Food Lion 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

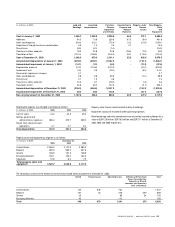

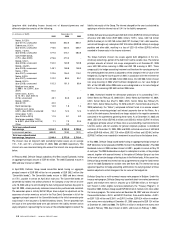

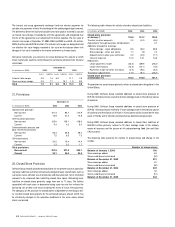

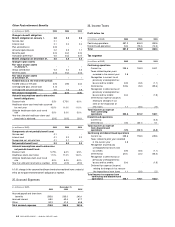

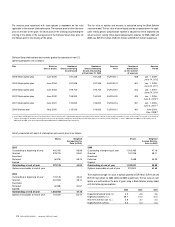

Expenses recorded in the income statement and charged to closed store provision

for 2005, 2004 and 2003 were as follows:

(in m illions of EUR) 2005 2004 2003

Other operating expenses 9.5 1.2 38.3

Interest expense included

in “ finance costs” 9.4 11.2 13.6

Results from discontinued operations 1.9 43.9 (0.1)

Total 20.8 56.3 51.8

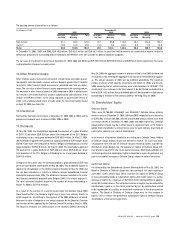

23. Self-Insurance Provision

Delhaize Group is self-insured for its operations in the U.S. for workers’ compen-

sation, general liability, vehicle accident and druggist claims. The self-insurance

liability is determined actuarially, based on claims filed and an estimate of claims

incurred but not yet reported. Maximum retention, including defense costs per

occurrence, is from USD 0.5 million to USD 1.0 million per accident for workers’

compensation, USD 5.0 million per accident for vehicle liability and USD 3.0 mil-

lion per accident for general liability, with an additional USD 2.0 million retention

in excess of the primary USD 3.0 million general liability retention for druggist

liability. We are insured for costs related to covered claims, including defense

costs, in excess of these retentions. The assumptions used in the development

of the actuarial estimates are grounded upon our historical claims data, including

the average monthly claims and the average lag time between incurrence and

payment. It is possible that the final resolution of some of these claims may

require us to make significant expenditures in excess of the existing reserves over

an extended period of time and in a range of amounts that cannot be reasonably

estimated.

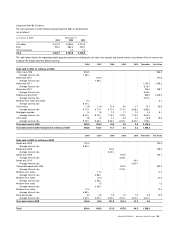

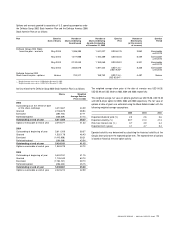

(in m illions of EUR) 2005 2004 2003

Self insurance provision

at January 1, 109.3 113.6 119.6

Expense charged to earnings 42.0 44.8 58.5

Claims paid (37.0) (40.8) (43.5)

Translation effect 16.7 (8.3) (21.0)

Self insurance provision

at December 31, 131.0 109.3 113.6

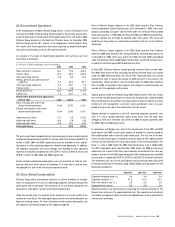

Delhaize America implemented a captive insurance program in 2001 whereby

the self-insured reserves related to workers’ compensation, general liability and

vehicle coverage were reinsured by The Pride Reinsurance Company (“Pride” ), an

Irish reinsurance captive wholly-owned by a subsidiary of Delhaize Group. The

purpose for implementing the captive insurance program was to provide Delhaize

America continuing flexibility in its risk program, while providing certain excess

loss protection through anticipated reinsurance contracts with Pride.

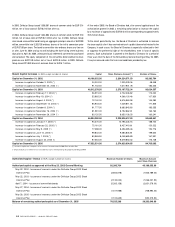

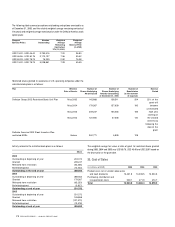

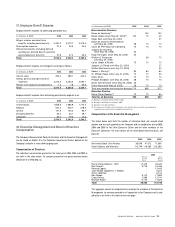

24. Benefit Plan Provision

Delhaize Group’s employees are covered by certain benefit plans, as described

below.

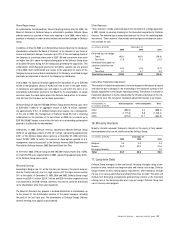

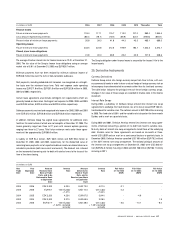

Defined Contribution Plans

In 2004, Delhaize Group adopted a defined contribution plan for substantially

all its employees in Belgium, under which the employer, and, from 2005 on, the

employees contribute a fixed monthly amount which is adapted annually accord-

ing to the Belgian consumer price index. Employees that were employed before

the adoption of the plan could opt not to participate in the personal contribution

part of the plan. The plan assures the employee a lump-sum at retirement, based

on contributions, with a minimum guaranteed return. The pension plan is insured

and is accounted for as a defined contribution plan. The expense related to the

plan was EUR 2.7 million in 2005 and EUR 2.7 million in 2004.

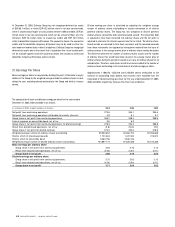

Delhaize America sponsors a profit-sharing retirement plan covering all employ-

ees at Food Lion and Kash n’ Karry with one or more years of service. Employees

become vested in any profit-sharing contributions made by their respective

employers after five years of consecutive service. Forfeitures of profit-sharing

contributions are used to offset plan expenses. Profit-sharing contributions to the

retirement plan are discretionary and determined by Delhaize America’s Board of

Directors. The profit-sharing plan includes a 401(k) feature that permits Food Lion

and Kash n’ Karry employees to make elective deferrals of their compensation and

allows Food Lion and Kash n’ Karry to make matching contributions. Hannaford

and Harveys also provide a defined contribution 401(k) plan including employer-

matching provisions to substantially all employees. The defined contribution

plans provide benefits to participants upon death, retirement or termination of

employment with Delhaize America. The expense related to the defined contribu-

tion retirement plans of Delhaize America was EUR 36.1 million, EUR 32.8 million

and EUR 42.2 in 2005, 2004 and 2003 respectively.

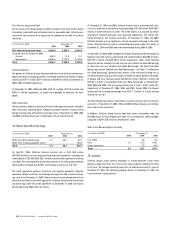

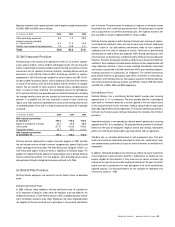

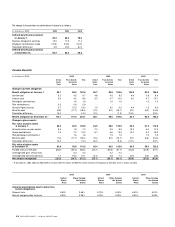

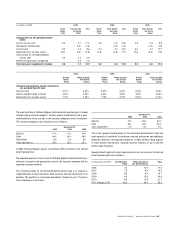

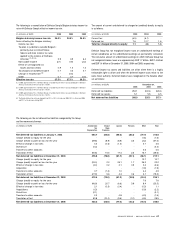

Defined Benefit Plans

Delhaize Belgium has a contributory defined benefit pension plan covering

approximately 5% of its employees. The plan provides benefits to participants

upon death or retirement based on a formula applied to the last annual salary

of the associate before his/her retirement. Delhaize Group funds the plan based

upon legal requirements and tax regulations. An insurance company guarantees a

minimum return on plan assets. Delhaize Group bears the risk above this minimum

guarantee.

Hannaford maintains a non-contributory defined benefit pension plan covering

approximately 50% of its employees. The plan provides for payment of retirement

benefits on the basis of employees’ length of service and earnings. Hannaford’s

policy is to fund the plan based upon legal requirements and tax regulations.

Alfa-Beta has an unfunded defined benefit post-employment plan. This plan

relates to termination indemnities prescribed by Greek law, consisting of lump-

sum compensations granted only in cases of normal retirement or termination of

employment.

In addition, Hannaford provides certain health care and life insurance benefits for

retired employees (“post-retirement benefits”). Substantially all employees may

become eligible for these benefits if they reach early or normal retirement age

and accrue ten years of service while working for Hannaford. The post-retirement

health care plan is contributory for most participants with retiree contributions

adjusted annually. Life insurance benefits are not available for employees who

retired after January 1, 1996.

DELHAIZE GROUP / ANNUAL REPORT 200 5 63