Food Lion 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

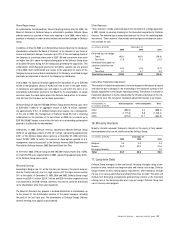

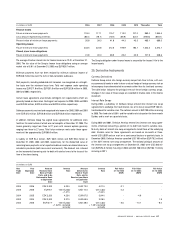

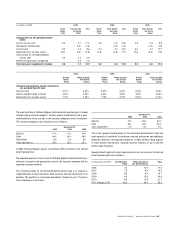

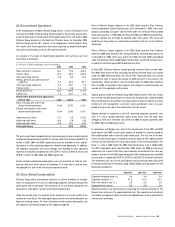

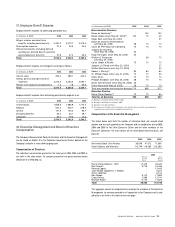

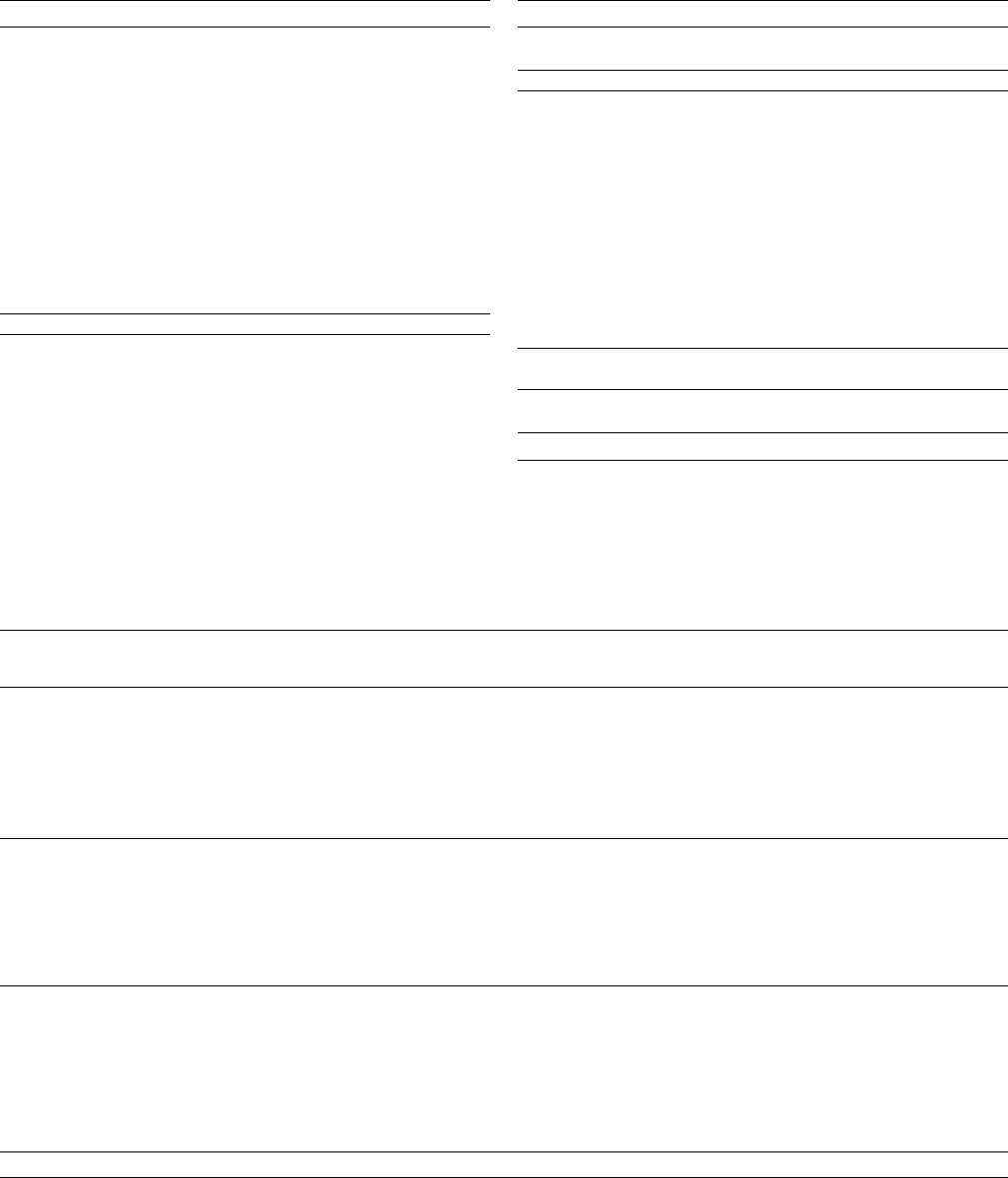

The following is a reconciliation of Delhaize Group’s Belgian statutory income tax

rate with Delhaize Group’s effective income tax rate:

(in m illions of EUR) 2005 2004 2003

Belgian statutory income tax rate 34.0% 34.0% 34.0%

Items affecting the Belgian statutory

income tax rate:

Taxation in juridictions outside Belgium:

(primarily due to United States

federal and state income tax rates

applied to the income of Delhaize

America)

(1) (2) (3)

3.9

3.5 6.4

Not taxable income (2.1) (1.9) (2.2)

Effect of unrecognized tax

losses and tax credits 0.9 1.0 1.4

Tax charges on dividend income 0.7 0.3 0.1

Change in enacted rate

(4)

-

(0.5) -

Other 0.1 0.7 (0.5)

Effective tax rate 37.5% 37.1% 39.2%

(1) In 2005, approximately 77% of Delhaize Group’s consolidated profit before tax was attributable to Delhaize

America, which had an effective tax rate of 39.0%.

(2) In 2004, approximately 71% of Delhaize Group’s consolidated profit before tax was attributable to Delhaize

America, which had an effective tax rate of 38.9%.

(3) In 2003, approximately 72% of Delhaize Group’s consolidated profit before tax was attributable to Delhaize

America, which had an effective tax rate of 42.9%.

(4) The Greek statutory tax rate was changed from 35% to 32% for fiscal year 2005, 29% for fiscal year 2006

and 25% for fiscal years starting 2007.

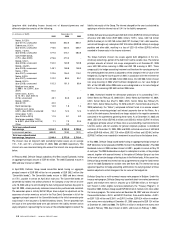

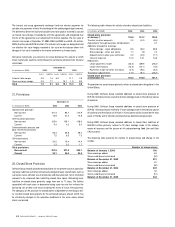

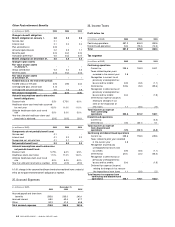

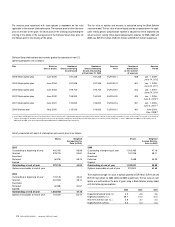

The amount of current and deferred tax charged or (credited) directly to equity

is as follows:

(in m illions of EUR) 2005 2004 2003

Current tax (6.5) (6.1) -

Deferred tax 7.6 10.7 1.6

Total tax charged directly to equity 1.1 4.6 1.6

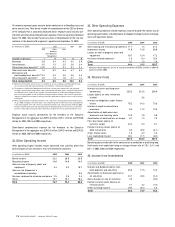

Delhaize Group has not recognized income taxes on undistributed earnings of

certain subsidiaries as the undistributed earnings are permanently reinvested.

The cumulative amount of undistributed earnings on which Delhaize Group has

not recognized income taxes was approximately EUR 1.7 billion, EUR 1.4 billion

and EUR 1.4 billion at December 31, 2005, 2004 and 2003, respectively.

Deferred income tax assets and liabilities are offset when there is a legally

enforceable right to offset and when the deferred income taxes relate to the

same fiscal authority. Deferred income taxes recognized on the balance sheet

are as follows:

(in m illions of EUR) December 31,

2005 2004 2003

Deferred tax liabilities 253.1 240.6 223.6

Deferred tax assets 5.1 5.5 6.5

Net deferred tax liabilities 248.0 235.1 217.1

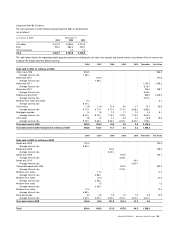

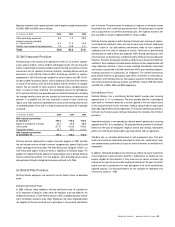

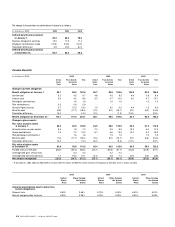

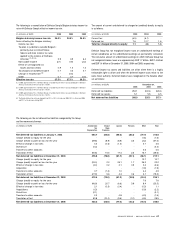

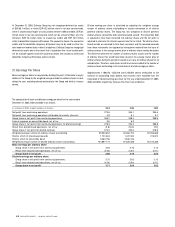

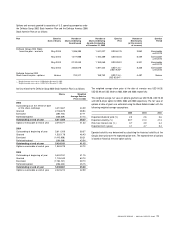

The following are the net deferred tax liabilities recognized by the Group

and the movements thereon:

(in millions of EUR)

Accelerated Closed Leases Pension Other Total

Tax Store

Depreciation Provision

Net deferred tax liabilities at January 1, 2003 603.7 (85.8) (99.2) (28.2) (77.7) 312.8

Charge (credit) to equity for the year - - - - (1.6) (1.6)

Charge (credit) to profit or loss for the year (39.8) (8.9) (8.9) 3.5 (3.2) (57.3)

Effect of change in tax rates 4.0 (0.6) (1.0) - 0.1 2.5

Divestiture (0.3) - - - - (0.3)

Transfers to other accounts - - - - 0.6 0.6

Translation effect (90.8) 15.5 17.4 2.6 15.7 (39.6)

Net deferred tax liabilities at December 31, 2003 476.8 (79.8) (91.7) (22.1) (66.1) 217.1

Charge (credit) to equity for the year - - - - 10.7 10.7

Charge (credit) to profit or loss for the year (33.0) 2.2 25.1 1.7 26.2 22.2

Effect of change in tax rates (4.0) 0.2 0.1 0.9 0.2 (2.6)

Acquisition - - - - (1.9) (1.9)

Transfers to other accounts 0.7 (1.2) 1.0 - 4.4 4.9

Translation effect (27.9) 5.6 4.3 0.6 2.1 (15.3)

Net deferred tax liabilities at December 31, 2004 412.6 (73.0) (61.2) (18.9) (24.4) 235.1

Charge (credit) to equity for the year - - - - 7.6 7.6

Charge (credit) to profit or loss for the year (46.9) 20.7 (6.6) 3.9 8.4 (20.5)

Effect of change in tax rates 2.1 (0.3) (0.4) - (0.3) 1.1

Acquisitions (1.3) - - - (0.9) (2.2)

Divestiture (0.1) - - - - (0.1)

Transfers to other accounts 2.0 - 0.8 - (4.3) (1.5)

Translation effect 53.8 (10.0) (9.6) (1.2) (4.5) 28.5

Net deferred tax liabilities at December 31, 2005 422.2 (62.6) (77.0) (16.2) (18.4) 248.0

DELHAIZE GROUP / ANNUAL REPORT 200 5 67