Hyundai 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

2000 Annual Report •Hyundai-Motor Company

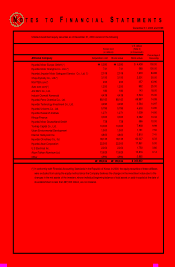

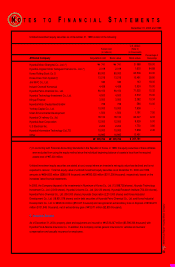

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

Stock Options

The Company computes total compensation expense to stock options, which are granted to employees and directors, by fair

value method using the option-pricing model. The compensation expense has been accounted for as a charge to current

operations and a credit to capital adjustment from the grant date using the straight-line method.

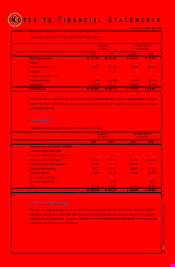

Derivative Instruments

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the

derivative instrument is not part of a transaction qualifying as a hedge, the adjustment to fair value is reflected in current

operations. The accounting for derivative transactions that are part of a qualified hedge, based both on the purpose of the

transaction and on meeting the specified criteria for hedge accounting, differs depending on whether the transaction is a fair

value hedge or a cash flow hedge. Fair value hedge accounting is applied to a derivative instrument designated as hedging

the exposure to changes in the fair value of an asset or a liability or a firm commitment (hedged item) that is attributable to a

particular risk. The gain or loss both on the hedging derivative instruments and on the hedged item attributable to the hedged

risk are reflected in current operations. Cash flow hedge accounting is applied to a derivative instrument designated as

hedging the exposure to variability in expected future cash flows of an asset or a liability or a forecasted transaction that is

attributable to a particular risk. The effective portion of gain or loss on a derivative instrument designated as a cash flow hedge

is recorded as a capital adjustment and the ineffective portion is recorded in current operations. The effective portion of gain or

loss recorded as a capital adjustment is reclassified to current earnings in the same period during which the hedged forecasted

transaction affects earnings. If the hedged transaction results in the acquisition of an asset or the incurrence of a liability, the

gain or loss in capital adjustment is added to or deducted from the asset or the liability.

The Company entered into derivative instrument contracts related to forward, option and swap to hedge the exposure to

changes in foreign exchange rate. In 2000, the Company deferred the loss on valuation of the effective portion of derivative

instruments for cash flow hedging purpose from forecasted exports as capital adjustments, amounting to ₩55,676 million

($44,198 thousand) as of December 31, 2000 and recognized loss on valuation of the ineffective portion of such instruments

and the other derivative instruments in current operations of ₩68,880 million ($54,680 thousand). The period in which the

forecasted transactions is expected to occur is within 12 months from December 31, 2000, and all deferred losses in capital

adjustments at that date are expected to enter into the determination of net income within the 12 month period. In 2000, the

Company recorded total loss on valuation of derivatives of ₩111,441 million ($88,466 thousand) in liabilities. In 1999, the

Company recognized gain on the derivative instruments amounting to ₩12,067 million ($9,579 thousand) in current operations

and recorded the equal amounts as accrued gain on valuation of derivatives in other assets.

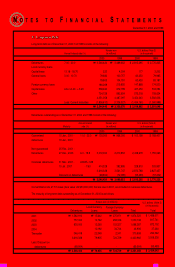

Accounting for Foreign Currency Transactions and Translation

The Company maintains its accounts in Korea won. Transactions in foreign currencies are recorded in Korean won based on

the prevailing rates of exchange on the transaction date. Monetary accounts with balances denominated in foreign currencies

are recorded and reported in the accompanying financial statements at the exchange rates prevailing at the balance sheet

dates. The balances have been translated using the Bank of Korea Basic Rate which was ₩1,259.7 and ₩1,145.4 to US

$1.00 at December 31, 2000 and 1999, respectively, and translation gains or losses have been reflected in current operations.

Assets and liabilities of branch outside the Republic of Korea are translated at the rate of exchange in effect on the balance

sheet date; income and expenses are translated at the average rates of exchange prevailing in 2000 which was ₩1,130.6 to

US$1.00.

Conversion Rights Adjustment

The Company is obligated to pay interest at a guaranteed rate to convertible debenture holders who do not exercise their

options to convert and instead hold the bond until maturity. The difference between the face value of the bonds and the

present value of principal amount payable at maturity is respectively recorded as conversion rights in the capital adjustment

account under shareholders’ equity and conversion right adjustment account.

At the time of conversion, the consideration received for the conversion rights is presented as other capital surplus, after

deducting the amount of related conversion right adjustment. However, if the convertible debentures are repaid, the

consideration received for conversion rights is offset against the related premium paid at the time of redemption.