Hormel Foods 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

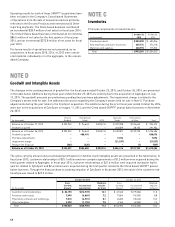

39

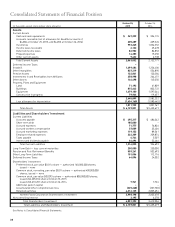

Consolidated Statements of Cash Flows

Fiscal Year Ended

October 25, October 26, October 27,

(in thousands) 2015 2014 2013

Operating Activities

Net earnings $ 687,264 $ 606,026 $ 530,076

Adjustments to reconcile to net cash provided by operating activities:

Depreciation 125,292 120,692 115,371

Amortization of intangibles 8,142 9,352 9,479

Goodwill impairment charge 21,537 – –

Equity in earnings of affi liates, net of dividends 13,438 5,246 13,507

Provision for deferred income taxes 19,979 9,800 1,067

Gain on property/equipment sales and plant facilities (5,240) (1,667) (2,127)

Non-cash investment activities (847) (1,387) (2,705)

Stock-based compensation expense 15,717 14,393 17,596

Excess tax benefi t from stock-based compensation (22,950) (24,700) (23,406)

Other – – 963

Changes in operating assets and liabilities, net of acquisitions:

Decrease (increase) in accounts receivable 22,451 (20,486) (44,459)

Decrease (increase) in inventories 82,437 (21,645) 31,699

Decrease (increase) in prepaid expenses and other current assets 62,635 11,592 (9,792)

(Decrease) increase in pension and post-retirement benefi ts (28,999) (32,644) 11,283

(Decrease) increase in accounts payable and accrued expenses (7,429) 72,307 (10,747)

Other (1,435) – –

Net Cash Provided by Operating Activities 991,992 746,879 637,805

Investing Activities

Net sale of trading securities – – 77,558

Acquisitions of businesses/intangibles (770,587) (466,204) (665,415)

Purchases of property/equipment (144,063) (159,138) (106,762)

Proceeds from sales of property/equipment 18,501 10,285 10,164

(Increase) decrease in investments, equity in

affi liates, and other assets (4,798) (1,718) (6,619)

Net Cash Used in Investing Activities (900,947) (616,775) (691,074)

Financing Activities

Proceeds from short-term debt 350,000 115,000 25,000

Principal payments on short-term debt (165,000) (115,000) (25,000)

Dividends paid on common stock (250,834) (203,156) (174,320)

Share repurchase (24,928) (58,937) (70,819)

Proceeds from exercise of stock options 10,468 10,523 30,212

Excess tax benefi t from stock-based compensation 22,950 24,700 23,406

Distribution to noncontrolling interest (1,581) (2,500) (4,000)

Payments to noncontrolling interest (11,702) – –

Net Cash Used in Financing Activities (70,627) (229,370) (195,521)

Effect of Exchange Rate Changes on Cash (7,353) (574) 416

Increase (Decrease) in Cash and Cash Equivalents 13,065 (99,840) (248,374)

Cash and cash equivalents at beginning of year 334,174 434,014 682,388

Cash and Cash Equivalents at End of Year $ 347,239 $ 334,174 $ 434,014

See Notes to Consolidated Financial Statements.