Huntington National Bank 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2003

inter • FACES

HUNTINGTON 2003 ANNUAL REPORT

Table of contents

-

Page 1

HUNTINGTON 2003 ANNUAL REPORT inter • FACES ANNUAL REPORT 2003 -

Page 2

... are Ohio, Michigan, West Virginia, Indiana and Kentucky. Founded in 1866, Huntington serves its customers as the "local bank with national resources." Over 8,200 associates provide consumer and commercial banking, mortgage banking, automobile financing, equipment leasing, investment management... -

Page 3

...progress in nurturing a corporate culture of personal empowerment are taking hold. We are growing market share through broader, more dynamic interfaces with our customers; expanding all lines of business through closer interfaces with the communities we serve; and increasing efficiency with smoother... -

Page 4

... environment, Huntington's financial performance continued to improve in 2003. Investments made in 2002 began to deliver results. Accounting practices were addressed openly and decisively, and we are better for it. Day by day, momentum builds. Associate enthusiasm is high. Customers are better... -

Page 5

... middle-market commercial loans was soft. But, with interest rates at 40-year lows, we generated strong growth in first mortgage residential real estate loans, home equity loans and lines, and auto loans and leases. We were also pleased with the signiï¬cant growth in loans to small businesses and... -

Page 6

...in small business, home equity and auto loans. Our net interest margin should remain close to the 2003 fourth quarter level. We also expect capital and equity markets to gain momentum. This may make deposit growth more of a challenge, but it should beneï¬t growth in brokerage and insurance fees and... -

Page 7

..., Sr., President and CEO of The Smoot Corporation, will both retire from the board at the 2004 Annual Meeting after nearly ten years of service. Their dedication to Huntington has also been greatly appreciated. We wish all of them well. Closing Comments The theme of this year's Annual Report is... -

Page 8

... Income before cumulative effect of change in accounting principle - diluted Net income per common share - diluted Cash dividends declared per common share Book value per share Performance Ratios Return on average assets(1) Return on average shareholders' equity Net interest margin(2) Efï¬ciency... -

Page 9

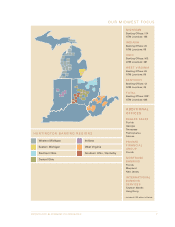

... OFFICES DEALER SALES Florida Georgia Tennessee Pennsylvania Arizona HUNTINGTON BANKING REGIONS Western Michigan Eastern Michigan Northern Ohio Central Ohio Indiana West Virginia Southern Ohio / Kentucky P R I VAT E FINANCIAL GROUP Florida M O RT G A G E BANKING Florida Maryland New Jersey... -

Page 10

..., we are better able to help them ï¬nancially. When they win, we win. Within Huntington, important interfaces have been improved. Lines of business are more closely integrated, and reï¬nements have also been made in communications and working relationships between individual associates and across... -

Page 11

...our associates and our passion to develop dynamic interfaces with all of our customers. Henry Dabish AND Jack Slocum SMALL BUSINESS CASE STUDY Sue Feamster AND Jim Nelson AND Don Gallion AND Karen Hartig PRIVATE FINANCIAL GROUP CASE STUDY Ellen Johnson RETAIL CASE STUDY Doug Smith COMMERCIAL... -

Page 12

Jack Slocum Vice President, Business Banker West Bloomfield, Michigan "It's a very healthy relationship (no pun intended) for a lot of reasons." He nry Dabish Huntington went out of its way to learn about our business, to We've always believed that the only way we're going to sustain membership ... -

Page 13

... our business," he says, "to learn about us personally and the way we think." He also appreciates the teamwork within Huntington that led to his larger interface with the bank. "I was fortunate enough to meet Linda Bomberski, a Private Banking Ofï¬cer with Huntington's Private Financial Group in... -

Page 14

...formed with Huntington was, initially at least, a highly mobile one. "She found a home and wanted to get the ï¬nancing taken care of quickly," says Karen Hartig, Huntington Vice President and Relationship Manager. "She was moving so fast and in so many directions, we had to work a lot by cell phone... -

Page 15

... for the client." Karen Hartig Vice President, Relationship Manager Cincinnati, Ohio Sue Feamster From the very beginning they made it extremely easy. It was just like banks used to be. I can get answers immediately, and for me that's important because I don't have time to go through layers of... -

Page 16

... the cool things the Web site can do, like giving you instant access to check images." Huntington was the ï¬rst bank in its markets to offer visual check images online. In addition to checking, Jim has a mortgage and a home equity credit line with Huntington. By far his favorite online feature is... -

Page 17

... online banks ranked Huntington No. 5 in the country." Ellen Johnson Vice President, Product Group Manager Columbus, Ohio Jim Nels on With Huntington's Bill Pay system, all I have to do The features are great, usability is fantastic, and when I have a problem, Huntington's customer service... -

Page 18

Doug Smith Assistant Vice President, Senior Commercial Sales Executive Morgantown, West Virginia "We interfaced with them at just the right time - in time to help them grow into...an ideal commercial customer." Don Gallion The Huntington team spent a lot of time with us and time on our floor ... -

Page 19

... have many government contracts, so they need plenty of ï¬nancial ï¬,exibility." Huntington also provides the company with Treasury Management and personal banking services, as well as home mortgage and insurance services for employees, a 401(k) plan and the Huntington At Work program, which offers... -

Page 20

... Senior Vice President, Regional Manager Indianapolis, Indiana "...we were able to simplify the process." De nnis Re inbold It's extremely important to me to be able to pick up the phone and call someone and say I Huntington's local presence, local decisionmaking and exceptional internal teamwork... -

Page 21

... with Treasury Management services, corporate checking and dealer investment accounts. The dealership also uses Huntington's loan and lease products to ï¬nance their new and used vehicle sales. Al points to Huntington's local presence, local decision-making and exceptional internal teamwork - "not... -

Page 22

..., operations, ï¬nancial needs and opportunities. "As the local bank with national resources, we understand what's driving the local economy and healthcare in particular," says John Irwin, Senior Vice President for Commercial Banking in Western Michigan. "It became obvious to us that Dr. Buzzitta is... -

Page 23

"As the local bank with national resources, we understand what's driving the local economy and healthcare in particular." John Irwin Senior Vice President, Commercial Region Manager Grand Rapids, Michigan James Buzzit ta, M.D. We not only talk about our organizations, but about the impact our ... -

Page 24

... better life. In spite of personal setbacks, Tina Coleman is all the more driven to create a secure future for herself and her two small children, thanks to Huntington's involvement in a national program available in New Philadelphia, Ohio. New Philadelphia is in Tuscarawas County, a small community... -

Page 25

Ways To Work: Family Loan Program, which enables participants to obtain low-interest auto loans so they can get to their jobs. Susan Klann Assistant Vice President, Banking Office Manager New Philadelphia, Ohio Tina Cole man They provided much more than a car. They gave me encouragement and ... -

Page 26

... we make available locally. Life insurance Safety deposit boxes Online banking & bill pay Business Banking Products and Services SBA loans Real estate loans Business term loans Equipment leases Lines of credit Business credit cards Business checking accounts Business check cards Business overdraft... -

Page 27

...online products, to help commercial Commercial Banking Products and Services Commercial loans Commercial real estate loans Lines of credit Equipment leasing and ï¬nancing Technology leasing Mezzanine lending Interest rate swaps Commercial checking accounts Investments(1) Asset management Corporate... -

Page 28

... retirement plans Custody Corporate trust Investment management Institutional asset management Proprietary mutual funds Fixed and variable annuities Securities brokerage (1) (1) customers operate more efï¬ciently. And we established programs to deï¬ne credit, sales and employee cultures in order... -

Page 29

... make available, including 401(k) plans for dealer employees, and products and services for dealership owners and key members of the management team designed and delivered by our Private Financial Group. Although we sold $2.1 billion in loans to reduce credit exposure to the auto sector in 2003... -

Page 30

... and services include home equity loans, ï¬rst mortgage loans, installment loans, small business loans and deposit products, as well as cash management, investment and insurance services. Commercial Banking Profile Customer base comprised of middle-market and larger corporations with annual sales... -

Page 31

[email protected] David P. Lauer Certiï¬ed Public Accountant; Retired Managing Partner, Deloitte & Touche, Columbus, Ohio Ofï¬ce Joined Board: 2003 Age: 61 Wm. J. Lhota Principal, LHOTA SERVICES; Retired President - Energy Delivery, American Electric Power; Retired Executive Vice President... -

Page 32

...by Huntington's statements due to a variety of factors including, but not limited to, those described under the heading "Business Risks" in Huntington's Form 10-K for the year ended December 31, 2003, and other factors described from time to time in Huntington's other filings with the Securities and... -

Page 33

... Results of Operations Report of Management Independent Auditor's Report Consolidated Balance Sheets Consolidated Income Statements 100 Consolidated Statements of Changes in Shareholders' Equity 101 Consolidated Statements of Cash Flows 102 Notes to Consolidated Financial Statements 141 Glossary of... -

Page 34

... Taxes Credit Risk Credit Risk Management Commercial Credit Consumer Credit Investment Portfolio Net Charge-offs Non-Performing Assets Allowance for Loan and Lease Losses Market Risk Interest Rate Risk Lease Residual Risk Price Risk Liquidity Bank Liquidity Parent Company Liquidity Off-Balance Sheet... -

Page 35

...Loan and Lease Losses and Related Statistics Contractual Obligations Deposit Liabilities Securities Available for Sale Maturity Schedule of Selected Loans and Leases Capital Adequacy Line of Business- GAAP Earnings vs. Operating Earnings Reconciliation Regional Banking Dealer Sales Private Financial... -

Page 36

...Provision for loan and lease losses Net interest income after provision for loan and lease losses Securities gains Gain on sale of Florida operations Merchant Services gain Gains on sale of credit card portfolios Non-interest income Non-interest expense Restructuring (releases) charges Income before... -

Page 37

...equipment leasing, investment management, trust services, and discount brokerage services, as well as underwriting credit life and disability insurance, and selling other insurance and financial products and services. Huntington's banking offices are located in Ohio, Michigan, West Virginia, Indiana... -

Page 38

...or financial performance in future periods. A discussion about the process used to estimate the ALLL is presented in the Credit Risk section of Management's Discussion and Analysis in this report. • Loan servicing rights - At December 31, 2003, there were $71.1 million of mortgage servicing rights... -

Page 39

...by the sale of the Florida-related assets and liabilities, was used to repurchase 9% of common shares outstanding, and to reinvest in a number of activities including improvements in customer service technology, and the purchases of a small money management firm and a niche equipment leasing company... -

Page 40

... Loan and Lease Losses Operating lease income Service charges on deposit accounts Trust services Brokerage and insurance Mortgage banking Bank owned life insurance Other service charges and fees Gain on sales of automobile loans Gain on sale of branch offices Securities gains Gain on sale of Florida... -

Page 41

.... 1. CORPORATE RESTRUCTURING CHARGES. The 2001 strategic refocusing plan included the intent to sell the Florida banking and insurance operations, credit-related and other actions to strengthen the balance sheet and financial performance, and the consolidation of numerous non-Florida banking offices... -

Page 42

...Net Income-GAAP Change from prior year-$ Change from prior year-% Restructuring charges (releases) Loss from Florida operations Gain on sale of Florida operations Merchant Services gain Gain on sale of automobile loans Cum. effect of change in accounting Gain on sale of branch offices Long-term debt... -

Page 43

... no netting provisions. Accordingly, residual values covered under this policy qualify for the direct financing method of accounting. This program is subject to renewal in May 2005. Operating leases are a non-interest earning asset with the related rental income, other revenue, and credit recoveries... -

Page 44

... equivalent yields are calculated assuming a 35% tax rate. (2) Average rates computed using historical cost average balances and do not give effect to changes in fair value of securities available for sale. (3) Individual loan and lease components include fees and cash basis interest received on... -

Page 45

MANAGEMENT'S DISCUSSION AND A NALYSIS Interest Income / Expense 2003 2002 2001 2000 1999 2003 2002 Average Rate(2)(3)(4) 2001 2000 1999 $ 0.6 0.6 1.6 30.0 159.6 23.5 183.1 274.5 53.8 141.5 $ ...% 0.14 3.62% 3.24% 0.05 3.29% 2.91% 0.09 3.00% 3.37% 0.16 3.53% HUNTINGTON BANCSHARES INCORPORATED 43 -

Page 46

... leases Securities Other Earning Assets Total Earning Assets Deposits Short-term borrowings Federal Home Loan Bank advances Subordinated notes and other long-term debt, including capital securities Total Interest-Bearing Liabilities Net Interest Income (1) Calculated assuming a 35% tax rate. 2003... -

Page 47

... sale of the Florida banking operations, as well as the planned run-off of lower-margin investment securities and other earning assets (see Table 4 and Balance Sheet discussion). BALANCE SHEET LOAN AND LEASE PORTFOLIO MIX Table 6 shows total loans and leases were $21.1 billion at December 31, 2003... -

Page 48

...lease assets, and securitized loans. AVERAGE BALANCE SHEET DISCUSSION-LOANS, LEASES, AND OTHER EARNING ASSETS 2003 versus 2002 Performance Average loans and leases increased $2.6 billion, or 15%, and reflected growth in automobile loans and leases, residential mortgages, home equity loans and lines... -

Page 49

... in average securities. This increase reflected an investment of a portion of the proceeds from the automobile loan sales and the securitization and retention of originated residential mortgages. Average operating lease assets were $1.7 billion in 2003, down 35% from the prior year, reflecting the... -

Page 50

... deposits in banks Trading account securities Federal funds sold and securities purchased under resale agreements Mortgages held for sale Securities: Taxable Tax exempt Total securities Loans and leases: C&I CRE Construction Commercial Consumer Automobile loans and leases Home equity Residential... -

Page 51

... that balance sheet growth during 2003 exceeded that of core deposits and, therefore, required funding through brokered CDs, Federal Home Loan Bank (FHLB) advances, and other longterm debt. As previously mentioned, though it had no significant impact on average balances, $250 million of secured long... -

Page 52

... Mortgage banking Bank owned life insurance Other service charges and fees Securities gains Other Sub-total before operating lease income Operating lease income Sub-total including operating lease income Gain on sales of automobile loans Gain on sale of branch offices Gain on sale of Florida... -

Page 53

...by a the positive impact of higher annuity sales, though fees associated with mutual fund sales declined. • $11.4 million decline in service charges on deposit accounts, with $27.2 million reflecting the sale of the Florida banking and insurance operations, which had $4.2 million and $31.4 million... -

Page 54

... and sales commission expense, especially related to mortgage banking activity, as well as higher benefit and pension costs, including an $11.5 million decline associated with the sold Florida banking and insurance operations. • $9.4 million, or 28%, increase in professional services including... -

Page 55

... loan quality factors. In 2003, the company increased its emphasis on extending credit to commercial customers with existing or expandable relationships within the company's primary markets. As a result, shared national credit exposure declined significantly over this period HUNTINGTON BANCSHARES... -

Page 56

... group composed of highly skilled and experienced lenders to manage problem credits. The group handles commercial recoveries, workouts, and problem loan sales, as well as the day-to-day management of relationships rated substandard or worse. The group is responsible for developing an action plan... -

Page 57

... economic environment. The following table compares 2003 performance to these targets: Net Charge-off Rates on an Annualized Basis Total C&I and CRE loans Automobile loans and leases Home equity loans and lines Total loans and leases (1) Assumes loan and lease portfolio mix comparable to 12/31/03... -

Page 58

... quality loans and leases, and the success in lowering individual concentrations in larger C&I and CRE credits, as well as the 2003 fourth quarter sale of lower credit quality commercial loans, including NPAs. Further improvement in the consumer net charge-off ratio is also expected. Net charge-offs... -

Page 59

...241 Beginning of Period New non-performing assets Returns to accruing status Loan and lease losses Payments Sales (1) End of Period (1) 2002 Includes $6.5 million related to the sale of the Florida operations and $21.4 million related to the fourth quarter special credit actions. 2003 includes $26... -

Page 60

... and lease losses reflects prior loss experiences as well as various judgments and assumptions, including (1) Management's evaluation of credit risk related to both individual borrowers and pools of loans, (2) observations derived from Management's ongoing internal review and examination processes... -

Page 61

...changes in the market value of the company's assets and liabilities. Market risk arises when the company extends fixed-rate loans, purchases fixed-rate securities, originates fixed-rate certificates of deposit (CDs), obtains funding through fixed-rate borrowings, and leases automobiles and equipment... -

Page 62

... basis point change in rates. Factors affecting the net interest margin in 2003 included (1) the reduction of relatively high-yielding automobile loans as part of Management's objective to reduce the concentration of automobile loans; (2) faster prepayments on mortgage-related loans and securities... -

Page 63

...the trading securities held by broker-dealer subsidiaries, in the foreign exchange positions that the Bank holds held to accommodate its customers, in investment's in limited partnerships, and in the marketable equity securities available for sale held by insurance subsidiaries. To manage price risk... -

Page 64

... The Huntington National Bank Moody's Investor Service Standard & Poor's Corporation Fitch Ratings A1 A A A2 AAP1 A1 F1 Negative CreditWatch Negative Stable BANK LIQUIDITY The company manages liquidity at the Bank level to ensure that adequate funding sources are available to meet ongoing business... -

Page 65

...maturity Certificates of deposit and other time deposits Short-term borrowings Federal Home Loan Bank advances Subordinated notes Other long-term debt Operating lease obligations Federal Funds Purchased and Repurchase Agreements (in thousands of dollars) Year Ended December 31, 2003 $1,378,058 0.73... -

Page 66

... more Brokered time deposits and negotiable CDs Foreign time deposits Total Deposits By Business Segment Regional Banking Central Ohio Northern Ohio Southern Ohio / Kentucky West Michigan East Michigan West Virginia Indiana Total Regional Banking Dealer Sales Private Financial Group Treasury/Other... -

Page 67

...31 3.89 3.84 4.15 4.08 4.94 9.12 8.38 6.12 6.72 6.74 5.93 2.28 1.80 4.06 10.71 3.99 4.87% (1) Weighted average yields were calculated using amortized cost and on a fully tax equivalent basis assuming a 35% tax rate. Marketable equity securities are excluded. HUNTINGTON BANCSHARES INCORPORATED 65 -

Page 68

... company's stock, debt service, and operating expenses. The parent company obtains funding to meet its obligations from dividends received from its direct subsidiaries, net taxes collected from its subsidiaries included in the consolidated tax return, and the issuance of debt securities. Management... -

Page 69

... The Bank enters into forward contracts relating to its mortgage banking business. At December 31, 2003 and 2002, commitments to sell residential real estate loans totaled $277 million and $782 million, respectively. These contracts mature in less than one year. Huntington and/or the Bank may... -

Page 70

... these products, the return calculation and assessment process is the same. This allows for a quantitative basis for balance sheet management decisions. Lines of Business Discussion Huntington has three distinct lines of business: Regional Banking, Dealer Sales, and the Private Financial Group (PFG... -

Page 71

... from the company's management reporting system. This most notably impacted the funds transfer pricing methodology (see above discussion). The 2001 previously reported segment results were not able to be restated for these methodology changes, which diminishes some of the benefit of net interest and... -

Page 72

... branch offices Long-term debt extinguishment Net Income-Operating Change from prior year-$ Change from prior year-% 2002 Net Income-GAAP Change from prior year-$ Change from prior year-% Restructuring charges Loss from Florida operations Gain on sale of Florida operations Merchant Services gain Net... -

Page 73

... Ohio, Michigan, West Virginia, Indiana, and Kentucky through the company's traditional banking network. Each region is further divided into Retail and Commercial Banking units. Retail products and services include home equity loans and lines of credit, first mortgage loans, direct installment loans... -

Page 74

... mortgages and home equity loans and lines. Average deposits increased 7%, led by a very strong 37% increase in interest bearing demand deposits. Non-interest income increased 2%, primarily reflecting higher service charges on consumer and commercial deposit accounts and fees for electronic banking... -

Page 75

... BALANCES (in millions) Loans: C&I CRE Construction Commercial Consumer Auto loans-indirect Home equity loans & lines of credit Residential mortgage Other loans Total Consumer Total Loans Deposits: Non-interest bearing deposits Interest bearing demand deposits Savings deposits Domestic time deposits... -

Page 76

... Banking(1) 2003 Change From 2002 Amount % 2002 Change From 2001 Amount % 2001 PERFORMANCE METRICS Return on average assets Return on average equity Net interest margin Efficiency ratio CREDIT QUALITY Net Charge-offs by Loan Type (in thousands) C&I CRE Total commercial Consumer Auto loans Home... -

Page 77

...-Regional Banking(1) 2003 Change From 2002 Amount % 2002 SUPPLEMENTAL DATA # employees-full-time equivalent (EOP) Retail Banking Average loans (in millions) Average deposits (in millions) # employees-full-time equivalent (EOP) # banking offices (EOP) # ATMs (EOP) # DDA households (EOP) # New 90-day... -

Page 78

... in net charge-offs. Net charge-offs for Dealer Sales are concentrated in automobile loans and leases. The net charge-off ratio for automobile loans was 1.24% in 2003, down from 1.37% in 2002, and reflected the continued upward trend in the credit quality of loans originated. Charge-offs of direct... -

Page 79

... lease expense. Other non-interest expense declined 6% primarily due to lower residual value insurance costs, while personnel costs increased 9%, primarily due to higher benefits costs and production-related salary costs. The return on average assets and return on average equity for Dealer Sales... -

Page 80

... 22-Dealer Sales(1) 2003 Change From 2002 Amount INCOME STATEMENT (in thousands) Net Interest Income Provision for loan losses Net Interest Income After Provision for Loan Losses Operating lease income Service charges on deposit accounts Brokerage and insurance income Trust services Mortgage banking... -

Page 81

...Dealer Sales(1) 2003 Change From 2002 Amount % 2002 Change From 2001 Amount % 2001 PERFORMANCE METRICS Return on average assets Return on average equity Net interest margin Efficiency ratio CREDIT QUALITY Net Charge-offs by Loan Type (in thousands) C&I CRE Total commercial Consumer Auto leases Auto... -

Page 82

MANAGEMENT'S DISCUSSION AND A NALYSIS Table 22-Dealer Sales(1) 2003 Change From 2002 Amount % 2002 SUPPLEMENTAL DATA # employees-full-time equivalent (EOP) Automobile loans Production (in millions) % Production new vehicles Average term (in months) Automobile leases Production (in millions) % ... -

Page 83

...FINANCIAL GROUP The Private Financial Group (PFG) provides products and services designed to meet the needs of the company's higher net worth customers. Revenue is derived through trust, asset management, investment advisory, brokerage, insurance, and private banking products and services. The trust... -

Page 84

... losses. Net interest income declined 2% driven by growth in lower margin loans, as well as a decline in the deposit rate credit, reflecting a lower interest rate environment. Average loans and leases increased 36%, reflecting strong growth in lower margin residential and home equity loans and lines... -

Page 85

MANAGEMENT'S DISCUSSION AND A NALYSIS Table 23-Private Financial Group(1) 2003 Change From 2002 Amount INCOME STATEMENT (in thousands) Net Interest Income Provision for loan losses Net Interest Income After Provision for Loan Losses Service charges on deposit accounts Brokerage and insurance income... -

Page 86

...-Private Financial Group(1) 2003 Change From 2002 Amount % 2002 Change From 2001 Amount % 2001 PERFORMANCE METRICS Return on average assets Return on average equity Net interest margin Efficiency ratio CREDIT QUALITY Net Charge-offs by Loan Type (in thousands) C&I CRE Total commercial Consumer Home... -

Page 87

... sharing Total Brokerage and Insurance Income (net of fee sharing) Mutual fund sales volume (in thousands) Annuities sales volume (in thousands) Trust Services Income (in thousands) Personal trust (including Haberer) Huntington funds Institutional trust Corporate trust Other trust $ 30,518 19,200... -

Page 88

...and expense related to assets, liabilities, and equity that are not directly assigned or allocated to one of the three business segments. Assets included in this segment include bank owned life insurance, investment securities, and mezzanine loans originated through Huntington Capital Markets. Since... -

Page 89

... 24-Treasury/Other(1) 2003 Change From 2002 Amount INCOME STATEMENT (in thousands) Net Interest Income Provision for loan losses Net Interest Income After Provision for Loan Losses Service charges on deposit accounts Brokerage and insurance income Bank owned life insurance income Other Total Non... -

Page 90

MANAGEMENT'S DISCUSSION AND A NALYSIS Table 24-Treasury/Other(1) 2003 Change From 2002 Amount % 2002 Change From 2001 Amount % 2001 PERFORMANCE METRICS Return on average assets Return on average equity Net interest margin Efficiency ratio CREDIT QUALITY Net Charge-offs by Loan Type (in thousands) ... -

Page 91

... loan losses Net Interest Income After Provision for Loan Losses Operating lease income Service charges on deposit accounts Brokerage and insurance income Trust services Mortgage banking Bank owned life insurance income Other service charges and fees Other Total Non-Interest Income Before Securities... -

Page 92

...average equity Net interest margin Efficiency ratio CREDIT QUALITY Net Charge-offs by Loan Type (in thousands) C&I CRE Total commercial Consumer Auto leases Auto loans Home equity loans & lines of credit Residential mortgage Other loans Total consumer Total Net Charge-offs Net Charge-offs-annualized... -

Page 93

... strong growth in adjustable rate mortgages. Average home equity loans and lines increased $0.5 billion, or 16%. Total average C&I and CRE loans were up $0.3 billion, or 3%, from a year ago, reflecting 11% growth in middle-market CRE loans and 10% growth in small business loans, partially offset by... -

Page 94

...lower concentrations in large, individual commercial credits, downward trending net charge-offs, and a higher percentage of the total loan portfolio being in lower-risk mortgages and home equity loans. The allowance for loan and lease losses as a percent of non-performing assets increased to 384% at... -

Page 95

...Operating lease income Service charges on deposit accounts Trust services Brokerage and insurance income Mortgage banking Bank Owned Life Insurance income Other service charges and fees Gain on sales of automobile loans Gain on sale of branch offices Securities gains (losses) Gain on sale of Florida... -

Page 96

... 2003 repurchase program Number of shares repurchased Remaining shares authorized to repurchase (2) Quarterly Key Ratios and Statistics Margin Analysis-As a % of Average Earning Assets (3) Interest income Interest expense Net Interest Margin Return on average assets Return on average shareholders... -

Page 97

... the signing of a definitive agreement to acquire Unizan Financial Corp. of Canton, Ohio. At December 31, 2003, Unizan had total assets of $2.7 billion. Under the terms of the agreement, Unizan shareholders will receive 1.1424 shares of Huntington common stock, on a tax-free basis, for each share of... -

Page 98

... to ensure that material information relating to the financial and operating condition of Huntington is properly reported to its chief executive officer, chief financial officer, internal auditors, and the audit/risk committee of the board of directors in connection with the preparation and... -

Page 99

... consolidated balance sheets of Huntington Bancshares Incorporated and Subsidiaries as of December 31, 2003 and 2002, and the related consolidated statements of income, changes in shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2003. These financial... -

Page 100

... deposits in banks Trading account securities Mortgage loans held for sale Securities available for sale-at fair value Investment securities-fair value $3,937 and $7,725, respectively Loans and leases: Commercial and industrial Commercial real estate Consumer Automobile loans Automobile leases Home... -

Page 101

... lease income Service charges on deposit accounts Trust services Brokerage and insurance Mortgage banking Bank owned life insurance Other service charges and fees Gain on sale of automobile loans Gain on sale of branch offices Securities gains Gain on sale of Florida operations Merchant Services... -

Page 102

... ($0.72 per share) Stock options exercised Treasury shares sold to employee benefit plans Balance -December 31, 2001 Comprehensive income: Net income Unrealized net holding gains on securities available for sale arising during the period, net of reclassification adjustment for net gains included in... -

Page 103

...securities available for sale Gains on sales/securitizations of loans Gain on sale of branch offices Gain on sale of Florida banking and insurance operations Gain on restructuring of Huntington Merchant Services LLC Loss on early extinguishment of debt Restructuring (releases) charges Other, net Net... -

Page 104

...equipment leasing, investment management, trust services, and discount brokerage services, as well as underwriting credit life and disability insurance, and selling other insurance and financial products and services. Huntington's banking offices are located in Ohio, Michigan, West Virginia, Indiana... -

Page 105

... Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, which was adopted by Huntington in 2001. Asset securitization involves the sale of a pool of loan receivables, generally to a trust, in exchange for funding collaterized by these loans... -

Page 106

...in securities available for sale and the servicing rights are recorded in other assets in the consolidated balance sheets. Servicing revenues, net of the amortization of servicing rights, are included in other non-interest income. Allowance for Loan and Lease Losses: The allowance for loan and lease... -

Page 107

...and equipment leased to business customers. These assets are reported at cost, including net deferred origination fees or costs, less accumulated depreciation. For automobile operating leases, net deferred origination fees or costs include the referral payments Huntington makes to automobile dealers... -

Page 108

...0.49 Assumptions Risk-free interest rate Expected dividend yield Expected volatility of Huntington's common stock Pro Forma Results Net income, as reported Less pro forma expense related to options granted Pro Forma Net Income Net Income Per Common Share: Basic, as reported Basic, pro forma Diluted... -

Page 109

... by Huntington's management reporting system, as appropriate. Prior periods are not restated for these changes. Statement of Cash Flows: Cash and cash equivalents are defined as "Cash and due from banks" and "Federal funds sold and securities purchased under resale agreements." 2. New Accounting... -

Page 110

... of the effects of an entity's accounting policy with respect to stock-based employee compensation on reported net income and earnings per share in annual and interim financial statements. While FAS 148 does not require companies to account for employee stock options using the fair value method... -

Page 111

... available for sale include privately placed collateralized mortgage obligations, Federal Home Loan Bank and Federal Reserve Bank stock, corporate debt and municipal securities, and marketable equity securities. Management does not believe any individual unrealized loss as of December 31, 2003... -

Page 112

... Under 1 year 1 - 5 years 6 - 10 years Over 10 years Retained interests in securitizations Marketable equity securities Total Securities Available For Sale At December 31, 2003, the carrying value of securities pledged to secure public and trust deposits, trading account liabilities, U.S. Treasury... -

Page 113

...secure potential discount window borrowings from the Federal Reserve Bank. Huntington's loan and lease portfolio includes lease financing receivables consisting of direct financing leases on equipment, which are included in commercial and industrial loans, and on automobiles. Net investment in lease... -

Page 114

... and receives annual servicing fees of 1.0% of the outstanding loan balances. Servicing income, net of amortization of capitalized servicing assets, amounted to $4.5 million in 2003, $1.0 million in 2002, and $3.6 million in 2001. There were no impairment charges related to Huntington's retained... -

Page 115

... trusts to purchase new balances in revolving securitizations Servicing fees received Other cash flows received on retained interest RESIDENTIAL MORTGAGE LOANS During 2003, Huntington securitized $354.2 million of residential mortgage loans and retained all of the resulting securities. Accordingly... -

Page 116

...The allowance associated with the 2002 sale of the Florida banking and insurance operations was $22.3 million. (2) Includes impaired commercial and industrial and commercial real estate loans with outstanding balances greater then $500,000. A loan is impaired when it is probable that Huntington will... -

Page 117

... to make a fixed monthly rental payment over a specified lease term, typically from 36 to 66 months. These vehicles, net of accumulated depreciation, were recorded as operating lease assets in the consolidated balance sheet. Rental income is earned by Huntington on the operating lease assets and... -

Page 118

... acquired banking operations reported under the Regional Banking line of business. In 2001, prior to the adoption of Statement No. 142, Huntington amortized $16.2 million, or $0.06 per share, of non-deductible goodwill and $22.9 million, or $0.09 per share, of deductible goodwill. For the years 2004... -

Page 119

...819 Average balance during the year Average interest rate during the year Maximum month-end balance during the year Commercial paper is issued by Huntington Bancshares Financial Corporation, a non-bank subsidiary, with principal and interest guaranteed by the parent company. HUNTINGTON BANCSHARES... -

Page 120

...of the parent company are no longer eliminated in consolidation as an inter-company item and are therefore reported as obligations of Huntington. At December 31, 2003, the parent company had an equity investment in both of the business trusts of $9.3 million. 118 HUNTINGTON BANCSHARES INCORPORATED -

Page 121

... Banking, Dealer Sales, and the Private Financial Group (PFG). A fourth segment includes Huntington's Treasury function and other unallocated assets, liabilities, revenue, and expense. Line of business results are determined based upon Huntington's management reporting system, which assigns balance... -

Page 122

... Ohio, Michigan, West Virginia, Indiana, and Kentucky through Huntington's traditional banking network. Each region is further divided into Retail and Commercial Banking units. Retail products and services include home equity loans and lines of credit, first mortgage loans, direct installment loans... -

Page 123

... of branch offices Long-term debt extinguishment Reported Earnings 2002 Net interest income Provision for loan and lease losses Non-interest income Non-interest expense Income taxes Operating Earnings Restructuring charges Florida operations sold Gain on sale of Florida operations Merchant Services... -

Page 124

... effect of change in accounting method for derivatives used in cash flow hedging relationships: Unrealized net losses Related tax benefit Net Minimum pension liability: Unrealized net loss Related tax benefit Net Unrealized holding gains and losses on securities available for sale arising during... -

Page 125

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 19. Earnings Per Share Basic earnings per share is the amount of earnings for the period available to each share of common stock outstanding during the reporting period. Diluted earnings per share is the amount of earnings available to each share of common... -

Page 126

... TO CONSOLIDATED FINANCIAL STATEMENTS 20. Stock-based Compensation Huntington sponsors nonqualified and incentive stock option plans. These plans provide for the granting of stock options to officers and other employees. Huntington's board of directors has approved all of the plans. Shareholders... -

Page 127

... sale of Huntington's banking and insurance operations in Florida, the consolidation of certain banking offices, and other actions to strengthen Huntington's balance sheet and financial performance. The 1998 reserve was established for, among other items, the exit from under-performing product lines... -

Page 128

... plan. For any employee retiring on or after January 1, 1993, post-retirement healthcare benefits are based upon the employee's number of months of service and are limited to the actual cost of coverage. Life insurance benefits are a percentage of the employee's base salary at the time of retirement... -

Page 129

...and 2002, respectively. In both years, the fair value of Huntington's plan assets exceeded its accumulated benefit obligation. The following table presents the funded status of the Plan and the post-retirement benefit plan with the amounts recognized in the consolidated balance sheets at December 31... -

Page 130

... million and net periodic post-retirement benefits cost to approximate $6 million for 2004. At September 30, 2003 and 2002, The Huntington National Bank, as trustee, held all Plan assets. The Plan assets consisted of investments in a variety of Huntington mutual funds and Huntington common stock as... -

Page 131

... 2001. The number of shares of Huntington common stock held by this plan was 8,368,383 at December 31, 2003 and 8,812,405 at the end of the prior year. The market value of these shares was $188.3 million and $164.9 million at the same respective dates. Dividends received by the plan during 2003 were... -

Page 132

... assets: Allowance for loan losses Alternative minimum tax Net operating loss Other Total Deferred Tax Assets Deferred tax liabilities: Lease financing Undistributed income of subsidiary Pension and other employee benefits Mortgage servicing rights Unrealized gains on securities available for sale... -

Page 133

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS At December 31, 2003, Huntington's deferred tax asset related to loss and credit carry-forwards amounted to $8.7 million. This is comprised of net operating loss carry-forwards for United States federal income tax purposes, which will begin expiring in ... -

Page 134

...-term assets Trading account securities Mortgages held for sale Securities Net loans and direct financing leases Customers' acceptance liability Financial Liabilities: Deposits Short-term borrowings Bank acceptances outstanding Federal Home Loan Bank advances Subordinated notes Other long-term debt... -

Page 135

...losses in the loan and lease portfolio. Deposits-demand deposits, savings accounts, and money market deposits are, by definition, equal to the amount payable on demand. The fair values of fixed-rate time deposits are estimated by discounting cash flows using interest rates currently being offered on... -

Page 136

... that swap variable-rate interest for fixed-rate interest over the life of the contracts. Interest rate swaps are used to manage the interest rate risk associated with its retained interest in a securitization trust. This retained interest provides the right to receive any future cash flows arising... -

Page 137

...,188 Cash Flow Hedges $ 575,000 170,000 985,000 650,000 1,750,000 $4,130,000 Total $1,497,188 924,000 985,000 650,000 2,250,000 $6,306,188 Instruments associated with: Loans Deposits Federal Home Loan Bank advances Subordinated notes Other long-term debt Total Notional Value at December 31, 2003... -

Page 138

... are offered to enable customers to meet their financing and investing objectives and for their risk management purposes. Derivative financial instruments held in Huntington's trading portfolio during 2003 and 2002 consisted predominantly of interest rate swaps, but also included interest rate caps... -

Page 139

... offices or on deposit at the Federal Reserve Bank. During 2003 and 2002, the average balance of these deposits were $66.6 million and $70.0 million, respectively. Under current Federal Reserve regulations, the Bank is limited as to the amount and type of loans it may make to the parent company... -

Page 140

... Securities available for sale Due from The Huntington National Bank Due from non-bank subsidiaries Investment in The Huntington National Bank Investment in non-bank subsidiaries Goodwill, net of accumulated amortization Accrued interest receivable and other assets Total Assets Liabilities Short... -

Page 141

... from (advances to) subsidiaries Purchase of securities available for sale Proceeds from sale of securities available for sale Net Cash (Used in) Provided by Investing Activities Financing Activities Decrease in short-term borrowings Proceeds from issuance of other long-term debt Payment of other... -

Page 142

... Income Provision for loan and lease losses Gain on sale of Florida operations Merchant Services gain Securities gains Non-interest income Non-interest expense Restructure (releases) charges Income Before Income Taxes Income taxes Net Income Per Common Share: Net Income-Basic Net Income- Diluted... -

Page 143

... Margin - Net interest income on a fully taxable equivalent basis divided by total average earning assets. Non-Core Funding - Includes domestic time deposits of $100,000 or more, brokered time deposits and negotiable CDs, foreign time deposits, short-term borrowings, Federal Home Loan Bank advances... -

Page 144

... debt and the allowance for loan and lease losses. Treasury Stock - Common stock repurchased and held by the issuing corporation for possible future issuance. Other Financial Terms For analytical purposes, including understanding performance trends, decision-making, and peer comparison, management... -

Page 145

... call (800) 725-0674. SHAREHOLDER INFORMATION Corporate Headquarters (614) 480-8300 Direct Bank (800) 480-BANK (2265) Business Direct (800) 480-2001 Dealer Sales (800) 445-8460 The Huntington Investment Company (800) 322-4600 Mortgage Group (800) 562-6871 Private Financial Group (800) 544-8347... -

Page 146

Huntington Center 41 S. High Street Columbus, Ohio 43287 (614) 480-8300 huntington.com HUNTINGTON BANCSHARES INCORPORATED ® and Huntington® are federally registered service marks of Huntington Bancshares Incorporated. © 2004 Huntington Bancshares Incorporated. 03004AR