Hormel Foods 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

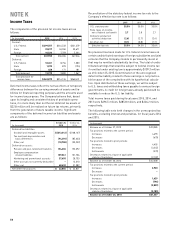

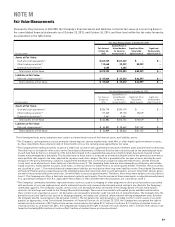

53

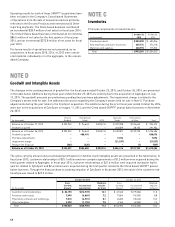

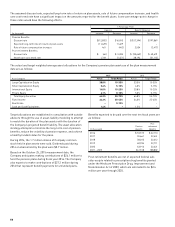

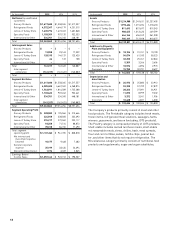

A reconciliation of the beginning and ending balance of the

investments measured at fair value using signifi cant unob-

servable inputs (Level 3) is as follows:

(in thousands) 2015 2014

Beginning Balance $ 58,723 $ 45,783

Purchases, issuances, and

settlements (net) (3,574) 3,050

Unrealized gains 7,741 4,260

Realized gains 7,623 4,479

Interest and dividend income 1,262 1,151

Ending Balance $ 71,775 $ 58,723

The Company has commitments totaling $85.0 million for

the private equity investments within the pension plans. The

unfunded private equity commitment balance for each invest-

ment category as of October 25, 2015, and October 26, 2014 is

as follows:

(in thousands) 2015 2014

Domestic equity $ 9,264 $ 17,659

International equity 9,514 12,640

Unfunded commitment balance $ 18,778 $ 30,299

Funding for future private equity capital calls will come from

existing pension plan asset investments and not from addi-

tional cash contributions into the Company’s pension plans.

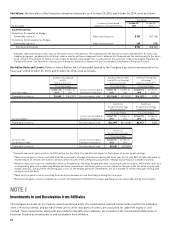

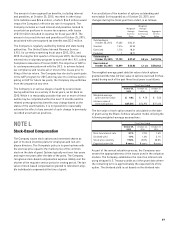

NOTE H

Derivatives and Hedging

The Company uses hedging programs to manage price risk

associated with commodity purchases. These programs

utilize futures contracts, options, and swaps to manage the

Company’s exposure to price fl uctuations in the commodities

markets. The Company has determined that its programs

which are designated as hedges are highly effective in offset-

ting the changes in fair value or cash fl ows generated by the

items hedged.

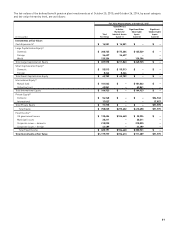

Cash Flow Hedges: The Company currently utilizes corn

futures to offset price fl uctuations in the Company’s future

direct grain purchases, and has historically entered into

various swaps to hedge the purchases of grain at certain

plant locations. The fi nancial instruments are designated

and accounted for as cash fl ow hedges, and the Company

measures the effectiveness of the hedges at least quarterly.

Effective gains or losses related to these cash fl ow hedges are

reported in accumulated other comprehensive loss (AOCL)

and reclassifi ed into earnings, through cost of products sold,

in the period or periods in which the hedged transactions

affect earnings. Any gains or losses related to hedge ineffec-

tiveness are recognized in the current period cost of products

sold. The Company typically does not hedge its grain exposure

beyond the next two upcoming fi scal years. As of October 25,

2015, and October 26, 2014, the Company had the following

outstanding commodity futures contracts that were entered

into to hedge forecasted purchases:

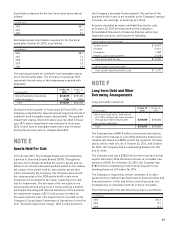

Volume

Commodity October 25, 2015 October 26, 2014

Corn 20.1 million bushels 18.3 million bushels

As of October 25, 2015, the Company has included in AOCL

hedging gains of $1.0 million (before tax) relating to its

positions, compared to losses of $14.8 million (before tax) as

of October 26, 2014. The Company expects to recognize the

majority of these gains over the next 12 months.

Fair Value Hedges: The Company utilizes futures to minimize

the price risk assumed when fi xed forward priced contracts

are offered to the Company’s commodity suppliers. The intent

of the program is to make the forward priced commodities

cost nearly the same as cash market purchases at the date of

delivery. The futures contracts are designated and accounted

for as fair value hedges, and the Company measures the

effectiveness of the hedges at least quarterly. Changes in the

fair value of the futures contracts, along with the gain or loss

on the hedged purchase commitment, are marked-to-market

through earnings and are recorded on the Consolidated

Statement of Financial Position as a current asset and liabil-

ity, respectively. Effective gains or losses related to these fair

value hedges are recognized through cost of products sold in

the period or periods in which the hedged transactions affect

earnings. Any gains or losses related to hedge ineffectiveness

are recognized in the current period cost of products sold. As

of October 25, 2015, and October 26, 2014, the Company had

the following outstanding commodity futures contracts desig-

nated as fair value hedges:

Volume

Commodity

October 25, 2015 October 26, 2014

Corn 5.3 million bushels 8.0 million bushels

Lean hogs 0.4 million cwt 0.7 million cwt

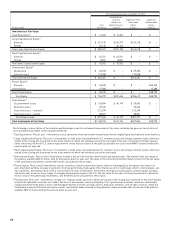

Other Derivatives: The Company holds certain futures and

options contract positions as part of a merchandising program

and to manage the Company’s exposure to fl uctuations in

commodity markets. The Company has not applied hedge

accounting to these positions.

As of October 25, 2015, and October 26, 2014, the Company

had the following outstanding futures and options contracts

related to these programs:

Volume

Commodity October 25, 2015 October 26, 2014

Corn 2.6 million bushels 2.9 million bushels

Soybean meal 11,500 tons –