Food Lion 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP / ANNUAL REPORT 2005

2

Sales grow th is a key driver for building shareholder value in

the food retail industry. Thus, for Delhaize Group, 2005 w as

a year of advancem ent, as we accelerated our sales perfor-

m ance for the third consecutive year. Our total sales increased

by 4.2% at actual and by 4.1% at identical exchange rates.

This was possible due to a balanced m ix between stronger

sales in existing stores, m ore store openings and selective

fi ll-in acquisitions.

In the fi rst half of 2005, we were confronted with w eak

sales m omentum, particularly in the Southeast of the U.S.

However, continued focus on our key strategic initiatives,

combined w ith a prompt reaction from our teams, bore fruit

and, from June 2005, w e saw sales trends at Food Lion, our

largest operating com pany, im proving. In Belgium , sales

w ere under pressure throughout the year from lagging con-

sum er confi dence and many com petitive openings.

In 2005, Delhaize Group undertook num erous initiatives to

reinforce its businesses and build future grow th. Food Lion

renew ed two of its markets, Greensboro, North Carolina and

Baltim ore, Maryland; it also reinforced its Bloom stores and

launched the new deep discount brand Bottom Dollar. In

Florida, 19 Sw eetbay Superm arkets w ere added, m ostly con-

verted Kash n’ Karry stores. All acquired Victory stores were

converted to the Hannaford brand and Delhaize Belgium

acquired 43 Cash Fresh stores to expand its network.

The intensive renew al and conversion work resulted in tem-

porarily higher operating expenses. In addition, operating

expenses w ere impacted by higher fuel expenses, increased

m edical costs in the U.S. and statutory labor rate increases

in Belgium . However, these higher operating expenses w ere

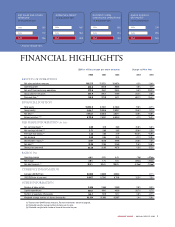

offset by a strong gross margin increase. As a result, our

operating m argin rem ained stable at 4.8% of sales, a strong

fi gure in the food retail sector. Our net profi t amounted to

EUR 364.9 million. Basic net earning per share increased by

21.8% to EUR 3.89.

Based on this good performance, our future capital expendi-

ture needs and its belief in the Com pany’s future, Delhaize

Group’s Board of Directors w ill propose to the Ordinary

General Meeting of May 24, 2006, the payment of a EUR 1.20

gross dividend per share (EUR 0.90 net of 25% Belgian w ith-

holding tax), a 7.1% increase over last year’s dividend.

Dear Shareholder,

LETTER FROM

THE CHAIRMAN&

THE CHIEF EXECUTIVE

OFFICER

Georges JacobsPierre-Olivier Beckers