Goldman Sachs 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

right

Lloyd C. Blankfein

Chairman and

Chief Executive Of cer

left

Gary D. Cohn

President and

Chief Operating Of cer

in the U.S.Treasury’s TARP Capital Purchase Program,

which was designed to promote the broader stability of the

nancial system. We subsequently repurchased the warrants

acquired by the U.S.Treasury in connection with that

investment which, when combined with preferred dividends

paid, represented an additional $1.4billion, or an annualized

23percent return for U.S. taxpayers.

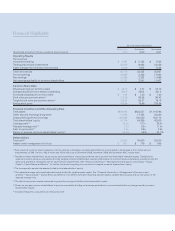

CONSERVATIVE FINANCIAL PROFILE

In light of the events of the last two years, we believe it is

important to highlight for our shareholders that GoldmanSachs

did not and does not operate or manage our risk with any

expectation of outside assistance. Given our roots as a privately-

held partnership, we have always focused on maintaining a

conservative nancial pro le and view liquidity as the single

most important consideration for a nancial institution.

Having steadily increased our Global Core Excess pool of

liquidity for several years, it stood at roughly $170billion in cash

or highly liquid securities, or almost 20percent of our balance

sheet at the end of 2009. Keeping this pool of liquidity is

expensive, but, in our judgment, it is money well-worth spending.

Leading up to 2008, we reduced our exposures even though it

meant selling at prices many thought were irrational. When the

crisis hit, we raised nearly $11billion in capital — $5billion

of preferred equity from Berkshire Hathaway and $5.75billion

in common equity

—

without any knowledge that TARP funds

would be forthcoming.

While the past two years have validated our conservative

approach to liquidity and to managing our risk, they have also

prompted signi cant change within our organization.

Speci cally, we have embraced new realities pertaining to

regulation and ensuring that our nancial strength remains in

line with our commitment to the long-term stability of our

franchise and the overall markets.

We became a nancial holding company, now regulated

primarily by the Federal Reserve and subject to new capital and

leverage tests. Since May 2008, our balance sheet has fallen

by approximately one-quarter while our capital has increased by

over one-half. Over 90percent of our shareholders’ equity

is common equity. The amount of level 3 — or illiquid — assets is

down by 40percent representing less than 6percent of our

total assets. In 2009, our Basel

I

Tier 1 capital ratio increased

to 15percent, well in excess of the required minimum.

IMPORTANT ROLES WE PLAY

ON BEHALF OF OUR CLIENTS

Maintaining a sound nancial pro le is vital if we are to be

effective in meeting the needs of our clients. Among the

roles we play for our largely institutional client base are advisor,

nancier, market maker, asset manager and co-investor.

Goldman Sachs 2009 Annual Report