Hyundai 2000 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

2000 Annual Report •Hyundai-Motor Company

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

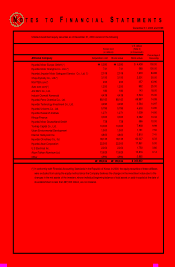

Inventories

Inventories are stated at the lower of cost or net realizable value, cost being determined by the moving average cost method.

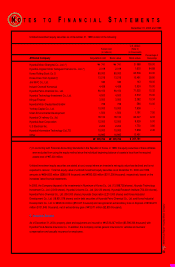

Valuation of Investment Securities

Equity securities held for investment (excluding those accounted for using the equity method discussed in the next paragraph)

that are not actively traded (unlisted security) are stated at acquisition cost, as determined by the moving average method.

Actively quoted (listed) securities, including those traded over-the-counter, are stated at fair value, with the resulting valuation

gain or loss reported as a capital adjustment within shareholders’ equity. If the fair value of a listed equity security or the net

equity value of an unlisted security held for investment declines compared to acquisition cost and is not expected to recover

(impaired investment security), the carrying value of the equity security is adjusted to fair value or net equity value, with the

resulting valuation loss charged to current operations. If the net equity value or fair value subsequently recovers, in the case of

an unlisted security, the increase in value is recorded in current operations, up the amount of the previously recognized

impairment loss, and in the case of a listed security, the increase in value is recorded in current operations, up to the amount of

the previously recognized impairment loss, and any excess is recorded as a capital adjustment.

Equity securities held for investment that are in companies in which the Company is able to exercise significant influence over

the operating and financial policies of the investees are accounted for using the equity method. The Company’s share in the

net income or net loss of investees is reflected in current operations. Changes in the retained earnings, capital surplus or other

capital accounts of investees are accounted for as an adjustment to retained earnings or to capital adjustment.

Debt securities held for investment are classified as either held-to-maturity investment debt securities or available for sale

investment debt securities at the time of purchase. Held-to-maturity debt securities are stated at acquisition cost, as

determined by the moving average method. When the face value of a held-to-maturity investment debt security differs from its

acquisition cost, the effective interest method is applied to amortize the difference over the remaining term of the security.

Available-for-sale investment debt securities are stated at fair value, resulting valuation gain or loss reported as a capital

adjustment within shareholder’ equity. However, if the fair value of a held-to-maturity or an available-for-sale investment debt

security declines compared to the acquisition cost and is not expected to recover (impaired investment security), the carrying

value of the debt security is adjusted to fair value, with the resulting valuation gain or loss charged to current operations. If the

fair value of the security subsequently recovers, in the case of a held-to-maturity debt security, the increase in value is recorded

in current operations, up to the amount of the previously recognized impairment loss, and in the case of an available-for-sale

debt security, the increase in value is recorded in current operations, up the amount of the previously recognized impairment

loss, and any excess is recorded as a capital adjustment.

The lower of the acquisition cost of investments in treasury stock funds and the fair value of treasury stock included in a fund is

accounted for as treasury stock in capital adjustments.

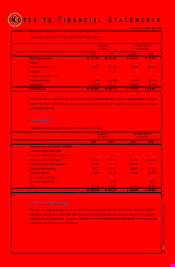

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are stated at cost, except for the effects of any upward revaluations made in accordance with

the Asset Revaluation Law of Korea to give accounting recognition to the loss in purchasing power of the Korean won. Routine

maintenance and repairs are expensed as incurred. Expenditures that result in the enhancement of the value or extension of

the useful lives of the facilities involved are treated as additions to property, plant and equipment.

The Company capitalizes interest as part of the cost of constructing major facilities and equipment. The amount of capitalized

interest is ₩101,011 million ($80,187 thousand) in 2000 and ₩77,130 million ($61,705 thousand) in 1999.