Food Lion 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

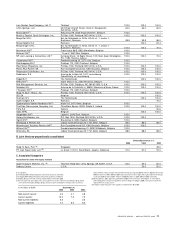

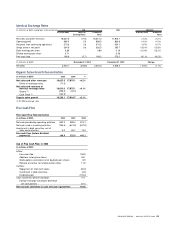

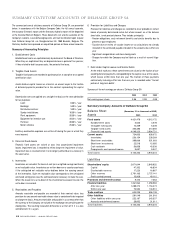

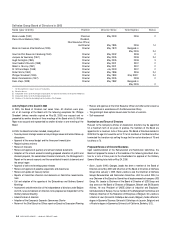

Approximate reconciliation to US GAAP of net income and shareholders' equity would be as follows:

(in millions of EUR) 2005 2004 2003

as restated as restated

Net income in accordance with IFRS 364.9 295.7 278.9

Items having the effect of increasing (decreasing) reported net income:

a. Goodw ill - transition to IFRS 3.7 8.6 5.0

c. Goodw ill - tax adjustments (3.9) (7.1) -

e. Pension (2.6) (2.1) (2.5)

f. Share-based payment 1.0 19.2 19.9

g. Impairment of assets (0.2) (7.0) (7.0)

h. Taxes (0.6) 0.4 (1.2)

i. Convertible bonds 5.3 3.4 -

j. Change in accounting principle - - (102.0)

k. Closed store provision 5.3 0.4 24.7

l. Other (2.4) 1.0 1.8

Total US GAAP adjustments before tax effects 5.6 16.8 (61.3)

Tax effects of US GAAP adjustments (6.8) (8.1) 24.3

Net income in accordance with US GAAP 363.7 304.4 241.9

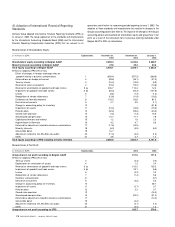

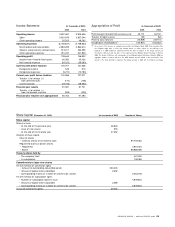

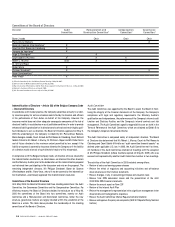

December 31,

(in millions of EUR) 2005 2004 2003

as restated as restated

Shareholders’ equity in accordance w ith IFRS 3,586.0 2,847.7 2,774.7

Items having the effect of increasing (decreasing) reported shareholders’ equity:

a. Goodw ill - transition to IFRS 102.8 86.6 84.4

b. Goodw ill - impairment 66.6 57.7 62.2

c. Goodw ill - tax adjustments (11.6) (6.5) -

d. Amortization of trade names (17.8) (15.4) (16.6)

e. Pension 15.6 16.4 16.1

g. Impairment of assets 0.1 (0.3) 7.6

h. Taxes (17.0) (16.5) (16.9)

i. Convertible bonds (20.1) (25.4) -

k. Closed store provision 6.8 2.0 0.4

l. Other (8.0) (5.7) (2.1)

Total US GAAP adjustments before tax effects 117.4 92.9 135.1

Tax effects of US GAAP adjustments (12.8) (11.3) (14.0)

Shareholders’ equity in accordance w ith US GAAP 3,690.6 2,929.3 2,895.8

j. Change in Accounting Principle

In the second quarter of 2003, Food Lion and Kash n’ Karry changed their method

of accounting for store inventories from the retail method to the average item cost

method. As a result, Delhaize Group decided to change its accounting policy for

inventory from the “ First In First Out” (FIFO) method to the average cost method. For

US GAAP, this change in accounting method resulted in a charge of EUR 77.2 million

to net profit in 2003. IFRS 1 requires an entity to use the same accounting polices in

its opening IFRS balance sheet and throughout all periods presented in its first IFRS

financial statements. Therefore, Delhaize Group has adjusted the January 1, 2003

shareholders’ equity to reflect this change in accounting policy.

Under US GAAP, Delhaize Group adopted in 2003 EITF 02-16, “ Accounting by a

Reseller for Cash Consideration Received”. EITF 02-16 requires cash consideration

received from a vendor to be presumed to be a reduction of inventory, and recognized

in cost of sales when the product is sold, unless it is a reimbursement of specific

costs incurred in advertising the vendor’s products. Under US GAAP, EUR 24.8 mil-

lion was recorded as a change in accounting principle in 2003. Under IFRS, Delhaize

Group follows the same accounting principle and the initial adjustment of EUR 24.8

million was recorded in the opening IFRS balance sheet on January 1, 2003.

k. Closed Store Provision

The timing for recognizing and the amount of closed store provisions under US GAAP

for stores closed prior to the adoption of SFAS 146 “Accounting for Costs Associated

with Exit or Disposal Activities” are different from IFRS. In addition, under IFRS, the

provision for closed stores reflects the estimated settlement amount versus the

market value used for US GAAP. Estimated sublease income that is considered in

recording the provision may differ from the market value approach when supermarket

restrictions are placed on a closed store site to retain the customer base in the market

in which a store has operated and has been closed. The discounting rules associated

with long-term provisions are more prescriptive under IFRS than US GAAP.

l. Other

“Other” primarily relates to finance leases. Under US GAAP, finance leases for real

estate are separated into the land and building components with the land compo-

nent accounted for separately as an operating lease if the land represents 25% or

more of the value of the leased asset. Under IFRS, the land component of finance

leases is accounted for separately as an operating lease if it is material, which is

defined by Delhaize Group as 10% or more of the total value of the leased property.

In addition, Delhaize Group applies EITF 97-10 “ The Effect on Lessee Involvment in

Asset Construction” , by which a lessee should be considered the owner of a real

estate project during the construction period if the lessee has substantially all of the

construction period risks and sales-leaseback accounting should be considered. For

US GAAP, EITF 97-10 is applied on a prospective basis for new leases after the date

of adoption. Under IFRS, this treatment is applied retrospectively to all finance leases

existing at the date of transition to IFRS on January 1, 2003.

DELHAIZE GROUP / ANNUAL REPORT 200 5 87