Goldman Sachs 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

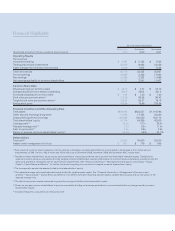

Strategic Advice

Our advisory business serves as our primary point of contact

with our clients and is often the genesis for sourcing other

opportunities to serve them. In some instances, business

garnered from our long-standing investment banking relationships

is captured from a nancial reporting perspective in the revenues

reported within other segments, particularly within our Trading

and Principal Investments segment. For instance, we have been

successfully building our risk management solutions business

within investment banking — encapsulating our strategy

of integrating advice, capital and risk management expertise.

Since 2005, revenues from this business have grown 32percent

compounded annually. This trend is consistent with our business

model and operating philosophy which are predicated on the

rm functioning as an integrated whole.

While classic advisory revenues in 2009 reached a near

cyclical low, the latter half of the year yielded greater

levels of strategic dialogues, re ecting an improvement in

CEO con dence. Although it is dif cult to predict what

types of transactions or which industries will rebound most

quickly, our broad and deep franchise allows GoldmanSachs

to remain knowledgeable and relevant across multiple

sectors, and poised to serve our clients. Over the past ve

years, Investment Banking has advised over 1,000 clients

in 67 countries, solidifying our leading market share

position and allowing us to retain industry-leading positions

in cross-border, acquirer, target and strategic defense

advisory league tables.

Financing for Growth

Our investment banking relationships are also the basis

for most of our financing mandates. As a financial

intermediary, GoldmanSachs acts to match the capital

of our investing clients with the needs of our corporate

and government clients, who rely on financing to generate

growth, create jobs and deliver the products and services

that drive economic development. Since the beginning of

2007, we have underwritten over $750billion in corporate

debt and over $450billion in equity and equity-related

products across approximately 1,900 offerings for

800 clients globally.

We have a long history of helping states and municipalities

access the capital markets. Since entering the public nance

business in 1951, GoldmanSachs has been one of the most

signi cant industry participants and over the past decade

has helped states and municipalities raise over $250billion

in capital. In 2009, we were the number one underwriter

for the Build America Bond program, which allows states and

municipalities to meet their borrowing needs and invest in

infrastructure projects. We also helped nance over $28billion

for nonpro t institutions including education services, healthcare

and government entities.

Market Intermediary

Through our role as a market maker, we commit and deploy our

capital to ensure that buyers and sellers can complete their

transactions, contributing to the liquidity, ef ciency and stability

of nancial markets. Throughout the crisis, we made prices

when markets were volatile and illiquid and extended

credit when credit was scarce. Fixed Income, Commodities

and Currencies (FICC) and Equities, our market intermediation

businesses that comprise our Securities Division, were

meaningful drivers of our strong rmwide performance last year.

By remaining close to our clients, we were able to direct

our human and nancial capital to those businesses within our

market making franchise that most re ected clients’ interests

and needs. Another important component of growth has been

the dynamic that, as clients grow in size, the scope of the

business that they execute with the rm also increases.

In 2009, 2,500 of our clients were active across both Equities

and FICC products, which is up 25percent from 2006.

Client-Driven Risk Exposures

Given concern by some over the nature and level of risk that

nancial institutions undertake, it is important to note that for

GoldmanSachs, the vast majority of the risk we take and the

revenues we generate is derived from trades that advance a

client need or objective.

By way of example, in 2009, an energy consumer asked us

to help protect it against a rise in the cost of fuel, concerned that

an increase would affect its ability to grow. To accomplish this,

GoldmanSachs structured a long-term collateralized hedge

facility. We then entered into hedges to offset the fuel price risk

that we had assumed. As part of our normal accounting and

risk management, we regularly revalue the amount of collateral

necessary to be posted when fuel prices declined during

the life of the transaction. We also routinely hedge our client

counterparty risk in addition to receiving collateral. In the end,

we were able to structure the transaction at a fair price for

our client and generate an attractive risk-adjusted return for the

rm and our shareholders. This is representative of the risk we

assume and manage daily to allow our clients to focus on their

underlying businesses.

Co-Investing

Co-investing is another way we directly align the rm’s interests

with those of our clients. Two-thirds of our corporate investing

opportunities are sourced from our investment banking

relationships. In addition, the vast majority of money committed

to our investing funds comes from our clients, who seek

to partner with us. While returns uctuate based on equity

market performance and other factors, our merchant banking

businesses have provided much needed capital to our

investment banking clients and achieved strong returns for our

investors and shareholders over the long term. This business

Goldman Sachs 2009 Annual Report