Goldman Sachs 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Goldman Sachs annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our people provide solutions

resources grow ideas

ideas bene t communities

market knowledge manages risk

advice promotes innovation

trading supports markets

entrepreneurship stimulates commerce

nancing creates jobs

engagement furthers sustainability

investment expertise provides security

capital fosters opportunity

our work enables growth

Goldman Sachs

2009 Annual Report

Table of contents

-

Page 1

... knowledge manages risk advice promotes innovation trading supports markets entrepreneurship stimulates commerce financing creates jobs engagement furthers sustainability investment expertise provides security capital fosters opportunity our work enables growth Goldman Sachs 2009 Annual Report -

Page 2

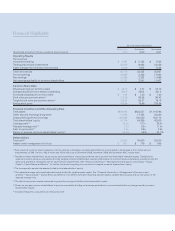

... Dividends declared per common share Book value per common share (1) Tangible book value per common share (2) Ending stock price Financial Condition and Other Operating Data Total assets Other secured financings (long-term) Unsecured long-term borrowings Total shareholders' equity Leverage ratio... -

Page 3

Goldman Sachs 2009 Annual Report At Goldman Sachs, our work as advisors, fi nanciers, market makers, asset managers and co-investors makes a meaningful contribution to the growth of businesses, local communities and the global economy. Our first priority is and always has been to serve our clients'... -

Page 4

...teamwork and performance-driven culture. Our shared values have allowed us to be nimble and reactive, yet governed by prudent, long-term thinking. In this year's letter, we will address some of the steps Goldman Sachs took to further strengthen our capital, liquidity and competitive position in 2009... -

Page 5

...our total assets. In 2009, our Basel I Tier 1 capital ratio increased to 15 percent, well in excess of the required minimum. IMPORTANT ROLES WE PLAY ON BEHALF OF OUR CLIENTS In light of the events of the last two years, we believe it is important to highlight for our shareholders that Goldman Sachs... -

Page 6

... and over $450 billion in equity and equity-related products across approximately 1,900 offerings for 800 clients globally. We have a long history of helping states and municipalities access the capital markets. Since entering the public finance business in 1951, Goldman Sachs has been one of the... -

Page 7

Goldman Sachs 2009 Annual Report generates management fees as well as incentive fees based on the funds' performance. As a result, our merchant banking business helps diversify the fi rm's revenues. The focus of our funds spans the capital structure, including senior debt, mezzanine and private ... -

Page 8

Goldman Sachs 2009 Annual Report education, capital and support services best addresses the barriers to growth for small businesses. The program's business and management curriculum is supported by a $200 million commitment to community colleges and universities to build educational capacity and to... -

Page 9

... towards meaningful changes that improve our financial system. OUR RELATIONSHIP WITH AIG Over the last year, there has been a lot of focus on Goldman Sachs' relationship with AIG, particularly our credit exposure to the company and the direct effect the U.S. government's decision to support AIG had... -

Page 10

... 2009 Annual Report The figure of $12.9 billion that AIG paid to Goldman Sachs post the government's decision to support AIG is made up as follows: • In these cases, we are executing transactions in connection with our role of providing liquidity to markets. Clients come to us as a market maker... -

Page 11

.... The investors who transacted with Goldman Sachs in CDOs in 2007, as in prior years, were primarily large, global financial institutions, insurance companies and hedge funds (no pension funds invested in these products, with one exception: a corporate-related pension fund that had long been active... -

Page 12

Goldman Sachs 2009 Annual Report Balance Sheet Restructuring Strengthens Competitive Stance Goldman Sachs' work with Ford Motor Company on a major debt restructuring helped to strengthen Ford's balance sheet and position it for future growth. 10 -

Page 13

... 2009, with the auto industry reeling from the recession, Goldman Sachs worked with Ford to develop a plan to strengthen its capital structure by retiring a substantial portion of its outstanding debt. While Ford had a solid cash position, due in part to a 2006 financing managed by Goldman Sachs... -

Page 14

Goldman Sachs 2009 Annual Report Innovation and Teamwork Protect Pension Benefits A Goldman Sachs insurance subsidiary, Rothesay Life, provided an added measure of security for some 15,000 pensioners in the U.K. by insuring a significant proportion of the pension liabilities of the U.K. pension ... -

Page 15

...security. Close collaboration by Goldman Sachs' Insurance and Pensions Principalling, Interest Rate Products and Investment Banking businesses helped facilitate the transaction. In developing a solution to RSA's needs, Goldman Sachs created a new product in the U.K. pension buyout market that can be... -

Page 16

...come first. If we serve our clients well, our own success will follow. Client service is at the heart of Goldman Sachs' culture. Whether we help clients obtain financing, buy or sell a business, manage risk or invest their assets, we are focused at all times on helping to protect their interests and... -

Page 17

Our Work Enables Growth I N V E S T M E N T M A N AG E M E N T, N E W YO R K I N V E S T M E N T M A N AG E M E N T, L O N D O N I N V ESTM EN T BA NK I NG, BEI JI NG I N V E S T M E N T M A N AG E M E N T, L O N D O N I N V ESTM EN T BA NK I NG, LON DON I N V E S T M E N T M A N AG E M E N T,... -

Page 18

Goldman Sachs 2009 Annual Report Bond Market Innovation Supports Aviation Jobs Goldman Sachs' bond market expertise helped Emirates finance the purchase of three new Boeing 777-300ER aircraft, supporting the employment of many highly skilled Boeing employees in the U.S. 16 -

Page 19

... of a loan. By tapping the deep and liquid global capital markets and by targeting major institutional investors, Goldman Sachs was able to achieve substantially better pricing and much deeper capacity than was available in the traditional bank markets. The benefits of this groundbreaking financing... -

Page 20

Goldman Sachs 2009 Annual Report Financing Solutions Build Schools and Communities As a result of Goldman Sachs' innovative infrastructure and school construction financing, thousands of students in California will have new or upgraded educational facilities. 18 -

Page 21

... and diverse group of investors worldwide. Goldman Sachs was the leading underwriter for Build America Bonds and Qualified School Construction Bonds in 2009, helping state and local governments across the country fund infrastructure projects, thereby supporting local growth and job creation. 19 -

Page 22

... in buying and selling stocks, bonds and other fi nancial products; raising capital; advising on mergers; or managing investments. Our management approach is designed to encourage and reward close collaboration across business units, regional borders and market sectors to achieve exceptional... -

Page 23

Our Work Enables Growth T EC H NOLOG Y A N D SE RV IC E S T E A M WOR K I NG ON T H E N E W H E A D Q U A R T E R S I N N E W YO R K G L O B A L I N V E S T M E N T R E S E A RC H , L O N D O N I N V E S T M E N T M A N AG E M E N T, H O N G KO N G S E C U R I T I E S D I V I S I O N , N E W YO ... -

Page 24

Goldman Sachs 2009 Annual Report Advisory Expertise Supports a Company's Recovery A Goldman Sachs investment banking team, led by our Mumbai office, worked around the clock to organize the sale of Satyam Computer Services, one of India's largest IT services companies. The successful outcome ... -

Page 25

Our Work Enables Growth SATYAM FACILITY HYDERABAD, INDIA Satyam's new, government-appointed board of directors appointed Goldman Sachs as fi nancial advisor and provided us with a challenging mandate: avert the potential failure of Satyam by finding a buyer for the technology services giant within... -

Page 26

Goldman Sachs 2009 Annual Report Global Resources Drive Expansion in Investment Management In 2009, our Investment Management Division launched a coordinated expansion plan for both our Goldman Sachs Asset Management (GSAM) and Private Wealth Management (PWM) businesses. Our people are offering ... -

Page 27

...global markets. We are enhancing our global risk management platform, drawing investment insights from worldwide research teams and, as appropriate, sharing our portfolio managers' views across asset classes. Through responsible management of client investments, our professionals help pension funds... -

Page 28

...: Goldman Sachs Gives, a donor-advised fund that makes grants to charitable organizations recommended by the firm and our participating managing directors; Community TeamWorks, which encourages our people to undertake volunteer projects and has provided over 134,000 hours of service this past year... -

Page 29

Our Work Enables Growth C T W V O L U N T E E R S E M P OW E R W O M E N I N BA NGA LOR E C T W VO L U N T E E R S E S C O R T C H I L D R E N T O T H E Z O O I N L O N D O N G O L D M A N S AC H S PA R T N E R M E N T O R S A 10 , 0 0 0 WOM E N S C H O L A R I N RWA N D A 27 -

Page 30

Goldman Sachs 2009 Annual Report Supporting Small Businesses Stimulates Local Economies 10,000 Small Businesses, a $500 million Goldman Sachs initiative, will seek to unlock the potential of entrepreneurs to create jobs and economic opportunity in underserved communities across the U.S. 28 -

Page 31

... City is the first city in the program, and our first educational partner is LaGuardia Community College in Queens, New York, which houses a Small Business Development Center. The first CDFI partner is New York-based Seedco Financial Services, Inc. An Advisory Council, co-chaired by Goldman Sachs... -

Page 32

... Sachs 2009 Annual Report The Goldman Sachs Group, Inc. is a leading global investment banking, securities and investment management fi rm that provides a wide range of financial services to a substantial and diversified client base that includes corporations, fi nancial institutions, governments... -

Page 33

Goldman Sachs 2009 Annual Report Financial Information - Table of Contents Management's Discussion and Analysis Introduction...Executive Overview ...Business Environment ...Certain Risk Factors That May Affect Our Businesses ...Critical Accounting Policies ...Fair Value ...Goodwill and ... -

Page 34

... funds, mutual funds, pension funds and foundations, and to highnet-worth individuals worldwide. When we use the terms "Goldman Sachs," "the fi rm," "we," "us" and "our," we mean Group Inc., a Delaware corporation, and its consolidated subsidiaries. References herein to our Annual Report on Form... -

Page 35

..."- Results of Operations - Financial Overview" below for further information regarding our calculation of ROE. Tangible common shareholders' equity equals total shareholders' equity less preferred stock, goodwill and identifiable intangible assets. Tangible book value per common share is computed by... -

Page 36

... during the second half of the year as real gross domestic product (GDP) growth turned positive in most major economies and growth in emerging markets improved. In addition, equity and credit markets were characterized by increasing asset prices, lower volatility and improved liquidity during... -

Page 37

... our Annual Report on Form 10-K. Market Conditions and Market Risk. Our fi nancial calendar year 2009, compared with a decrease of 1.2% in 2008. Measures of business investment, consumer expenditures and exports declined. Measures of inflation also declined during 2009. The Bank of Japan maintained... -

Page 38

...making businesses, commit large amounts of capital to maintain trading positions in interest rate and credit products, as well as currencies, commodities and equities. Because nearly all of these investing and trading positions are marked-to-market on a daily basis, declines in asset values directly... -

Page 39

... Risk - Credit Ratings" below. Group Inc. has guaranteed the payment obligations of Goldman, Sachs & Co. (GS&Co.), Goldman Sachs Bank USA (GS Bank USA) and Goldman Sachs Bank (Europe) PLC (GS Bank Europe), subject to certain exceptions, and has pledged significant assets to GS Bank USA to support... -

Page 40

...a consolidated basis. Our status as a bank holding company and the operation of our lending and other businesses through GS Bank USA subject us to additional regulation and limitations on our activities, as described in "Regulation - Banking Regulation" in Part I, Item 1 of our Annual Report on Form... -

Page 41

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis Critical Accounting Policies Fair Value The use of fair value to measure fi nancial instruments, with related gains or losses generally recognized in "Trading and principal investments" in our consolidated statements of earnings... -

Page 42

... valued based on quoted market prices, broker or dealer quotations, or alternative pricing sources with reasonable levels of price transparency include most government agency securities, most corporate bonds, certain mortgage products, certain bank loans and bridge loans, less liquid listed equities... -

Page 43

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis By their nature, these investments have little or no price transparency. We value such instruments initially at transaction price and adjust valuations when evidence is available to support such adjustments. Such evidence ... -

Page 44

... merger proposals, tender offers or debt restructurings); and significant changes in fi nancial metrics (e.g., operating results as compared to previous projections, industry multiples, credit ratings and balance sheet ratios). Real estate fund investments are carried at net asset value per share... -

Page 45

... private equity investments and real estate fund investments. Real estate investments were $1.23 billion and $2.62 billion as of December 2009 and November 2008, respectively. Includes certain mezzanine financing, leveraged loans arising from capital market transactions and other corporate bank debt... -

Page 46

... the fair value of our long positions in prime, Alt-A and subprime mortgage cash instruments: Long Positions in Loans and Securities Backed by Residential Real Estate As of December 2009 November 2008 originate, securitize and syndicate fi xed and floating rate commercial mortgages globally. At any... -

Page 47

... average price-to-earnings multiples of our competitors in these businesses and price-to-book multiples). We derive the net book value of our operating segments by estimating the amount of shareholders' equity required to support the activities of each operating segment. Our last annual impairment... -

Page 48

... 2009 Carrying Value Range of Estimated Remaining Lives (in years) November 2008 Carrying Value ($ in millions) Customer lists (1) New York Stock Exchange (NYSE) Designated Market Maker (DMM) rights Insurance-related assets (2) Exchange-traded fund (ETF) lead market maker rights Other (3) Total... -

Page 49

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis A prolonged period of weakness in global equity markets could adversely impact our businesses and impair the value of our identifiable intangible assets. In addition, certain events could indicate a potential impairment of our ... -

Page 50

... were positive compared with losses in 2008. During 2009, Equities operated in an environment characterized by a significant increase in global equity prices, favorable market opportunities and a significant decline in volatility levels. Net revenues in Asset Management and Securities Services... -

Page 51

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis primarily reflected the impact of changes in the composition of assets managed, principally due to equity market depreciation during the fourth quarter of 2008, as well as lower incentive fees. During the year ended December 31,... -

Page 52

... in money market assets, partially offset by outflows in fi xed income, equity and alternative investment assets. Net revenues in Securities Services reflected favorable changes in the composition of securities lending balances, but were negatively impacted by a decline in total average customer... -

Page 53

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis The following table sets forth our operating expenses and total staff: Operating Expenses and Total Staff Year Ended December 2009 November 2008 November 2007 One Month Ended December 2008 ($ in millions) Compensation and ... -

Page 54

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis $600 million related to consolidated entities held for investment purposes during 2009. The real estate impairment charges, which were measured based on discounted cash flow analysis, are included in our Trading and Principal ... -

Page 55

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis Segment Operating Results The following table sets forth the net revenues, operating expenses and pre-tax earnings of our segments: Segment Operating Results Year Ended December 2009 November 2008 November 2007 One Month Ended ... -

Page 56

... volumes: Goldman Sachs Global Investment Banking Volumes (1) Year Ended December 2009 November 2008 November 2007 One Month Ended December 2008 (in billions) Announced mergers and acquisitions (2) Completed mergers and acquisitions (2) Equity and equity-related offerings (3) Debt offerings... -

Page 57

...make markets in and trade interest rate and credit products, mortgage-related securities and loan products and other asset-backed instruments, currencies and commodities, structure and enter into a wide variety of derivative transactions, and engage in proprietary trading and investing. â-ª Equities... -

Page 58

...by asset writedowns across noninvestment-grade credit origination activities, corporate debt, private and public equities, and residential and commercial mortgage loans and securities. Net revenues in Equities of $9.89 billion for 2009 increased 7% compared with 2008. Net revenues for 2009 reflected... -

Page 59

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis $3.1 billion (net of hedges) related to non-investment-grade credit origination activities and losses from investments, including corporate debt and private and public equities. Results in mortgages included net losses of ... -

Page 60

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis Assets under management typically generate fees as a percentage of asset value, which is affected by investment performance and by inflows and redemptions. The fees that we charge vary by asset class, as do our related expenses.... -

Page 61

... in our assets under management: Changes in Assets Under Management Year Ended December 31, 2009 November 30, 2008 2007 (in billions) Balance, beginning of year Net inflows/(outflows) Alternative investments Equity Fixed income Total non-money market net inflows/(outflows) Money markets Total net... -

Page 62

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis net inflows. Net inflows reflected inflows in money market assets, partially offset by outflows in fi xed income, equity and alternative investment assets. Securities Services net revenues were $236 million for the month of ... -

Page 63

...subordinated debt issued to trusts to be part of our equity capital, as it qualifies as capital for regulatory and certain rating agency purposes. Consolidated Capital Requirements The Federal Reserve Board is the primary U.S. regulator of Group Inc., a bank holding company that in August 2009 also... -

Page 64

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis CONSOLIDATED CAPITAL RATIOS The following table sets forth information regarding our consolidated capital ratios as of December 2009 calculated in accordance with the Federal Reserve Board's regulatory capital requirements ... -

Page 65

...GS Bank USA has also been assigned a long-term issuer rating as well as ratings on its long-term and short-term bank deposits. In addition, credit rating agencies have assigned ratings to debt obligations of certain other subsidiaries of Group Inc. The level and composition of our equity capital are... -

Page 66

...information on our assets, shareholders' equity, leverage ratios, capital ratios and book value per common share: As of ($ in millions, except per share amounts) December 2009 November 2008 Total assets $848,942 Adjusted assets (1) 546,151 Total shareholders' equity 70,714 Tangible equity capital... -

Page 67

... total shareholders' equity less preferred stock, goodwill and identifiable intangible assets. Tangible book value per common share is computed by dividing tangible common shareholders' equity by the number of common shares outstanding, including RSUs granted to employees with no future service... -

Page 68

... transfers accounted for as financings rather than sales and debt raised through our William Street credit extension program. Excludes $2.51 billion of time deposits maturing within one year of our financial statement date. Represents estimated future interest payments related to unsecured long-term... -

Page 69

... risk limits are also monitored by the Finance Division and reviewed by the appropriate risk committee. The Investment Management Division Risk Committee oversees market, counterparty credit and liquidity risks related to our asset management businesses. Business Practices Committee. The Business... -

Page 70

...our credit ratings. The Finance Committee regularly reviews our liquidity, balance sheet, funding position and capitalization and makes adjustments in light of current events, risks and exposures, and regulatory requirements. New Products Committee. The New Products Committee, under the oversight of... -

Page 71

...the market risk of positions that cannot be liquidated or offset with hedges within one day. The following tables set forth the daily VaR: Average Daily VaR (1) (in millions) Year Ended December 2009 November 2008 November 2007 Risk Categories Interest rates Equity prices Currency rates Commodity... -

Page 72

... credit spreads on unsecured borrowings for which the fair value option was elected was an $8 million gain (including hedges) as of December 2009. Daily VaR (1) (in millions) As of December 2009 November 2008 Year Ended December 2009 High Low Risk Categories Interest rates Equity prices Currency... -

Page 73

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis TRADING NET REVENUES DISTRIBUTION The following chart sets forth the frequency distribution of our daily trading net revenues for substantially all inventory positions included in VaR for the year ended December 2009: Daily ... -

Page 74

... of mortgage and other asset-backed loans and securities. As of November 2008, we held approximately $10.39 billion of financial instruments in our bank and insurance subsidiaries, primarily consisting of $2.86 billion of money market instruments, $3.08 billion of government and U.S. federal agency... -

Page 75

..., the market risk of derivative positions is managed together with our nonderivative positions. The fair value of our derivative contracts is reflected net of cash paid or received pursuant to credit support agreements and is reported on a net-by-counterparty basis in our consolidated statements of... -

Page 76

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis The following tables set forth the fair values of our OTC derivative assets and liabilities by tenor and by product type or credit rating. Tenor is based on expected duration for mortgage-related credit derivatives and generally... -

Page 77

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis OTC Derivatives (in millions) As of November 2008 0-12 Months 1-5 Years 5-10 Years 10 Years or Greater Total Assets Product Type Interest rates Credit derivatives Currencies Commodities Equities Netting across product types ... -

Page 78

... significant flexibility to address both Goldman Sachs-specific and broader industry or market liquidity events. Our principal objective is to be able to fund Goldman Sachs and to enable our core businesses to continue to generate revenues, even under adverse circumstances. We manage liquidity risk... -

Page 79

... markets and of Goldman Sachs. Our liquidity model, through which we analyze the consolidated fi rm as well as our major broker-dealer and bank depository institution subsidiaries, identifies and estimates potential contractual and contingent cash and collateral outflows over a short-term horizon... -

Page 80

...market opportunities in certain of our businesses, our total assets and adjusted assets at financial statement dates are typically not materially different from those occurring within our reporting periods. Liabilities. We seek to structure our liabilities to meet the following objectives: â-ª Term... -

Page 81

... debt without put provisions or other provisions that would, based solely upon an adverse change in our credit ratings, financial ratios, earnings, cash flows or stock price, trigger a requirement for an early payment, collateral support, change in terms, acceleration of maturity or the creation... -

Page 82

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis Deposits. As of December 2009, our bank depository â-ª anticipated draws on our unfunded loan commitments; and â-ª capital or other forms of financing in our regulated subsidiaries that are in excess of their long-term ... -

Page 83

... including, but not limited to, the potential risk factors, identification of liquidity outflows, mitigants and potential actions. CREDIT RATINGS We rely upon the short-term and long-term debt capital markets to fund a significant portion of our day-to-day operations. The cost and availability... -

Page 84

Goldman Sachs 2009 Annual Report Management's Discussion and Analysis On February 25, 2010, Moody's Investors Service lowered the ratings on Group Inc.'s non-cumulative preferred stock and the APEX from A3 to Baa2, and the rating on the Trust Preferred from A2 to A3. Based on our credit ratings as... -

Page 85

... Sachs 2009 Annual Report Management's Report on Internal Control over Financial Reporting Management of The Goldman Sachs Group, Inc., together with its consolidated subsidiaries (the fi rm), is responsible for establishing and maintaining adequate internal control over fi nancial reporting... -

Page 86

... the related consolidated statements of earnings, changes in shareholders' equity, cash flows and comprehensive income present fairly, in all material respects, the fi nancial position of The Goldman Sachs Group, Inc. and its subsidiaries (the Company) at December 31, 2009 and November 28, 2008, and... -

Page 87

Goldman Sachs 2009 Annual Report Consolidated Statements of Earnings Year Ended (in millions, except per share amounts) December 2009 November 2008 November 2007 Revenues Investment banking Trading and principal investments Asset management and securities services Total non-interest revenues ... -

Page 88

... as of December 2009 and November 2008, respectively) Payables to brokers, dealers and clearing organizations Payables to customers and counterparties Trading liabilities, at fair value Unsecured short-term borrowings, including the current portion of unsecured long-term borrowings (includes $18... -

Page 89

Goldman Sachs 2009 Annual Report Consolidated Statements of Changes in Shareholders' Equity Year Ended (in millions) December 2009 (1) November 2008 November 2007 Preferred stock Balance, beginning of year Issued Accretion Repurchased Balance, end of year Common stock Balance, beginning of ... -

Page 90

...Annual Report Consolidated Statements of Cash Flows Year Ended (in millions) December 2009 November 2008 November 2007 Cash flows from operating activities Net earnings Non-cash items included in net earnings Depreciation and amortization Deferred income taxes Share-based compensation Changes... -

Page 91

Goldman Sachs 2009 Annual Report Consolidated Statements of Comprehensive Income Year Ended (in millions) December 2009 November 2008 November 2007 Net earnings Currency translation adjustment, net of tax Pension and postretirement liability adjustments, net of tax Net gains/(losses) on cash ... -

Page 92

... fees Other expenses Total non-compensation expenses Total operating expenses Pre-tax loss Benefit for taxes Net loss Preferred stock dividends Net loss applicable to common shareholders Loss per common share Basic Diluted Dividends declared per common share Average common shares outstanding Basic... -

Page 93

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements NOTE 1 NOTE 2 Description of Business The Goldman Sachs Group, Inc. (Group Inc.), a Delaware corporation, together with its consolidated subsidiaries (collectively, the fi rm), is a leading global investment banking, ... -

Page 94

... partner. As a result, the fi rm does not consolidate these funds. These fund investments are included in "Trading assets, at fair value" in the consolidated statements of fi nancial condition. In connection with becoming a bank holding company, the fi rm was required to change its fiscal year... -

Page 95

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements and assumptions relate to fair value measurements, the accounting for goodwill and identifi able intangible assets and the provision for potential losses that may arise from litigation and regulatory proceedings and tax ... -

Page 96

... valued based on quoted market prices, broker or dealer quotations, or alternative pricing sources with reasonable levels of price transparency include most government agency securities, most corporate bonds, certain mortgage products, certain bank loans and bridge loans, less liquid listed equities... -

Page 97

..., recapitalizations and other transactions across the capital structure, offerings in the equity or debt capital markets, and changes in fi nancial ratios or cash flows. For positions that are not traded in active markets or are subject to transfer restrictions, valuations are adjusted to reflect... -

Page 98

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements â-ª Resale and Repurchase Agreements. Securities purchased under agreements to resell and securities sold under agreements to repurchase, principally U.S. government, federal agency and investment-grade sovereign ... -

Page 99

...have been resolved. Overrides are included in "Trading and principal investments" in the consolidated statements of earnings. Asset Management. Management fees are recognized over the period that the related service is provided based upon average net asset values. In certain circumstances, the fi rm... -

Page 100

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Identifiable Intangible Assets Identifi able intangible assets, which consist primarily of customer lists, New York Stock Exchange (NYSE) Designated Market Maker (DMM) rights and the value of business acquired (VOBA) in ... -

Page 101

..., results of operations or cash flows. Accounting for Income Tax Benefits of Dividends on Share-Based Payment Awards (ASC 718). In June 2007, Earnings Per Common Share (EPS) Basic EPS is calculated by dividing net earnings applicable to common shareholders by the weighted average number of common... -

Page 102

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating Securities (ASC 260). In June 2008, the FASB issued amended accounting principles related to determining whether instruments ... -

Page 103

... amended accounting principles which change the accounting for securitizations and VIEs. These principles were codified as Accounting Standards Update (ASU) No. 2009-16, "Transfers and Servicing (Topic 860) - Accounting for Transfers of Financial Assets" and ASU No. 2009-17, "Consolidations (Topic... -

Page 104

...derivatives to manage a long or short risk position. As of December 2009 (in millions) November 2008 Assets Liabilities Assets Liabilities Commercial paper, certificates of deposit, time deposits and other money market instruments Government and U.S. federal agency obligations Mortgage and other... -

Page 105

... time deposits and other money market instruments U.S. government and federal agency obligations Non-U.S. government obligations Mortgage and other asset-backed loans and securities (1): Loans and securities backed by commercial real estate Loans and securities backed by residential real estate Loan... -

Page 106

... Total (in millions) U.S. government and federal agency obligations Non-U.S. government obligations Mortgage and other asset-backed loans and securities: Loans and securities backed by commercial real estate Loans and securities backed by residential real estate Bank loans and bridge loans... -

Page 107

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Financial Assets at Fair Value as of November 2008 Level 1 Level 2 Level 3 Netting and Collateral Total (in millions) Commercial paper, certificates of deposit, time deposits and other money market instruments Government... -

Page 108

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Financial Liabilities at Fair Value as of November 2008 Level 1 Level 2 Level 3 Netting and Collateral Total (in millions) Government and U.S. federal agency obligations Mortgage and other asset-backed loans and ... -

Page 109

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Cash Instruments The net unrealized loss on level 3 cash instruments of $4.31 billion for the year ended December 2009 primarily consisted of unrealized losses on private equity investments and real estate fund investments... -

Page 110

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The tables below set forth a summary of changes in the fair value of the fi rm's level 3 fi nancial assets and fi nancial liabilities at fair value for the years ended December 2009 and November 2008 and one month ended ... -

Page 111

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Level 3 Financial Assets and Financial Liabilities at Fair Value Net unrealized gains/(losses) relating to instruments still held at the reporting date (in millions) Balance, beginning of year Net realized gains/(losses... -

Page 112

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Impact of Credit Spreads On an ongoing basis, the fi rm realizes gains or losses relating to changes in credit risk on derivative contracts through changes in credit mitigants or the sale or unwind of the contracts. The ... -

Page 113

...fair value of these secured financings are offset by changes in the fair value of the related financial instruments included in "Trading assets, at fair value" in the consolidated statements of financial condition. Such gains/(losses) were not material for the one month ended December 2008. Excludes... -

Page 114

... investment approach across various asset classes and strategies including long/short equity, credit, convertibles, risk arbitrage, special situations and capital structure arbitrage. These funds invest globally, primarily in real estate companies, loan portfolios, debt recapitalizations and direct... -

Page 115

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Credit Concentrations Credit concentrations may arise from trading, investing, underwriting, lending and securities borrowing activities and may be impacted by changes in economic, industry or political factors. The fi rm ... -

Page 116

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The fi rm applies a long-haul method to all of its hedge accounting relationships to perform an ongoing assessment of the effectiveness of these relationships in achieving offsetting changes in fair value or offsetting ... -

Page 117

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The fi rm also has embedded derivatives that have been bifurcated from related borrowings. Such derivatives, which are classified in unsecured short-term and unsecured long-term borrowings in the fi rm's consolidated ... -

Page 118

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements â-ª Credit default swaps. Single-name credit default swaps protect the buyer against the loss of principal on one or more bonds, loans or mortgages (reference obligations) in the event of a default by the issuer (reference... -

Page 119

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The following table sets forth certain information related to the fi rm's credit derivatives. Fair values in the table below exclude the effects of both netting under enforceable netting agreements and netting of cash paid... -

Page 120

... did not have the right to sell or repledge are included in "Trading assets, at fair value" in the consolidated statements of fi nancial condition and were $109.11 billion and $80.85 billion as of December 2009 and November 2008, respectively. Other assets (primarily real estate and cash) owned and... -

Page 121

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements NOTE 4 Securitization Activities and Variable Interest Entities Securitization Activities The fi rm securitizes residential and commercial mortgages, corporate bonds and other types of fi nancial assets. The fi rm acts as... -

Page 122

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The following table sets forth the weighted average key economic assumptions used in measuring the fair value of the fi rm's retained interests and the sensitivity of this fair value to immediate adverse changes of 10% and... -

Page 123

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements As of December 2009 and November 2008, the fi rm held mortgage servicing rights with a fair value of $88 million and $147 million, respectively. These servicing assets represent the fi rm's right to receive a future stream... -

Page 124

... these VIEs are included in "Trading assets, at fair value" and "Trading liabilities, at fair value," respectively, in the consolidated statement of financial condition. The firm obtains interests in these VIEs in connection with making investments in real estate, distressed loans and other types of... -

Page 125

...rm has aggregated consolidated VIEs based on principal business activity, as reflected in the fi rst column. As of December 2009 (in millions) November 2008 (1) (2) VIE Assets (1) VIE Liabilities VIE Assets (1) Real estate, credit-related and other investing Municipal bond securitizations CDOs... -

Page 126

... value due to the short-term nature of the obligations. Unsecured short-term borrowings are set forth below: As of December 2009 November 2008 (in millions) Current portion of unsecured long-term borrowings (1) (2) Hybrid financial instruments Promissory notes (3) Commercial paper (4) Other short... -

Page 127

...are based on LIBOR or the federal funds target rate. Equity-linked and indexed instruments are included in floating rate obligations. Includes $19.03 billion as of December 2009, guaranteed by the FDIC under the TLGP. (2) (3) Unsecured long-term borrowings by maturity date are set forth below: As... -

Page 128

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The fi rm enters into derivative contracts to effectively convert a substantial portion of its unsecured long-term borrowings which are not accounted for at fair value into floating rate obligations. Accordingly, excluding... -

Page 129

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements APEX Trusts. The fi rm has the right to defer payments on the junior subordinated debt and the stock purchase contracts, subject to limitations, and therefore cause payment on the APEX to be deferred. During any such ... -

Page 130

... funds managed by the firm, which will be funded at market value on the date of investment. Includes commitments of $104 million and $388 million as of December 2009 and November 2008, respectively, related to the firm's new headquarters in New York City. (3) (4) (5) Commitments to Extend Credit... -

Page 131

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements â-ª William Street credit extension program. Substantially all of the commitments provided under the William Street credit extension program are to investment-grade corporate borrowers. Commitments under the program are ... -

Page 132

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Guarantees The fi rm enters into various derivative contracts that meet the defi nition of a guarantee under ASC 460. Disclosures about derivative contracts are not required if such contracts may be cash settled and the fi... -

Page 133

... the payment obligations of Goldman, Sachs & Co. (GS&Co.), GS Bank USA and GS Bank Europe, subject to certain exceptions. In November 2008, the fi rm contributed subsidiaries into GS Bank USA, and Group Inc. agreed to guarantee certain losses, including credit-related losses, relating to assets held... -

Page 134

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements payments to the U.S. Treasury related to the U.S. Treasury's TARP Capital Purchase Program totaled $11.42 billion, including the return of the U.S. Treasury's $10.0 billion investment (inclusive of the $426 million ... -

Page 135

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements In 2007, the Board authorized 17,500.1 shares of perpetual Non-Cumulative Preferred Stock, Series E (Series E Preferred Stock), and 5,000.1 shares of perpetual Non-Cumulative Preferred Stock, Series F (Series F Preferred ... -

Page 136

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements NOTE 10 Earnings Per Common Share The computations of basic and diluted earnings per common share are set forth below: Year Ended December 2009 November 2008 November 2007 One Month Ended December 2008 (in millions, ... -

Page 137

... in the consolidated statements of fi nancial condition: As of December 2009 November 2008 (in millions) Investment Banking Underwriting Trading and Principal Investments FICC Equities (1) Principal Investments Asset Management and Securities Services Asset Management (2) Securities Services Total... -

Page 138

...at fair value under the fair value option as of December 2009 and November 2008, respectively, which are included in "Trading assets, at fair value" in the consolidated statements of financial condition. (2) (3) Includes $598 million and $784 million related to consolidated investment funds as of... -

Page 139

... or inactive employees prior to retirement. On November 30, 2007, the fi rm adopted amended principles related to employers' accounting for defi ned benefit pension and other postretirement plans which require an entity to recognize in its statement of fi nancial condition the funded status of its... -

Page 140

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The following table provides a summary of the changes in the plans' benefit obligations and the fair value of plan assets for the years ended December 2009 and November 2008, as well as a statement of the funded status of ... -

Page 141

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The accumulated benefit obligation for all defi ned benefit pension plans was $1.31 billion and $769 million as of December 2009 and November 2008, respectively. For plans in which the accumulated benefit obligation ... -

Page 142

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The weighted average assumptions used to develop the actuarial present value of the projected benefit obligation and net periodic pension cost are set forth below. These assumptions represent a weighted average of the ... -

Page 143

..., mutual funds, corporate bonds, alternative investments (e.g., hedge funds), cash and short-term investments, and real estate investment trust holdings. Substantially all of the fi rm's pension plan assets are classified within level 1 or level 2 of the fair value hierarchy as of December 31, 2009... -

Page 144

... and accrued expenses" in the consolidated statements of fi nancial condition. The fi rm has a discount stock program through which Participating Managing Directors may be permitted to acquire RSUs at an effective 25% discount (for 2009 and 2008 year-end compensation, the program was suspended, and... -

Page 145

...Sachs 2009 Annual Report Notes to Consolidated Financial Statements Restricted Stock Units The fi rm issues RSUs to employees under the SIP, primarily in connection with year-end compensation and acquisitions. RSUs are valued based on the closing price of the underlying shares on the date of grant... -

Page 146

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Stock Options Stock options granted to employees generally vest as outlined in the applicable stock option agreement. No options were granted in fiscal 2009. Year-end options granted in December 2008 will become ... -

Page 147

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The weighted average fair value of options granted for the year ended 2007 and in the one month ended December 2008 was $51.04 and $14.08 per option, respectively. Fair value was estimated as of the grant date based on a ... -

Page 148

...of (in millions) December 2009 November 2008 Deferred tax assets Compensation and benefits Unrealized losses ASC 740 asset Non-U.S. operations Foreign tax credits Net operating losses Occupancy related Other, net Valuation allowance (1) Total deferred tax assets (2) Total deferred tax liabilities... -

Page 149

... the changes in the fi rm's unrecognized tax benefits (in millions): 2009 2008 (1) Balance, beginning of year Increases based on tax positions related to the current year Increases based on tax positions related to prior years Decreases related to tax positions of prior years Decreases related to... -

Page 150

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements The fi rm is subject to examination by the U.S. Internal Revenue Service (IRS) and other taxing authorities in jurisdictions where the fi rm has significant business operations, such as the United Kingdom, Japan, Hong Kong... -

Page 151

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements NOTE 17 Regulation and Capital Adequacy The Federal Reserve Board is the primary U.S. regulator of Group Inc., a bank holding company that in August 2009 also became a fi nancial holding company under the U.S. GrammLeach-... -

Page 152

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements GS Bank USA, a New York State-chartered bank and a member of the Federal Reserve System and the Federal Deposit Insurance Corporation (FDIC), is regulated by the Federal Reserve Board and the New York State Banking ... -

Page 153

... Goldman Sachs Japan Co., Ltd. (GSJCL). GSI, the fi rm's regulated U.K. broker-dealer, is subject to the capital requirements of the FSA. GSJCL, the fi rm's regulated Japanese broker-dealer, is subject to the capital requirements imposed by Japan's Financial Services Agency. As of December 2009 and... -

Page 154

Goldman Sachs 2009 Annual Report Notes to Consolidated Financial Statements Segment Operating Results Management believes that the following information provides a reasonable representation of each segment's contribution to consolidated pre-tax earnings and total assets: As of or for the Year ... -

Page 155

...Commodities, and Equities: location of the trading desk. â-ª Principal Investments: location of the investment. â-ª Asset Management: location of the sales team. â-ª Securities Services: location of the primary market for the underlying security. The following table sets forth the total net revenues... -

Page 156

... to resell and federal funds sold Trading assets, at fair value Other interest (2) Total interest income Interest expense Deposits Securities loaned and securities sold under agreements to repurchase, at fair value Trading liabilities, at fair value Short-term borrowings (3) Long-term borrowings... -

Page 157

...equivalents Loans to and receivables from subsidiaries Bank subsidiary Nonbank subsidiaries Investments in subsidiaries and associates Bank subsidiary Nonbank subsidiaries and associates Trading assets, at fair value Other assets Total assets Liabilities and shareholders' equity Unsecured short-term... -

Page 158

... income Net revenues, including net interest income Operating expenses (2) Pre-tax earnings/(loss) Provision/(benefit) for taxes Net earnings/(loss) Preferred stock dividends Net earnings/(loss) applicable to common shareholders Earnings/(loss) per common share Basic Diluted Dividends declared per... -

Page 159

Goldman Sachs 2009 Annual Report Supplemental Financial Information Common Stock Price Range The following table sets forth, for the quarters indicated, the high and low sales prices per share of the fi rm's common stock: Year Ended December 2009 November 2008 November 2007 High First quarter ... -

Page 160

... funds, private equity, real estate, currencies, commodities and asset allocation strategies. Rounded to the nearest penny. Exact dividend amount was $0.4666666 per common share and was refl ective of a four-month period (December 2008 through March 2009), due to the change in the firm's fiscal year... -

Page 161

Goldman Sachs 2009 Annual Report Supplemental Financial Information Statistical Disclosures Distribution of Assets, Liabilities and Shareholders' Equity The following table sets forth a summary of consolidated average balances and interest rates for the years ended December 2009, November 2008 ... -

Page 162

Goldman Sachs 2009 Annual Report Supplemental Financial Information Distribution of Assets, Liabilities and Shareholders' Equity (continued) For the Year Ended December 2009 Average balance Interest Average rate November 2008 Average balance Interest Average rate November 2007 Average balance ... -

Page 163

...have been allocated to volume. For the Year Ended December 2009 versus November 2008 Increase (decrease) due to change in: (in millions) Volume Rate Net change November 2008 versus November 2007 Increase (decrease) due to change in: Volume Rate Net change Interest-earning assets Deposits with banks... -

Page 164

...-for-sale securities, December 2009 Commercial paper, certificates of deposit, time deposits and other money market instruments U.S. government, federal agency and sovereign obligations Mortgage and other asset-backed loans and securities Corporate debt securities and other debt obligations Total... -

Page 165

... Ten Years Amount Yield (1) Total Amount Yield (1) Fair value of available-for-sale securities Commercial paper, certificates of deposit, time deposits and other money market instruments U.S. government, federal agency and sovereign obligations Mortgage and other asset-backed loans and securities... -

Page 166

... within one year of the financial statement date. Includes short-term secured financings of $12.93 billion as of December 2009, $21.23 billion as of November 2008 and $32.41 billion as of November 2007. As of December 2009, November 2008 and November 2007, weighted average interest rates include the... -

Page 167

Goldman Sachs 2009 Annual Report Supplemental Financial Information Cross-border Outstandings Cross-border outstandings are based upon the Federal Financial Institutions Examination Council's (FFIEC) regulatory guidelines for reporting cross-border risk. Claims include cash, receivables, ... -

Page 168

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors BOARD OF DIRECTORS MANAGEMENT COMMITTEE MANAGING DIRECTORS Lloyd C. Blankfein Chairman and Chief Executive Offi cer Gary D. Cohn President and Chief Operating Offi cer John H. Bryan Retired Chairman and Chief Executive Offi... -

Page 169

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Ravi Sinha* Edward M. Siskind Sarah E. Smith* Steven H. Strongin Patrick Sullivan Daisuke Toki John... William C. Montgomery Stephen P. Hickey Yusuf A. Alireza* John A. Ashdown Christopher M. Barter Elizabeth E. Beshel Alan ... -

Page 170

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Craig W. Crossman Jeffrey R. Currie Stephen D. Daniel Bradley S. DeFoor...Lester R. Brafman Cynthia A. Brower Philippe L. Camu John W. Cembrook Robert J. Ceremsak James R. Cielinski William J. Conley, Jr. Colin J. Corgan Thomas ... -

Page 171

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Robert D. Patch Bruce B. Petersen Cameron P. Poetzscher Kenneth A. Pontarelli Vijay C. Popat Lora J. Robertson Lorin P. Radtke Deepak K. Rao Buckley T. Ratchford Luigi G. Rizzo J. Timothy Romer John R. Sawtell Alexander ... -

Page 172

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Robin Rousseau Kristin F. Gannon Charles W. Lockyer Adam S. ... Weiner Owen O. West Alan S. Wilmit David T. Wilson Edward C. Wilson Donna A. Winston Carinne S. Withey Christopher D. Woolley Brendan Wootten John M. Yae Salvatore ... -

Page 173

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Erich Bluhm ...Chang Christian Channell Westley D. Chapman Eva Chau David Chou Thalia Chryssikou Michael J. Civitella Luke E. Clayton Kathleen A. Connolly John G. Creaton Cecile Crochu Gavin S. Da Cunha Lauren Dang Anne Marie... -

Page 174

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Richard Shannon Daniel A. Sharfman Song Shen Jonathan M. Sheridan James Roger... Scruggs Joseph M. Spinelli Teresa Teague Atanas Bostandjiev Antonio F. Esteves Kevin Shone Caglayan Cetin Aya Stark Hamilton Alan Zagury Mary Anne ... -

Page 175

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Eugeny Levinzon David H. Loeb Ning Ma John G. Madsen Brian M. Margulies Michael C. Marsh David W. May Adam J. Mazur Ryan L. McCorvie Robert A. McEvoy William... Wada Scott Connelly Keith Tomao Alan Zhang Ming Jin Steve L. Bossi... -

Page 176

Goldman Sachs 2009 Annual Report Board Members, Of ficers and Directors Simon J. Fennell Danielle Ferreira John...John V. Lanza Solenn Le Floch Craig A. Lee Rose S. Lee José Pedro Leite da Costa Allison R. Liff Luca M. Lombardi Joseph W. Long...Nelson Roger ...Williams Julian Wills Troy D. Wilson William... -

Page 177

... Boston Buenos Aires Calgary Chicago Dallas Doha Dubai Dublin Frankfurt Geneva George Town Hong Kong Houston Jersey City Johannesburg London Los Angeles Madrid Melbourne* Mexico City Miami Milan Moscow Mumbai New York Paris Philadelphia Princeton Salt Lake City San Francisco São Paulo Seattle... -

Page 178

... from registered shareholders of The Goldman Sachs Group, Inc. regarding lost or stolen stock certificates, dividends, changes of address and other issues related to registered share ownership should be addressed to: Mellon Investor Services LLC 480 Washington Boulevard Jersey City, New Jersey 07310... -

Page 179

... the letter and spirit of the laws, rules and ethical principles that govern us. Our continued success depends upon unswerving adherence to this standard. Our goal is to provide superior returns to our shareholders. Profitability is critical to achieving superior returns, building our capital, and... -

Page 180

www.gs.com