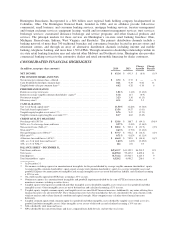

Huntington National Bank 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Huntington Bancshares Incorporated

PART I

When we refer to “we”, “our”, and “us” in this report, we mean Huntington Bancshares Incorporated and our consolidated

subsidiaries, unless the context indicates that we refer only to the parent company, Huntington Bancshares Incorporated. When we

refer to the “Bank” in this report, we mean our only bank subsidiary, The Huntington National Bank, and its subsidiaries.

Item 1: Business

We are a multi-state diversified regional bank holding company organized under Maryland law in 1966 and headquartered in

Columbus, Ohio. We have 11,873 average full-time equivalent employees. Through the Bank, we have 149 years of serving the

financial needs of our customers. We provide full-service commercial, small business, consumer, and mortgage banking services, as

well as automobile financing, equipment leasing, investment management, trust services, brokerage services, insurance programs, and

other financial products and services. The Bank, organized in 1866, is our only bank subsidiary. At December 31, 2014, the Bank had

14 private client group offices and 715 branches as follows:

• 404 branches in Ohio • 43 branches in Indiana

• 179 branches in Michigan • 31 branches in West Virginia

• 48 branches in Pennsylvania • 10 branches in Kentucky

Select financial services and other activities are also conducted in various other states. International banking services are

available through the headquarters office in Columbus, Ohio, a limited purpose office located in the Cayman Islands, and another

located in Hong Kong. Our foreign banking activities, in total or with any individual country, are not significant.

Our business segments are based on our internally-aligned segment leadership structure, which is how we monitor results and

assess performance. For each of our five business segments, we expect the combination of our business model and exceptional service

to provide a competitive advantage that supports revenue and earnings growth. Our business model emphasizes the delivery of a

complete set of banking products and services offered by larger banks, but distinguished by local delivery and customer service.

A key strategic emphasis has been for our business segments to operate in cooperation to provide products and services to our

customers and to build stronger and more profitable relationships using our OCR sales and service process. The objectives of OCR

are to:

1. Provide a consultative sales approach to provide solutions that are specific to each customer.

2. Leverage each business segment in terms of its products and expertise to benefit customers.

3. Target prospects who may want to have multiple products and services as part of their relationship with us.

Following is a description of our five business segments and Treasury / Other function:

Retail and Business Banking – The Retail and Business Banking segment provides a wide array of financial products

and services to consumer and small business customers including but not limited to checking accounts, savings accounts,

money market accounts, certificates of deposit, consumer loans, and small business loans. Other financial services

available to consumer and small business customers include investments, insurance, interest rate risk protection, foreign

exchange hedging, and treasury management. Huntington serves customers primarily through our network of branches in

Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. In addition to our extensive branch network,

customers can access Huntington through online banking, mobile banking, telephone banking, and ATMs.

Huntington has established a “Fair Play” banking philosophy and built a reputation for meeting the banking needs of

consumers in a manner which makes them feel supported and appreciated. Huntington believes customers are

recognizing this and other efforts as key differentiators, and it has earned us more customers, deeper relationships and

the J.D. Power retail service excellence award for 2013 and 2014.