Food Lion 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 |Delhaize Group |Annual Report 2002

stock awards and stock options representing an aggregate number of

249,315 Delhaize Group shares were allocated to the members of the

Executive Committee in 2002.

Executives benefit from corporate pension plans which vary from

banner to banner, including a defined benefit group insurance system

for European based executives that is contributory and based on the

individual’s career length. U.S.-based executives also participate in

profit sharing plans as well as defined benefit plans.

Dividend Policy

It is the policy of Delhaize Group to pay out a dividend evolving in

line with underlying results while retaining free cash flow consistent

with opportunities to finance the future growth of the Company.

Shareholders‘ Structure

Belgian law requires that each shareholder or group of shareholders

owning more than 5% of the shares of a Belgian listed company file

a disclosure statement to such company and the Banking and Finance

Commission. On May 23, 2002, the Extraordinary General Meeting

of Shareholders approved a reduction of this threshold to 3%. This

action was taken in order to adapt the reporting requirement for the

increase in outstanding shares that resulted from the share exchange

with Delhaize America in 2001.

No shareholder or group of shareholders has declared ownership of

more than 3% of the capital of Delhaize Group as of December 31,

2002. Delhaize Group is not aware of the existence of agreements in

respect of voting the shares of the company between shareholders

who are descendants of the founders of the Company.

On December 31, 2002, the directors and members of the Executive

Committee of Delhaize Group owned as a group 1,339,280 ordinary

shares or ADRs of Delhaize Group, which represented approximate-

ly 1.4% of the total number of outstanding shares of Delhaize Group

as of that date. On December 31, 2002, the members of the Executive

Committee of Delhaize Group and the former Executive Committee

members serving at the Board of Directors owned as a group 828,695

stock options over an equal number of ordinary shares or ADRs of the

Company.

External Audit

The external audit of the Company and of the subsidiaries of Delhaize

Group is conducted by Deloitte & Touche, Registered Auditors, repre-

sented by James Fulton, until the General Meeting of 2005. On the

basis of the audit conducted by the Statutory Auditor in accordance

with the standards of the Belgian Institut des Reviseurs d’Entreprises

(Institute of Registered Auditors), the Statutory Auditor is required to

certify that the financial statements of the Company give a true and

fair view of the Company. The Board examines and discusses the

detailed annual report of the Statutory Auditor on both the consolidat-

ed accounts and the accounts of the parent company in his presence.

In 2002, the fees for the legally required audit activities for Delhaize

Group SA and its subsidiaries were EUR 1.4 million, including EUR

189,800 for the statutory audit of Delhaize Group SA. Deloitte &

Touche charged Delhaize Group SA and its subsidiaries EUR 2.3 mil-

lion for tax consulting, accounting consultation and other non-routine

audit services.

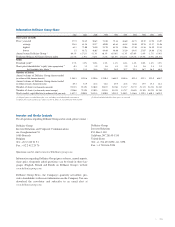

Fees Charged by Deloitte & Touche to Delhaize Group in 2002

(in EUR) 2002

Statutory audit Delhaize Group SA 189,800

Statutory audit Delhaize Group subsidiaries 1,059,200

Limited audit reviews in the course of the year 143,322

Subtotal legally required audits 1,392,322

Accounting consultation and other non-routine audit work 763,877

Tax consulting 1,498,243

Subtotal other services 2,262,120

Total 3,654,442

In 2002, Delhaize Group commissioned consulting services from

Deloitte Consulting, which is legally and operationally fully separate

from Deloitte & Touche Registered Auditors. In January 2003,

Deloitte Consulting was renamed Braxton.