Food Lion 2005 Annual Report Download - page 88

Download and view the complete annual report

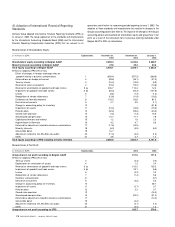

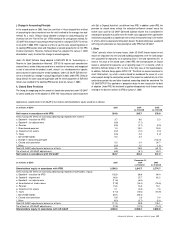

Please find page 88 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.with the Hannaford acquisition was increased by EUR 14.6 million, EUR 12.7 million

and EUR 13.7 million at the end of 2005, 2004 and 2003, respectively.

b. Goodwill - Impairment

Under IFRS, goodwill is tested for impairment at the level of groups of cash generat-

ing units that represent the lowest level at which goodwill is monitored for internal

management purpose. At the date of transition to IFRS, January 1, 2003, the impair-

ment test of goodwill and other intangibles resulted in an impairment loss of the

Kash n’ Karry goodwill. Under US GAAP, goodwill is tested for impairment at the level

of the reporting unit and no impairment loss was recorded for Kash n’ Karry.

c. Goodwill - Tax Adjustments

Under IFRS, purchase accounting adjustments relating to income tax contingencies

recorded subsequent to the original acquisition accounting are recorded as an offset

to income tax expense when there is a change in estimate regarding the realization

of the deferred tax balance. Under U.S. GAAP, purchase accounting adjustments

relating to income tax contingencies recorded subsequent to the original acquisi-

tion accounting are offset to goodwill. If goodwill is reduced to zero, the remaining

amount is first used to reduce other non-current intangible assets, and any excess

beyond that amount is recorded as an adjustment to income tax expense.

The favorable resolution of certain tax accruals that existed at the time of certain

purchase accounting transactions are reflected as a reduction to tax expense for

IFRS and a reduction to goodwill for US GAAP. The adjustments were EUR 3.9 million

and EUR 7.1 million to increase income tax expense under US GAAP during 2005 and

2004, respectively.

d. Amortization of Trade Names

Under IFRS, Delhaize Group does not amortize intangible assets with indefinite lives.

Upon first-time adoption of IFRS, this accounting policy was applied retrospectively

to all trade names existing at the date of transition, on January 1, 2003. Under US

GAAP, Delhaize Group ceased amortizing intangible assets with indefinite lives, upon

adoption of SFAS 142 on January 1, 2002. As a result, an adjustment to decrease the

carrying amount of trade names in accordance with US GAAP was recorded in the

amount of EUR 17.8 million, EUR 15.4 million and EUR 16.6 million at December 31,

2005, 2004 and 2003 respectively.

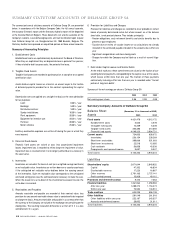

e. Pensions

Under IFRS, Delhaize Group accounts for pensions in accordance with IAS 19

“Employee Benefits” . At the date of transition to IFRS on January 1, 2003, Delhaize

Group recognized all existing unrecognized actuarial gains and losses. After

January 1, 2003, Delhaize Group elected to amortize actuarial gains and losses that

fall outside the allowed corridor over the expected average remaining working lives

of employees participating in the plans. Under US GAAP, actuarial gains and losses

that fall outside the allowed corridor are amortized over the average remaining

working lives of employees participating in the plans. Unlike IFRS, under US GAAP,

an additional minimum pension liability is recognized when the accumulated benefit

obligation is lower than the plan assets.

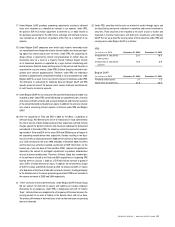

f. Stock Options

Under IFRS, Delhaize Group records share-based compensation expense related

to stock options and restricted shares in accordance with IFRS 2 “ Share-Based

Payment” for all options and restricted shares granted but not fully vested at the

date of transition to IFRS on January 1, 2003. Under US GAAP, until December 31,

2004, Delhaize Group applied the provisions of Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees” (“APBO 25” ), for grants of

restricted shares and stock options. As of January 1, 2005, Delhaize Group adopted

SFAS 123(R) “ Stock-Based Payment.” Under IFRS 2 and SFAS 123(R), compensa-

tion expense is based on the fair value of the share-based awards. Delhaize Group

estimates the fair value using the Black-Scholes valuation model. Under APBO 25,

compensation expense was based on the intrinsic value (i.e., the difference between

the market price of the underlying share at grant date and the exercise price of the

award). The retrospective transition provision of IFRS 2 and the modified prospective

transition provision of SFAS 123(R) give rise to differences in the historical income

statement for share-based compensation. Differences surrounding the effective date

of application of the standards to unvested shares (i.e., using the straight-line method

for US GAAP and the graded method for IFRS) give rise to both current and historical

income statement differences in share-based compensation. As a result, adjustments

were made to decrease compensation expense in accordance with US GAAP, in the

amount of EUR 1.0 million, EUR 19.2 million and EUR 19.9 million in 2005, 2004 and

2003 respectively. Under IFRS, a tax benefit for tax deductible share-based payments

is recognized in the operating statement at the lower of the cumulative realizable tax

deduction at the balance sheet date based on the current share value and the tax

effected cumulative share-based compensation expense. Any tax benefit in excess of

that amount is recognized directly in equity. Under APBO 25, all tax benefits related

to stock options is recorded directly in equity. Under SFAS 123(R), the equity pool

from past stock option activity is considered when recognizing tax benefits through

the operating statement. As a result, adjustments were recorded to increase income

tax expense in accordance with US GAAP by EUR 3.5 million, EUR 6.5 million and

EUR 2.6 million, for 2005, 2004 and 2003, respectively.

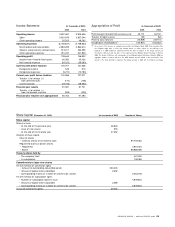

g. Impairment of Assets

Under IFRS, Delhaize Group tests assets for impairment in compliance with IAS 36

“Impairment of Assets” , whenever events or circumstances indicate that impairment

may exist. The Group has identified a store as a cash generating unit. Stores for

which there is potential impairment are tested for impairment by comparing the car-

rying value of the assets to the higher of their value in use (i.e. projected discounted

cash flows) or fair value less costs to sell. If impairment exists, the assets are written

down to their recoverable amount (i.e. higher of value in use or fair value less cost to

sell). If impairment is no longer justified in future periods due to a recovery in assets’

fair value or value in use, the impairment loss is reversed. Under US GAAP, Delhaize

Group reviews long-lived assets for impairment whenever events or changes in cir-

cumstances indicate that the carrying amount of the assets may not be recoverable.

If these events or changes in circumstances indicate that such amounts could not be

recoverable, Delhaize Group estimates the future cash flows expected to result from

the use of the asset and its eventual disposition. If the sum of undiscounted future

cash flows is less than the carrying amount of the asset, Delhaize Group recognizes

an impairment loss for the difference between the carrying value of the asset and

its fair value. The estimate of fair value considers prices for similar assets and the

results of analyses of expected future cash flows using a discount rate commensu-

rate with the risks involved. After an impairment is recognized, the reduced carrying

amount of the asset is accounted for as its new cost. For a depreciable asset, the

new cost is depreciated over the asset’s remaining useful life. Restoration of previ-

ously recognized impairment losses is not permitted.

h. Taxes

Under IFRS, deferred tax liabilities are not recognized on tax-exempt reserves relating

to capital gains realized in the past on the disposal of investments and real estate,

which will be taxed only when distributed to shareholders. Under US GAAP, such

deferred tax liabilities are recognized.

i. Convertible Bond

In 2004, Delhaize Group issued a convertible bond in the amount of EUR 300 million.

Under IFRS, Delhaize Group accounts for the convertible bond in accordance with

IAS 32 “Financial Instruments: Disclosure and Presentation” , and IAS 39 “Financial

Instruments: Recognition and Measurement”. Accordingly, the convertible bond was

recognized partly as a liability and partly as an equity instrument. Under US GAAP,

the convertible bond was recorded in accordance with APB Opinion 14, “ Accounting

for Convertible Debt and Debt issued with Stock Purchase Warrants” , SFAS 133,

“Accounting for Derivative Instruments and Hedging Activities” and EITF Issue No.

00-19 “Accounting for Derivative Financial Instruments Indexed to, and Potentially

Settled in, a Company’s Own Stock.” Accordingly, the convertible bond was fully

recognized as a liability.

DELHAIZE GROUP / ANNUAL REPORT 200 5

86