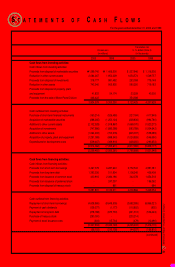

Finished goods and merchandise

Semifinished goods and work in process

Raw materials and supplies

Materials in transit

2000

$ 401,882

197,987

141,407

70,368

$ 811,644

1999

$ 376,381

153,409

124,679

59,095

$ 713,564

1999

₩474,127

193,249

157,059

74,442

₩

₩898,877

2000

₩506,251

249,404

178,131

88,642

₩

₩1,022,428

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

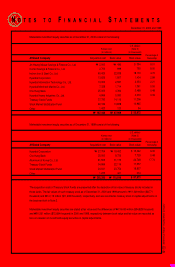

Equity securities accounted for using

the equity method

Marketable equity securities

Unlisted equity securities

Debt securities

2000

$ 1,863,013

53,972

205,632

74,014

$ 2,196,631

1999

$ 1,665,112

87,973

261,781

40,117

$ 2,054,983

1999

₩2,097,542

110,819

329,766

50,535

₩

₩2,588,662

2000

₩2,346,838

67,989

259,034

93,235

₩

₩2,767,096

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)