Hyundai 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

2000 Annual Report •Hyundai-Motor Company

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

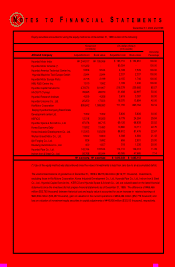

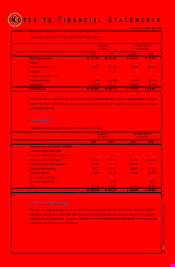

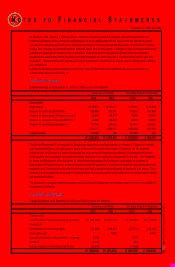

Unlisted investment equity securities as of December 31, 1999 consist of the following:

(*) In conformity with Financial Accounting Standards in the Republic of Korea, in 1999, the equity securities of these affiliates

were excluded from using the equity method since the individual beginning balance of assets is less than the required

assets level of ₩7,000 million.

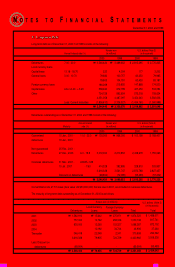

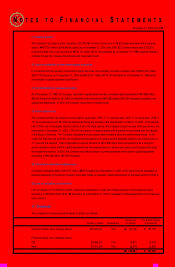

Unlisted investment equity securities are stated at cost, except where an investee’s net equity value has declined and is not

expected to recover. Total net equity value of unlisted investment equity securities as at December 31, 2000 and 1999,

amounts to ₩364,833 million ($289,619 thousand) and ₩392,026 million ($311,206 thousand), respectively, based on the

investees’ latest financial statements.

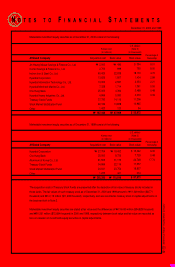

In 2000, the Company disposed of its investments in Aluminum of Korea Co., Ltd. (13,098,726 shares), Hyundai Technology

Investment Co., Ltd. (2,000 shares), Hyundai Unicorns Co., Ltd. (26,120 shares), Hyundai Research Institute (702,000 shares),

Hyundai Petro-Chemical Co., Ltd. (350,000 shares), Hyundai Corporation (2,210,000 shares) and Korea Industrial

Development Co., Ltd. (18,951,079 shares) and in debt securities of Hyundai Petro-Chemical Co., Ltd. and Korea Industrial

Development Co., Ltd. for ₩63,044 million ($50,047 thousand) and recognized an extraordinary loss on disposal of ₩166,215

million ($131,948 thousand), net of extraordinary gain of ₩3,571 million ($2,835 thousand).

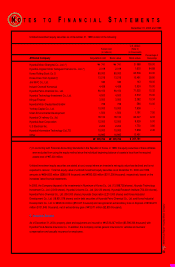

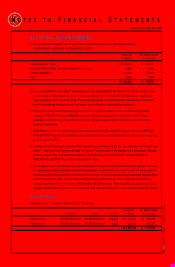

5. Insured Assets

As of December 31, 2000, property, plant and equipment are insured for ₩4,530,267 million ($3,596,306 thousand) with

Hyundai Fire & Marine Insurance Co. In addition, the Company carries general insurance for vehicles and workers’

compensation and casualty insurance for employees.

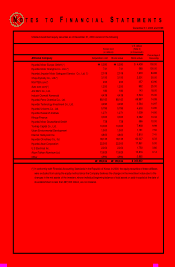

Hyundai Motor Shanghai Co., Ltd. (*)

Hyundai Jingxian Motor Safeguard Service Co., Ltd. (*)

Korea Rolling Stock Co.(*)

Korea Drive Train System(*)

Jinil MVC Co., Ltd.

Industri Otomotif Komersial

Hyundai Petro-Chemical Co., Ltd.

Hyundai Technology Investment Co., Ltd.

Kihyup Finance

Hyundai Motor Deutschland GmbH

Yonhap Capital Co., Ltd.

Ulsan Environmental Development

Hyundai Oil refinery Co., ltd.

Hyundai Asan Corporation

U.S Electrical Inc.

Hyundai Information Technology Co.LTD

Other

Percentage of

Ownership

100.00

84.88

40.00

29.90

18.00

15.00

15.32

15.00

10.34

10.00

-

7.50

6.33

5.00

3.80

2.45

Book value

$ 588

1,603

63,506

10,491

143

3,524

71,525

3,572

2,382

586

7,938

1,191

62,027

9,526

1,750

7,938

13,491

$ 261,781

Book value

₩741

2,019

80,000

13,216

180

4,439

90,100

4,500

3,000

738

10,000

1,500

78,134

12,000

2,204

10,000

16,995

₩

₩329,766

Acquisition costAffiliated Company

₩741

2,019

80,000

13,216

180

4,439

90,100

4,500

3,000

738

10,000

1,500

78,134

12,000

2,204

10,000

16,995

₩

₩329,766

U.S. dollars

(Note 2)

(in thousands)

Korean won

(in millions)