Goldman Sachs 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Fellow Shareholders:

When we reported to you last,

the world’s nancial system and the global economy remained in the grips of

uncertainty. Our industry had been shaken to its foundation in the wake of severe

volatility, a sharp deterioration in equity values and extreme illiquidity across most

credit markets. Governments, regulators and market participants were forced to

confront simultaneously the unwinding of several nancial institutions, ensuring

short-term market stability, shoring up investor con dence and enacting measures

to secure the long-term viability of the global capital markets.

By the end of 2009, owed in no small part to actions taken by

governments to fortify the system, conditions across nancial

markets had improved signi cantly and to an extent few

predicted or thought possible. Equity prices largely rebounded,

credit spreads tightened and market activity was revitalized by

investors seeking new opportunities, all of which imply renewed

optimism, if not the beginnings of a potential recovery.

While improving nancial conditions are often a precursor to

better economic ones, the economy nevertheless remains

fragile. Unemployment is high, consumer spending tepid and

access to credit for many smaller businesses continues to

be elusive. The effects of unwinding leverage embedded in the

system may linger for some time. As the global economy works

its way to recovery, the roles that we play for our clients become

even more important as companies and investors position

themselves to emerge stronger following the crisis.

The rm’s focus on staying close to our clients and helping

them to navigate uncertainty and achieve their objectives is

largely responsible for what proved to be a year of resiliency

across our businesses and, by extension, a strong performance

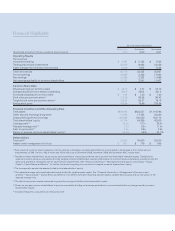

for GoldmanSachs. In 2009, the rm generated net revenues

of $45.17billion with net earnings of $13.39billion. Diluted

earnings per common share were $22.13 and our return on

average common shareholders’ equity was 22.5percent. Book

value per common share increased 23percent during 2009,

and has grown from $20.94 at the end of our rst year as a

public company in 1999 to $117.48, a compounded annual

growth rate of 19percent over this period.

This past year, clients came to GoldmanSachs because of our

ability to integrate advice, nancing, market making and investing

capabilities with sophisticated risk management. Importantly,

during the crisis, we were able to commit capital when market

liquidity and capital were scarce. Our duty to shareholders is to

protect and grow our client-focused franchise by remaining true

to our teamwork and performance-driven culture. Our shared

values have allowed us to be nimble and reactive, yet governed

by prudent, long-term thinking.

In this year’s letter, we will address some of the steps

GoldmanSachs took to further strengthen our capital, liquidity

and competitive position in 2009. We will discuss the rm’s

client franchise and our contribution to well-functioning markets

in times of distress and, on an ongoing basis, by operating at

the center of global capital markets. We also will report to you on

how our integrated business model, diverse revenue streams

and risk management practices serve as the core of our strategy.

Importantly, we will focus on how our people and culture have

been and remain fundamental to the rm’s success. Finally,

we will review the regulatory reform agenda as well as certain

developments that attracted considerable attention over the

course of the year.

EXTRAORDINARY MEASURES

Looking back on 2009, it is impossible to know what would have

happened to the nancial system absent concerted government

action around the world. Institutions were hoarding cash and

were unwilling to transact with each other. This had extreme

consequences for even the healthiest of nancial institutions and

companies. Through aggressive measures ranging from liquidity

and funding facilities to direct investment programs, the

government arrested the contagious fear that had engulfed the

global nancial system and averted more acute circumstances.

We believe such efforts were absolutely critical to protecting the

nancial system and ensuring the continued viability of the global

economy. GoldmanSachs is grateful for the indispensable

role governments played and we recognize that our rm and our

shareholders bene ted from it.

In June 2009, the rm repaid the U.S. government’s

investment of $10billion in GoldmanSachs as a participant

Goldman Sachs 2009 Annual Report