Goldman Sachs 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

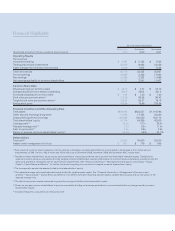

The gure of $12.9billion that AIG paid to GoldmanSachs post

the government’s decision to support AIG is made up as follows:

• $4.8billion for highly marketable U.S. Government

Agency securities that AIG had pledged to us in return

for a loan of $4.8billion. They gave us the cash, we gave

them back the securities. If AIG hadn’t repaid the loan,

we would simply have sold the securities and received

the $4.8billion of value in that way.

• An additional $2.5billion that AIG owed us in collateral

from September 16, 2008 (just after the government’s

action) through December 31, 2008. This represented

the additional collateral that was called as markets

continued to deteriorate and was consistent with the

existing agreements that we had with AIG.

• $5.6billion associated with a nancing entity called

Maiden Lane III, which was established in mid-November

2008 by the Federal Reserve to purchase the securities

underlying certain CDS contracts and to cancel those

contracts between AIG and its counterparties. The

Federal Reserve required that the counterparties deliver

the cash bonds to Maiden Lane III in order to settle

the CDS contracts and avoid any further collateral calls.

Consequently, the cash ow of $5.6billion between

Maiden Lane III and GoldmanSachs re ected the

Federal Reserve paying GoldmanSachs the face value

of the securities (approximately $14billion) less the

collateral (approximately $8.4billion) we already held on

those securities. GoldmanSachs then spent the vast

majority of the money we received to buy the cash

bonds from our counterparties in order to complete the

settlement as required by the Federal Reserve.

While our direct economic exposure to AIG was minimal,

the nancial markets, and, as a result, GoldmanSachs and every

other nancial institution and company, bene ted from the

continued viability of AIG. Although it is dif cult to determine

what the exact systemic implications would have been had AIG

failed, it would have been extremely disruptive to the world’s

already turbulent nancial markets.

OUR ACTIVITIES IN THE

MORTGAGE SECURITIZATION MARKET

Another issue that has attracted attention and speculation has

been how we managed the risk we assumed as a market maker

and underwriter in the mortgage securitization market. Again,

we want to provide you with the facts.

As a market maker, we execute a variety of transactions

each day with clients and other market participants, buying

and selling nancial instruments, which may result in long

or short risk exposures to thousands of different instruments

at any given time. This does not mean that we know or even

think that prices will fall every time we sell or are short, or rise

when we buy or are long.

In these cases, we are executing transactions in connection with

our role of providing liquidity to markets. Clients come to us as

a market maker because of our willingness and ability to commit

our capital and to assume market risk. We are responding to

our clients’ desire either to establish, or to increase or decrease,

their exposure to a position on their own investment views.

We are not “betting against” them.

As a market maker, we assume risk created through client

purchases and sales. This is fundamental to our role as a

nancial intermediary. As part of facilitating client transactions,

we generally carry an “inventory” of securities. This inventory

comprises long and short positions. Its composition re ects

the accumulation of customer trades and our judgments about

supply and demand or market direction. If a client asks us to

transact in an instrument we hold in inventory, we may be able

to give the client a better price than it could nd elsewhere in

the market and to execute the order without potential delay and

price movement. This inventory represents a risk position that

we manage continuously.

In so doing, we must also manage the size of our inventory

and keep exposures in line with risk limits. We believe that

risk limits are an important tool in managing our rm. They are

established by senior management, and scaled to be in line with

our nancial resources (capital, liquidity, etc.). They help ensure

that regardless of the opinions of an individual or business unit

about market direction, our risk must remain within prescribed

levels. In addition to selling positions, we use other techniques

to manage risk. These include establishing offsetting positions

(“hedges”) through the same or other instruments, which serve

to reduce the rm’s overall exposure.

In this way, we are able to serve our clients and to maintain

a robust client franchise while prudently limiting overall risk

consistent with our nancial resources.

Through the end of 2006, GoldmanSachs generally was

long in exposure to residential mortgages and mortgage-related

products, such as residential mortgage-backed securities

(RMBS), CDOs backed by residential mortgages and credit

default swaps referencing residential mortgage products.

In late 2006, we began to experience losses in our daily

residential mortgage-related products P&L as we marked down

the value of our inventory of various residential mortgage-

related products to re ect lower market prices.

In response to those losses, we decided to reduce our overall

exposure to the residential housing market, consistent with

our risk protocols — given the uncertainty of the future direction

of prices in the housing market and the increased market

volatility. The rm did not generate enormous net revenues

or pro ts by betting against residential mortgage-related

products, as some have speculated; rather, our relatively

early risk reduction resulted in our losing less money than

we otherwise would have when the residential housing market

began to deteriorate rapidly.

Goldman Sachs 2009 Annual Report