Hyundai 2000 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

2000 Annual Report •Hyundai-Motor Company

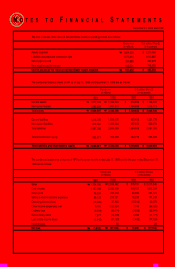

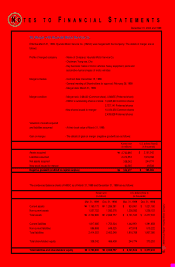

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

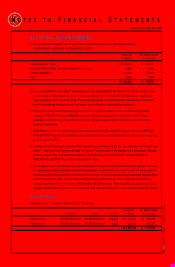

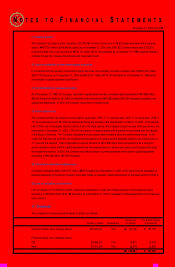

At January 1, 1981, January 1, 1993 and July 1, 1998, the Company revalued its property, plant and equipment at their

respective appraised values (which were appraised by the Korea Appraisal Board and approved by the relevant tax office).

The resultant cumulative appraisal gains, amounting to ₩2,547,417 million ($2,022,241 thousand), were included in capital

surplus, after offsetting accumulated deficit of ₩16,022 million ($12,719 thousand), a deferred foreign currency translation loss

of ₩594,275 million ($471,759 thousand), reduction for an asset revaluation tax payment of ₩67,547 million ($53,621

thousand) and adjustment of ₩16,702 million ($13,259 thousand) due to the disposal of revalued assets within 1 year after

revaluation. The asset revaluation surplus may only be transferred to capital stock or may be used to offset against a deficit, if

any, in the future.

In 2000, the increase in paid-in capital in excess of par value of ₩327,222 million ($259,762 thousand) arose from new

common stock issuance (See Note 13).

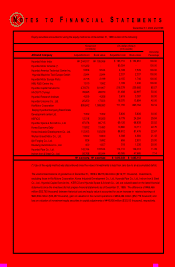

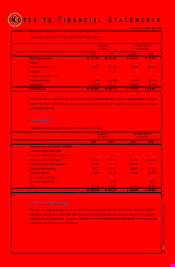

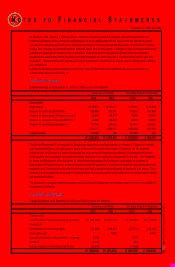

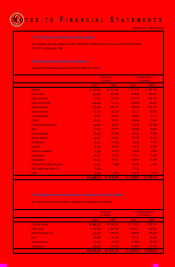

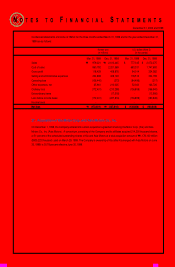

15.Retained Earnings

Retained earnings as of December 31, 2000 and 1999 consist of the following:

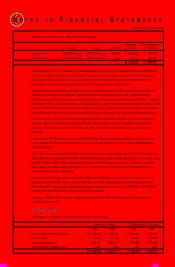

The Korean Commercial Code requires the Company to appropriate, as a legal reserve, a minimum of 10 percent of annual

cash dividends declared, until such reserve equals 50 percent of its capital stock issued. Pursuant to the Tax Incentive

Limitation Law, the Company is required to appropriate, as a reserve for business rationalization, the exemption of income

taxes resulting from investment tax credits and certain deductions from taxable income specified by the Law. The Regulation

on Issues and Disclosures of the Securities for listed companies requires the Company to appropriate, as a reserve for

improvement of financial structure, an amount equal to at least 50 percent of the net gain on disposition of property, plant and

equipment and 10 percent of net income for each year until the Company’s net worth equals 30 percent of total assets. These

reserves are not available for the payment of cash dividends, but may be transferred to capital stock or may be used to reduce

any accumulated deficit.

The reserves for overseas market development and technological development are voluntary reserves, which are available for

the payment of dividends.

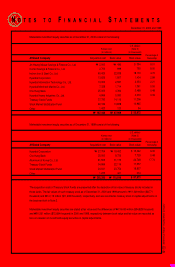

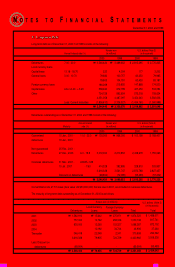

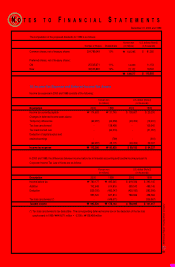

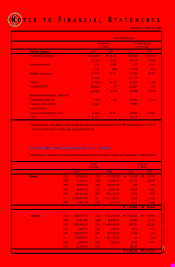

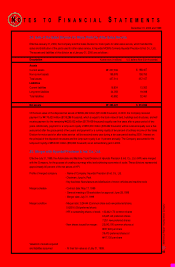

16. Capital Adjustments

Capital adjustments as of December 31, 2000 and 1999 consist of the following:

Appropriated:

Legal reserve

Reserve for business rationalization

Reserve for improvement of financial structure

Reserve for overseas market development

Reserve for technological development

Unappropriated

2000

$ 63,404

306,263

78,548

38,739

593,474

1,080,428

137,865

$ 1,218,293

1999

$ 50,226

211,955

78,548

38,739

462,491

841,959

156

$ 842,115

1999

₩63,270

267,000

98,947

48,800

582,600

1,060,617

196

₩

₩1,060,813

2000

₩79,870

385,800

98,947

48,800

747,600

1,361,017

173,667

₩

₩1,534,684

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

Treasury stock

Loss on valuation of investment equity securities

(see Note 4)

Consideration for conversion rights

Stock option cost

Cumulative translation adjustments for overseas

branches

Loss on valuation of derivatives (see Note 2)

2000

$ (346,948)

(207,700)

-

5,180

(853)

(44,198)

$ (594,519)

1999

$ (119,172)

(105,197)

6,340

-

-

-

$ (218,029)

1999

₩(150,121)

(132,517)

7,986

-

-

-

₩

₩(274,652)

2000

₩(437,050)

(261,640)

-

6,526

(1,075)

(55,676)

₩

₩(748,915)

U.S. dollars (Note 2) (in thousands)Korean won (in millions)