Hormel Foods 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

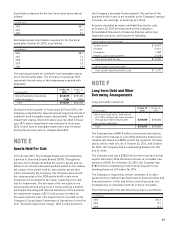

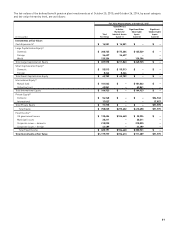

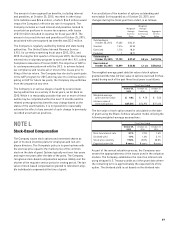

A reconciliation of the number of options outstanding and

exercisable (in thousands) as of October 25, 2015, and

changes during the fi scal year then ended, is as follows:

Weighted-

Weighted- Average

Average Remaining Aggregate

Exercise Contractual Intrinsic

Shares Price Term Value

Outstanding at

October 26, 2014 17,402 $ 24.61

Granted 1,514 52.55

Exercised 1,716 18.61

Forfeited 1 18.71

Outstanding at

October 25, 2015 17,199 $ 27.67 5.0 yrs $ 699,294

Exercisable at

October 25, 2015 12,899 $ 22.83 4.1 yrs $ 586,844

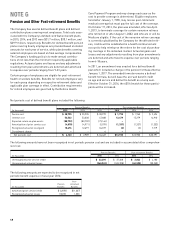

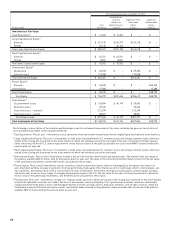

The weighted-average grant date fair value of stock options

granted and the total intrinsic value of options exercised (in thou-

sands) during each of the past three fi scal years is as follows:

Fiscal Year Ended

October 25, October 26, October 27,

2015 2014 2013

Weighted-average

grant date fair value $ 9.84 $ 9.70 $ 5.50

Intrinsic value of

exercised options $ 67,516 $ 74,972 $ 77,610

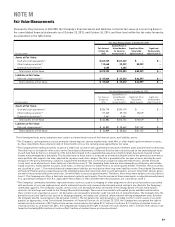

The fair value of each option award is calculated on the date

of grant using the Black-Scholes valuation model utilizing the

following weighted-average assumptions:

Fiscal Year Ended

October 25, October 26, October 27,

2015 2014 2013

Risk-free interest rate 2.1% 2.5% 1.4%

Dividend yield 1.9% 1.8% 2.1%

Stock price volatility 19.0% 20.0% 20.0%

Expected option life 8 years 8 years 8 years

As part of the annual valuation process, the Company reas-

sesses the appropriateness of the inputs used in the valuation

models. The Company establishes the risk-free interest rate

using stripped U.S. Treasury yields as of the grant date where

the remaining term is approximately the expected life of the

option. The dividend yield is set based on the dividend rate

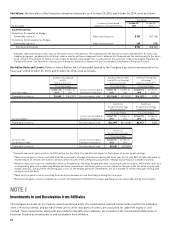

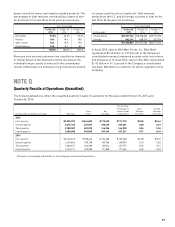

The amount of unrecognized tax benefi ts, including interest

and penalties, at October 25, 2015, recorded in other long-

term liabilities was $24.6 million, of which $16.0 million would

impact the Company’s effective tax rate if recognized. The

Company includes accrued interest and penalties related to

uncertain tax positions in income tax expense, with losses

of $1.0 million included in expense for fi scal year 2015. The

amount of accrued interest and penalties at October 25, 2015,

associated with unrecognized tax benefi ts was $3.2 million.

The Company is regularly audited by federal and state taxing

authorities. The United States Internal Revenue Service

(I.R.S.) is currently examining fi scal years 2013, 2014, and

2015. During the fi rst quarter of fi scal year 2015, the Company

entered into a voluntary program to work with the I.R.S. called

Compliance Assurance Process (CAP). The objective of CAP is

to contemporaneously work with the I.R.S. to achieve federal

tax compliance and resolve all or most of the issues prior to

fi ling of the tax return. The Company has elected to participate

in the CAP program for 2015 and may elect to continue partici-

pating in CAP for future tax years; the Company may withdraw

from the program at any time.

The Company is in various stages of audit by several state

taxing authorities on a variety of fi scal years, as far back as

2010. While it is reasonably possible that one or more of these

audits may be completed within the next 12 months and the

related unrecognized tax benefi ts may change based on the

status of the examinations, it is not possible to reasonably

estimate the effect of any amount of such change to previously

recorded uncertain tax positions.

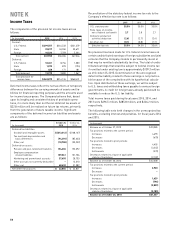

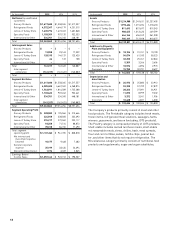

NOTE L

Stock-Based Compensation

The Company issues stock options and nonvested shares as

part of its stock incentive plans for employees and non-em-

ployee directors. The Company’s policy is to grant options with

the exercise price equal to the market price of the common

stock on the date of grant. Options typically vest over four years

and expire ten years after the date of the grant. The Company

recognizes stock-based compensation expense ratably over the

shorter of the requisite service period or vesting period. The fair

value of stock-based compensation granted to retirement-eligi-

ble individuals is expensed at the time of grant.