Food Lion 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

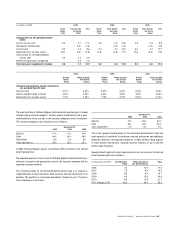

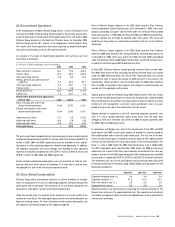

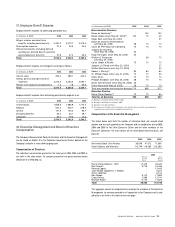

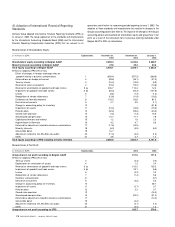

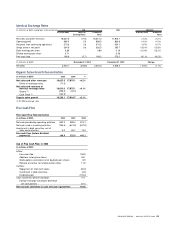

37. Net Foreign Exchange (Gains) Losses

The exchange differences (charged) credited to the income statement are as

follows:

(in m illions of EUR) 2005 2004 2003

Cost of sales 0.1 - (0.1)

Selling, general and administrative

expenses 0.2 (1.0) 0.7

Finance costs 3.3 (3.9) (6.1)

Income from investments 4.1 4.2 (1.5)

Result from discontinued operations (0.1) (0.1) -

Total 7.6 (0.8) (7.0)

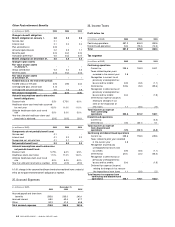

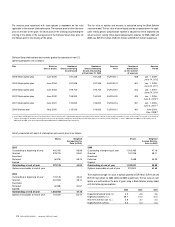

38. Supplemental Cash Flow Information

(in m illions of EUR) 2005 2004 2003

Non-cash investing and financing

activities:

Capitalized lease obligations incurred

for store properties and equipment 53.5 76.2 39.9

Capitalized lease obligations

terminated for store properties and

equipment 4.0 10.5 18.9

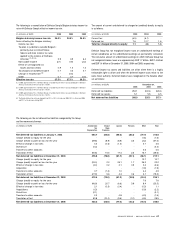

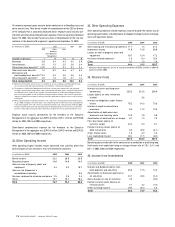

39. Hyperinflation

Until December 31, 2003, Romania was considered as a country with an hyper-

inflationary economy. Therefore, the 2003 financial statements of our Romanian

subsidiaries were restated for the changes in the general purchasing power of the

functional currency. The financial statements of the Romanian companies were

based on an historical approach.

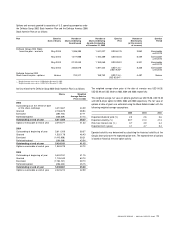

40. Related Party Transactions

In June 2004, Delhaize Group sold its interest of 70.0% in Super Dolphin, a non-

operating company of the Mega Image Group to the former executives of Super

Dolphin. In the same period, Delhaize Group also acquired most of the remaining

interests of the other companies related to its Romanian activities from the same

former executives (30.0% of Mega Image, 18.6% of M ega Dolphin, 13.2% of

Mega Doi, 30.0% of ATTM Consulting and Commercial and 30.0% of NP Lion

Leasing and Consulting). Delhaize Group paid an aggregate price of EUR 0.3 mil-

lion for all those transactions.

Several of the Group’s subsidiaries provide for post-employment benefit plans

for the benefit of employees of the Group. Payments made to these plans and

receivables from and payables to these plans are disclosed in Note 24.

41. Commitments

Capital expenditures contracted for at the balance sheet date but not yet incurred

as of December 31, 2005 amounted to EUR 28.5 million for property, plant and

equipment.

Commitments related to lease obligations are disclosed in Note 19.

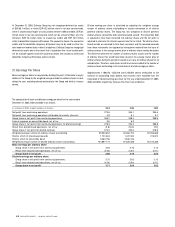

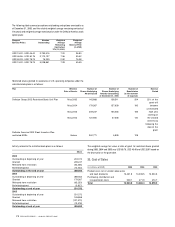

42. Contingencies

Delhaize Group is from time to time involved in legal actions in the ordinary

course of its business. Delhaize Group is not aware of any pending or threatened

litigation, arbitration or administrative proceedings the likely outcome of which

(individually or in the aggregate) it believes is likely to have a material adverse

effect on its business or financial statements. Any litigation, however, involves

risk and potentially significant litigation costs, and therefore Delhaize Group

cannot give any assurance that any litigation now existing or which may arise

in the future will not have a material adverse effect on its business or financial

statements.

We continue to experience tax audits in jurisdictions in which we do business,

which we consider to be part of our ongoing business activity. In particular, we

have experienced an increase in audit and assessment activity during both finan-

cial years 2004 and 2005 in the United States and Greece. Although some audits

have been settled in both the United States and Greece during 2005, Delhaize

Group expects continued audit activity in both of these juridictions in 2006. While

the ultimate outcome of these audits is not certain, we have considered the mer-

its of our filing positions in our overall evaluation of potential tax liabilities and

believe we have adequate liabilities recorded in our consolidated financial state-

ments for exposures on these matters. Based on our evaluation of the potential

tax liabilities and the merits of our filing positions, we also believe it is unlikely

that potential tax exposures over and above the amounts currently recorded as

liabilities in our consolidated financial statements will be material to our financial

condition or future results of operation.

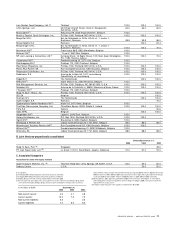

43. Subsequent Events

In February 2006, Delhaize Group reimbursed a 5.5% bonds in the amount of

EUR 150 million, using a combination of available cash, the proceeds from the

issuance of EUR 50 million medium-term notes in November 2005 (see Note 17)

and amounts borrowed under the existing credit facilities.

DELHAIZE GROUP / ANNUAL REPORT 200 5 75