Hyundai 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

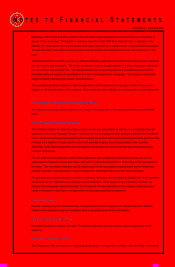

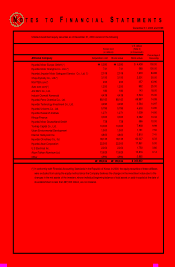

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

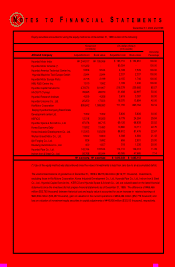

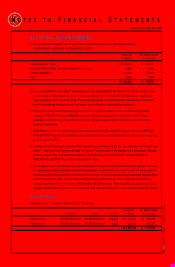

Hyundai Motor India

Hyundai Motor America (*)

Hyundai America Technical Center Inc.

Hyundai Machine Tool Europe GmbH

Hyundai Motor Europe Parts

HMJ R&D Center Inc.

Hyundai Capital Service Inc.

HAOSVT (Turkey)

Hyundai Research Institute

Hyundai Unicorns Co., Ltd.

Kia Motor Corporation

Beijing Hyundai Namyang Real Estate

Development center Ltd.

KEFICO

Hyundai Space & Aircraft Co., Ltd.

Korea Economy Daily

Korea Industrial Development Co., Ltd.

Wuhan Grand Motor Co., Ltd.

Iljin Forging Co., Ltd.

Daesung Automotive Co., Ltd.

Hyundai Pipe Co., Ltd.

Inchon Iron & Steel Co., Ltd.

Book value Ownership

Percentage

$ 154,851

-

7,576

2,337

1,746

1,240

239,666

22,997

3,387

13,894

863,764

5,836

24,264

68,838

10,711

81,476

4,684

2,931

1,236

106,013

47,665

$ 1,665,112

100.00

100.00

100.00

100.00

100.00

100.00

85.57

50.00

50.00

45.00

30.16

30.00

29.94

25.52

22.75

22.67

21.43

20.00

20.00

11.09

7.14

Acquisition cost

$ 193,710

80,354

4,728

2,337

2,155

1,199

216,379

31,488

3,619

16,075

711,155

5,836

9,779

69,126

10,980

88,912

4,368

656

318

114,110

45,065

$ 1,612,349

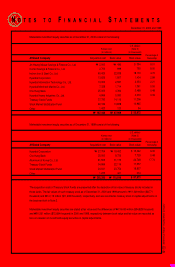

Book value

₩195,066

-

9,544

2,944

2,199

1,562

301,907

28,970

4,266

17,503

1,088,083

7,352

30,565

86,715

13,493

102,636

5,900

3,692

1,557

133,544

60,044

₩

₩2,097,542

AcquisitioncostAffiliated Company

₩244,017

101,222

5,956

2,944

2,715

1,510

272,573

39,665

4,559

20,250

895,842

7,352

12,318

87,078

13,832

112,003

5,502

826

400

143,744

56,768

₩

₩2,031,076

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

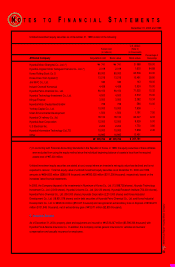

Equity securities accounted for using the equity method as of December 31, 1999 consist of the following:

(*) Use of the equity method was discontinued since the value of investments is less than zero due to an accumulated deficit.

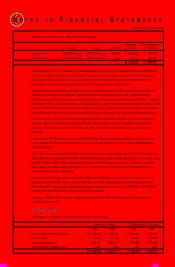

The unamortized balance of goodwill as of December 31, 1999 is ₩273,066 million ($216,771 thousand). Investments,

excluding those in Kia Motors Corporation, Korea Industrial Development Co., Ltd., Hyundai Pipe Co., Ltd., Inchon Iron & Steel

Co., Ltd., Hyundai Capital Service Inc., KEFICO and Hyundai Space & Aircraft Co., Ltd, are valued based on the latest financial

statements since the investees did not prepare financial statements as of December 31, 1999. The difference of ₩66,466

million ($52,763 thousand) between historical cost and equity value is accounted for as an increase in retained earnings of

₩40,936 million ($32,497 thousand), gain on valuation in the current operations of ₩66,486 million ($52,779 thousand) and

loss on valuation of investment equity securities in capital adjustments of ₩40,956 million ($32,513 thousand), respectively.