Hormel Foods 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

The Company recognized approximately $4.8 million of trans-

action costs in fi scal year 2014 related to the acquisition and

the charges were reported in selling, general and administra-

tive expense in the Consolidated Statement of Operations.

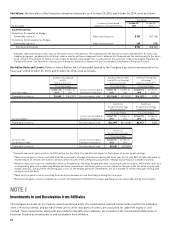

On November 26, 2013, the Company acquired the China

based SKIPPY® peanut butter business from Conopco, Inc.

(doing business as Unilever United States Inc.), of Englewood

Cliffs, N.J. for a fi nal purchase price of $41.9 million in cash.

This acquisition included the Weifang, China manufacturing

facility and all sales in Mainland China. The purchase price

was funded by the Company with cash on hand.

SKIPPY® is a well-established brand that allows the Company

to expand its presence in the center of the store with a

non-meat protein product and reinforces the Company’s

balanced product portfolio. The acquisition also provides the

opportunity to strengthen the Company’s global presence and

complements the international sales strategy for the SPAM®

family of products.

On January 31, 2013, the Company had previously acquired

the United States based SKIPPY® peanut butter business

from Unilever United States Inc. for a fi nal purchase price

of $665.4 million in cash. This acquisition included the Little

Rock, Arkansas manufacturing facility and all sales world-

wide, except sales in Mainland China. The purchase price was

funded by the Company with cash on hand generated from

operations and liquidating marketable securities.

The acquisition was accounted for as a business combina-

tion using the acquisition method. The Company estimated

the acquisition date fair values of the assets acquired and

liabilities assumed, using independent appraisals and other

analyses, and determined fi nal working capital adjustments.

Therefore, an allocation of the fi nal purchase price to the

acquired assets, liabilities, and goodwill is presented in the

table below.

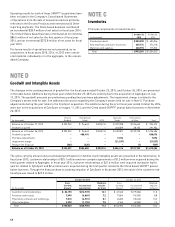

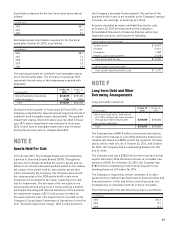

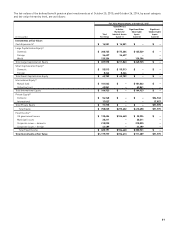

(in thousands)

Inventory $ 49,156

Property, plant and equipment 48,461

Intangible assets 264,500

Goodwill 303,597

Current liabilities (299)

Purchase price $665,415

Goodwill is calculated as the excess of the purchase price

over the fair value of the net assets recognized. The goodwill

recorded as part of the acquisition primarily refl ects the value

of the assembled workforce, cost synergies, and the potential

to integrate and expand existing product lines. The goodwill

balance is expected to be deductible for income tax purposes.

The goodwill and intangible assets have been allocated to

the Grocery Products and International & Other reporting

segments.

The Company recognized approximately $7.7 million of trans-

action costs in fi scal year 2013 (excluding transitional service

expenses) related to the acquisition and the charges were

reported in selling, general and administrative expense in the

Consolidated Statement of Operations.

funds from its revolving line of credit. The agreement provides

for a potential additional payment of up to $20.0 million sub-

ject to meeting specifi c fi nancial performance criteria over the

two years subsequent to the year of acquisition. The Company

recognized a $10.3 million liability related to this potential

payment through purchase accounting. In fi scal year 2015, the

Company had a positive $8.9 million adjustment related to this

accrual due to a current evaluation of net sales and earnings

targets associated with the acquisition.

CytoSport is the maker of Muscle Milk® products and is a lead-

ing provider of premium protein products in the sports nutri-

tion category. CytoSport’s brands align with the Company’s

focus on protein while further diversifying the Company’s

portfolio.

The acquisition was accounted for as a business combination

using the acquisition method. The Company has estimated the

acquisition date fair values of the assets acquired and liabil-

ities assumed, using independent appraisals and other anal-

yses, and determined fi nal working capital adjustments. The

fi nal allocation of the purchase price to the acquired assets,

liabilities, and goodwill is presented in the table below.

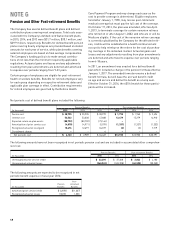

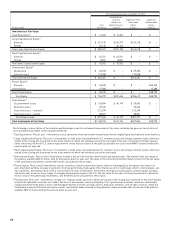

(in thousands)

Accounts receivable $ 30,580

Inventory 62,246

Prepaid and other assets 3,133

Property, plant and equipment 8,119

Intangible assets 188,500

Goodwill 270,925

Current liabilities (52,811)

Long-term liabilities (30,140)

Deferred taxes (59,700)

Purchase price $420,852

The liabilities shown above include $15.0 million representing

potential payments owed under a supplier agreement, which

are contingent on future production levels through fi scal year

2018.

Goodwill is calculated as the excess of the purchase price

over the fair value of the net assets recognized. The goodwill

recorded as part of the acquisition primarily refl ects the value

of the assembled workforce, manufacturing synergies, and

the potential to expand presence in alternate channels. The

goodwill balance is not expected to be deductible for income

tax purposes. The goodwill and intangible assets have been

allocated to the Specialty Foods and International & Other

reporting segments.

Operating results for this acquisition have been included in

the Company’s Consolidated Statements of Operations from

the date of acquisition and are refl ected in the Specialty Foods

and International & Other reporting segments. The acquisition

contributed an incremental $249.7 million of net sales for

fi scal year 2015, and incremental $73.5 million of net sales for

fi scal year 2014.