Goldman Sachs 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

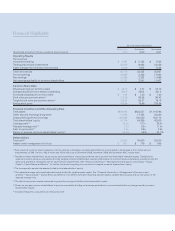

of the year. We accrue an estimate of compensation expenses

each of the rst three quarters. Only at year end, with the

visibility of our full-year performance, do we make nal decisions

on compensation. While the previous quarters’ accruals attract

much attention, our full-year compensation and bene ts to net

revenues ratio ultimately represents the rm’s compensation

expense. In 2009, that ratio was the lowest ever since we

became a public company — 35.8percent.

While 2009 total net revenues are only 2percent less than

the record net revenues that we posted in 2007, total

compensation and bene t expense is 20percent lower than in

2007, equating to a nearly $4billion difference in compensation

and bene ts expense between the two periods. Our approach

to compensation re ected the extraordinary events of 2009.

REGULATORY REFORM

GoldmanSachs has pledged to remain a constructive voice

and participant in the process of reform, and has been

forthcoming in recognizing lessons learned and mistakes made.

We have provided a number of recommendations concerning

how large nancial institutions should account for their assets,

how risk management processes can be enhanced, and how

new regulations can keep pace with innovation.

Given that much of the nancial contagion was fueled by

uncertainty about counterparties’ balance sheets, we support

measures that would require higher capital and liquidity levels,

as well as the use of clearinghouses for standardized derivative

transactions. More broadly, we support proposals that would

improve transparency for investors and regulators and reduce

systemic risk, including fair value accounting. In short, we

believe that sensible and signi cant reforms that do not impair

entrepreneurship or innovation, but make markets more ef cient

and safer, are in everyone’s best interest.

During our history, our rm has demonstrated an ability to

quickly and effectively adapt to regulatory change. As an

institution that interacts with thousands of entities, we bene t

from the general elevation of standards, and will continue to work

towards meaningful changes that improve our nancial system.

OUR RELATIONSHIP WITH AIG

Over the last year, there has been a lot of focus on

GoldmanSachs’ relationship with AIG, particularly our credit

exposure to the company and the direct effect the U.S.

government’s decision to support AIG had or didn’t have on our

rm. Here are the facts:

Since the mid-1990s, GoldmanSachs has had a trading

relationship with AIG. Our business with them spanned a number

of their entities, including many of their insurance subsidiaries.

And it included multiple activities, such as stock lending,

foreign exchange, xed income, futures and mortgage trading.

AIG was a AAA-rated company, one of the largest and

considered one of the most sophisticated trading counterparts in

the world. We established credit terms with them commensurate

with those extended to other major counterparts, including

a willingness to do substantial trading volumes but subject to

collateral arrangements that were tightly managed.

As we do with most other counterparty relationships, we limited

our overall credit exposure to AIG through a combination of

collateral and market hedges in order to protect ourselves against

the potential inability of AIG to make good on its commitments.

We established a pre-determined hedging program, which

provided that if aggregate exposure moved above a certain

threshold, credit default swaps (CDS) and other credit hedges

would be obtained. This hedging was designed to keep our

overall risk to manageable levels.

As part of our trading with AIG, we purchased from them

protection on super-senior collateralized debt obligation

(CDO) risk. This protection was designed to hedge equivalent

transactions executed with clients taking the other side of the

same trades. In so doing, we served as an intermediary in

assisting our clients to express a de ned view on the market.

The net risk we were exposed to was consistent with our role as

a market intermediary rather than a proprietary market participant.

In July 2007, as the market deteriorated, we began to

signi cantly mark down the value of our super-senior CDO

positions. Our rigorous commitment to fair value accounting,

coupled with our daily transactions as a market maker in these

securities, prompted us to reduce our valuations on a real-time

basis which we believe we did earlier than other institutions.

This resulted in collateral disputes with AIG. We believe that

subsequent events in the housing market proved our marks

to be correct — they re ected the realistic values markets were

placing on these securities.

Over the ensuing weeks and months, we continued to make

collateral calls, which were based on market values, consistent

with our agreements with AIG. While we collected collateral,

there still remained gaps between what we received and what

we believed we were owed. These gaps were hedged in full by

the purchase of CDS and other risk mitigants from third parties,

such that we had no material residual risk if AIG defaulted on

its obligations to us.

In mid-September 2008, prior to the government’s action to

save AIG, a majority of GoldmanSachs’ exposure to AIG was

collateralized and the rest was covered through various risk

mitigants. Our total exposure on the securities on which we

bought protection was roughly $10billion. Against this, we held

roughly $7.5billion in collateral. The remainder was fully covered

through hedges we purchased, primarily through CDS for which

we received collateral from our market counterparties. Thus, if

AIG had failed, we would have had the collateral from AIG and the

proceeds from the CDS protection we purchased and, therefore,

would not have incurred any material economic loss.

In this regard, a list of AIG’s cash ows to counterparties

indicates little about each bank’s credit exposure to the company.

Goldman Sachs 2009 Annual Report