Hormel Foods 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

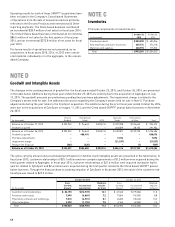

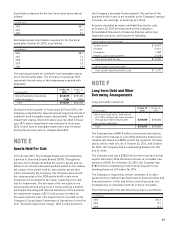

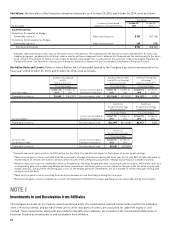

NOTE B

Acquisitions

On July 13, 2015, the Company acquired Applegate Farms,

LLC (Applegate) of Bridgewater, New Jersey for a preliminary

purchase price of $774.1 million in cash. The purchase price

is preliminary pending fi nal purchase accounting adjustments,

and was funded by the Company with cash on hand and by

utilizing short-term fi nancing.

Applegate® is the No. 1 brand in natural and organic val-

ue-added prepared meats and this acquisition will allow the

Company to expand the breadth of its protein offerings to

provide consumers more choice in that fast growing category.

The acquisition was accounted for as a business combination

using the acquisition method. The Company is in the process

of obtaining an independent appraisal. Therefore, a prelimi-

nary allocation of the purchase price to the acquired assets,

liabilities, and goodwill is presented in the table below.

(in thousands)

Accounts receivable $ 25,574

Inventory 22,089

Prepaid and other assets 2,916

Property, plant and equipment 3,463

Intangible assets 275,900

Goodwill 488,476

Current liabilities (23,420)

Deferred taxes (20,935)

Purchase price $774,063

Goodwill is calculated as the excess of the purchase price

over the fair value of the net assets recognized. The goodwill

recorded as part of the acquisition primarily refl ects the

value of the potential to expand presence in the natural and

organic channels and the supply chain for natural and organic

products. A portion of the goodwill balance is expected to be

deductible for income tax purposes. The goodwill and intan-

gible assets have been allocated to the Refrigerated Foods

reporting segment.

The Company recognized approximately $9.0 million of trans-

action costs in fi scal year 2015 related to the acquisition and

the charges were reported in selling, general and adminis-

trative expense in the Company’s Consolidated Statements of

Operations.

Operating results for this acquisition have been included in

the Company’s Consolidated Statements of Operations from

the date of acquisition and are refl ected in the Refrigerated

Foods reporting segment. The acquisition contributed $92.8

million of net sales since the date of acquisition.

On August 11, 2014, the Company acquired CytoSport

Holdings, Inc. (CytoSport) of Benicia, California for a fi nal

purchase price of $420.9 million in cash. The purchase price

was funded by the Company with cash on hand and by utilizing

companies to recognize revenue to depict the transfer of

goods or services to customers in amounts that refl ect the

consideration to which the company expects to be entitled in

exchange for those goods or services. The new standard will

also result in enhanced disclosures about revenue, provide

guidance for transactions that were not previously addressed

comprehensively, and improve guidance for multiple-element

arrangements. On July 8, 2015, the FASB approved a one-year

deferral of the effective date. The new guidance is effective

for annual reporting periods beginning after December 15,

2017, including interim reporting periods within that reporting

period, and early adoption is not permitted. Accordingly, the

Company expects to adopt the provisions of this new account-

ing standard at the beginning of fi scal year 2019, and adoption

is not expected to have a material impact on the consolidated

fi nancial statements.

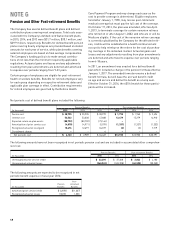

In April 2015, the FASB updated the guidance within ASC 835,

Interest. The update provides guidance on simplifying the

presentation of debt issuance cost. The amendments require

debt issuance costs related to a recognized debt liability be

presented in the balance sheet as a direct deduction from

the carrying amount of that debt liability. The new guidance

is effective for fi scal years beginning after December 15,

2015, and interim periods within those fi scal years, with early

adoption permitted. The Company expects to adopt the new

provisions of this accounting standard at the beginning of

fi scal year 2017, and is currently assessing the impact on its

consolidated fi nancial statements.

In April 2015, the FASB updated the guidance within ASC 715,

Compensation – Retirement Benefi ts. The update provides

guidance on simplifying the measurement date for defi ned

benefi t plan assets and obligations. The amendments allow

employers with fi scal year ends that do not coincide with a

calendar month end to make an accounting policy election to

measure defi ned benefi t plan assets and obligations as of the

end of the month closest to their fi scal year ends. The new

guidance is effective for fi scal years beginning after December

15, 2015, and interim periods within those fi scal years, with

early adoption permitted. The Company expects to adopt the

new provisions of this accounting standard at the beginning of

fi scal year 2017, and adoption is not expected to have a mate-

rial impact on its consolidated fi nancial statements.

In May 2015, the FASB updated the guidance within ASC 820,

Fair Value Measurements and Disclosures. The update provides

guidance on the disclosures for investments in certain entities

that calculate net asset value (NAV) per share (or its equiva-

lent). The amendments remove the requirement to categorize

within the fair value hierarchy all investments for which fair

value is measured using the NAV per share (or its equivalent)

as a practical expedient. The updated guidance is to be applied

retrospectively and is effective for annual reporting periods

beginning after December 15, 2015, and interim periods within

those fi scal years, with early adoption permitted. The Company

expects to adopt the provisions of this new accounting stan-

dard at the beginning of fi scal year 2017, and is currently

assessing the impact on its consolidated fi nancial statements.