Food Lion 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.needed for their originally intended purpose are reversed.

The value of owned property and equipment related to a closed store is

reduced to reflect the recoverable value based on the Group’s previous experi-

ence in disposing of similar assets and economic conditions at closing. The

resulting impairment loss is included in other operating expenses.

Inventory write-downs, if any, in connection with store closings are classified

in cost of sales or result from discontinued operations. Costs to transfer inven-

tory and equipment from closed stores are expensed as incurred.

• Self-insurance: The Group is self-insured for workers’ compensation, general

liability, automobile accident and druggist claims in the United States. The

self-insurance liability is determined actuarially, based on claims filed and an

estimate of claims incurred but not yet reported. Excess loss protection above

certain maximum exposures is provided by third party insurance companies.

Revenue Recognition

Sale of products to the Group’s retail customers is recognized at the point of sale.

Sales to wholesale customers are recognized upon delivery to the wholesale

customer. Discounts and incentives, including discounts from regular retail prices

for specific items and “buy one, get one free” incentives, are offered to customers

through loyalty card programs. Sales are recorded at the net amount received from

the customer. Funding from suppliers for these discounts, if available, is recognized

as a reduction of cost of sales at the time the related products are sold.

Cost of Sales

Purchases are recorded net of cash discounts and other supplier discounts and

allowances. Cost of sales includes all costs associated with getting product to the

back door of retail stores including buying, warehousing and transportation costs.

Supplier Allowances

Delhaize Group receives allowances and credits from suppliers primarily for in-

store promotions, co-operative advertising, new product introduction and volume

incentives. These allowances are included in cost of inventory and recognized

when the product is sold unless they represent reimbursement of a specific, iden-

tifiable cost incurred by the Group to sell the vendor’s product in which case they

are recorded as a reduction in selling, general and administrative expenses.

Income from new product introduction are allowances received to compensate for

costs incurred for product handling and are recognized over the product introduc-

tory period in cost of sales.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include store operating expenses,

administrative expenses and advertising expenses.

Employee Benefits

A defined benefit plan is a benefit plan that defines an amount of benefit that

an employee will receive on retirement, usually dependent on one or more fac-

tors such as age, years of service and compensation. The liability recognized in

the balance sheet for defined benefit plans is the present value of the defined

benefit obligation at the balance sheet date less the fair value of plan assets,

and adjustments for unrecognized actuarial gains or losses and past service costs.

The defined benefit obligation is calculated regularly by independent actuaries

using the projected unit credit method. The present value of the defined benefit

obligation is determined by discounting the estimated future cash outflows using

interest rates of high-quality corporate bonds that are denominated in the currency

in which the benefits will be paid and that have terms to maturity approximating

the terms of the related pension liability. Actuarial gains and losses that fall

outside the allowed corridor (i.e., 10% of the greater of the present value of the

defined benefit obligation or the fair value of plan assets) are amortized over the

expected average remaining working lives of employees participating in the plans.

Past service costs are recognized immediately in income unless the changes to the

plan are conditional on the employees remaining in service for a specified period

of time (the vesting period). In this case, the past service costs are amortized on a

straight-line basis over the vesting period. Pension expense is included in cost of

sales and in selling, general and administrative expenses.

A defined contribution plan is a pension plan under which the Group pays fixed

contributions usually to a separate entity. The Group has no legal or constructive

obligation to pay further contributions if the fund does not hold sufficient assets

to pay all employees the benefits relating to employee service in the current and

prior periods. The Group makes contributions to defined contribution plans on a

contractual and voluntary basis. The contributions are recognized as employee

benefit expense when they are due.

Termination benefits are payable when employment is terminated before the

normal retirement date or whenever an employee accepts voluntary termination

in exchange for benefits. The Group recognizes termination benefits when it is

demonstrably committed to terminating the employment of current employees

according to a detailed formal plan without possibility of withdrawal.

Share-Based Payments

The Group provides equity-settled share-based compensation plans. The fair value

of the employee services received in exchange for the grant of the share-based

awards is recognized as an expense. The fair value of the share-based awards is

calculated using the Black-Scholes valuation model. The resulting cost is charged

to the income statement over the vesting period of the share-based award.

Compensation expense is adjusted to reflect expected and actual levels of vesting.

Discontinued Operations

A discontinued operation is a component of a business that either has been

disposed of, or is classified as held for sale, and

• represents a separate major line of business or geographical area of opera-

tions;

• is part of a single co-coordinated plan to dispose of a separate major line of

business or geographical area of operations; or

• is a subsidiary acquired exclusively with a view to resale.

Delhaize Group has classified its businesses in Singapore, Thailand and Slovakia

in discontinued operations as well as the 34 Kash n’ Karry stores closed in the

first quarter of 2004, which were mainly located on the east coast of Florida and

in the Orlando market.

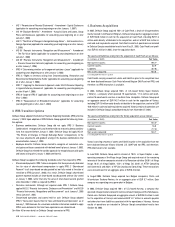

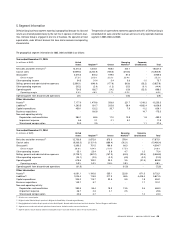

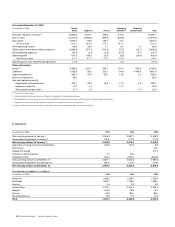

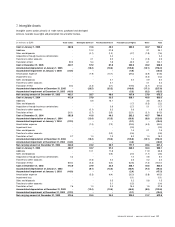

Segment Reporting

Delhaize Group’s primary segment reporting is geographical because its risks

and return are affected predominately by the fact that it operates in different

countries. Reportable segments include the United States, Belgium (including

Belgium, the Grand-Duchy of Luxembourg and Germany), Greece and Emerging

Markets. Emerging M arkets include the Group’s operations in the Czech Republic,

Romania and Indonesia and, until their divestiture, Thailand, Singapore and

Slovakia. Delhaize Group has only one business segment, the operation of retail

food supermarkets, which represents more than 92% of the Group’s consolidated

net sales and other revenues.

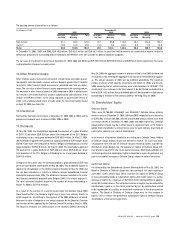

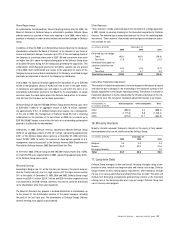

Standards and Interpretations Issued but not yet Effective

The Group did not early apply the following Standards and Interpretations which

were issued at the date of authorisation of these financial statements but not yet

effective on the balance sheet date, and anticipates that the adoption of these

Standards and Interpretations in future periods will have no material impact on

the financial statements of the Group in the period of initial application:

• IFRS 7 “ Financial Instruments: Disclosures” (applicable for accounting years

beginning on or after January 1, 2007)

DELHAIZE GROUP / ANNUAL REPORT 200 5 47