Hormel Foods 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

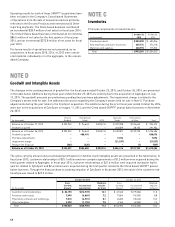

traded. The fair values of the Company’s private equity invest-

ments are determined by discounting the estimated future

cash fl ows of each entity. These cash fl ow estimates include

assumptions on growth rates and future currency exchange

rates (Level 3). Excluding charges related to the exit from

international joint venture businesses in fi scal year 2015, there

were no other charges on any of the Company’s equity invest-

ments in fi scal years 2015, 2014, or 2013.

See additional discussion regarding the Company’s equity

method investments in Note I.

Revenue Recognition: The Company recognizes sales when

title passes upon delivery of its products to customers, net of

applicable provisions for discounts, returns, and allowances.

Products are delivered upon receipt of customer purchase

orders with acceptable terms, including price and collectabil-

ity that is reasonably assured.

The Company offers various sales incentives to customers

and consumers. Incentives that are offered off-invoice include

prompt pay allowances, will call allowances, spoilage allow-

ances, and temporary price reductions. These incentives are

recognized as reductions of revenue at the time title passes.

Coupons are used as an incentive for consumers to purchase

various products. The coupons reduce revenues at the time

they are offered, based on estimated redemption rates.

Promotional contracts are performed by customers to pro-

mote the Company’s products to consumers. These incentives

reduce revenues at the time of performance through direct

payments and accrued promotional funds. Accrued promo-

tional funds are unpaid liabilities for promotional contracts

in process or completed at the end of a quarter or fi scal year.

Promotional contract accruals are based on a review of the

unpaid outstanding contracts on which performance has taken

place. Estimates used to determine the revenue reduction

include the level of customer performance and the historical

spend rate versus contracted rates.

Allowance for Doubtful Accounts: The Company estimates

the allowance for doubtful accounts based on a combination of

factors, including the age of its accounts receivable balances,

customer history, collection experience, and current market

factors. Additionally, a specifi c reserve may be established if

the Company becomes aware of a customer’s inability to meet

its fi nancial obligations.

Advertising Expenses: Advertising costs are expensed when

incurred. Advertising expenses include all media advertising

but exclude the costs associated with samples, demonstra-

tions, and market research. Advertising costs for fi scal years

2015, 2014, and 2013 were $145.3 million, $114.4 million, and

$89.9 million, respectively.

Shipping and Handling Costs: The Company’s shipping and

handling expenses are included in cost of products sold.

Research and Development Expenses: Research and devel-

opment costs are expensed as incurred and are included in

selling, general and administrative expenses. Research and

development expenses incurred for fi scal years 2015, 2014,

and 2013 were $32.0 million, $29.9 million, and $29.9 million,

respectively.

receive benefi ts under those plans. For plans with only retiree

participants, net gains or losses in excess of the corridor

are amortized over the average remaining life of the retirees

receiving benefi ts under those plans.

Contingent Liabilities: The Company may be subject to

investigations, legal proceedings, or claims related to the

on-going operation of its business, including claims both by

and against the Company. Such proceedings typically involve

claims related to product liability, contract disputes, wage and

hour laws, employment practices, or other actions brought

by employees, consumers, competitors, or suppliers. The

Company establishes accruals for its potential exposure, as

appropriate, for claims against the Company when losses

become probable and reasonably estimable. Where the

Company is able to reasonably estimate a range of potential

losses, the Company records the amount within that range

that constitutes the Company’s best estimate. The Company

also discloses the nature of and range of loss for claims

against the Company when losses are reasonably possible and

material.

Foreign Currency Translation: Assets and liabilities denom-

inated in foreign currency are translated at the current

exchange rate as of the statement of fi nancial position date,

and amounts in the statement of operations are translated at

the average monthly exchange rate. Translation adjustments

resulting from fl uctuations in exchange rates are recorded

as a component of accumulated other comprehensive loss in

shareholders’ investment.

When calculating foreign currency translation, the Company

deemed its foreign investments to be permanent in nature

and has not provided for taxes on currency translation adjust-

ments arising from converting the investment in a foreign

currency to U.S. dollars.

Derivatives and Hedging Activity: The Company uses com-

modity and currency positions to manage its exposure to price

fl uctuations in those markets. The contracts are recorded

at fair value on the Consolidated Statements of Financial

Position within other current assets or accounts payable.

Additional information on hedging activities is presented in

Note H.

Equity Method Investments: The Company has a number of

investments in joint ventures where its voting interests are in

excess of 20 percent but not greater than 50 percent and for

which there are no other indicators of control. The Company

accounts for such investments under the equity method of

accounting, and its underlying share of each investee’s equity is

reported in the Consolidated Statements of Financial Position

as part of investments in and receivables from affi liates.

The Company regularly monitors and evaluates the fair value

of our equity investments. If events and circumstances indicate

that a decline in the fair value of these assets has occurred and

is other than temporary, the Company will record a charge in

equity in earnings of affi liates in the Consolidated Statements

of Operations. The Company’s equity investments do not have

a readily determinable fair value as none of them are publicly