Food Lion 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 |Delhaize Group |Annual Report 2002

ADDITIONAL INFORMATION

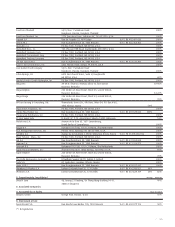

Reference Document for the Public Solicitation of Funds

On March 24, 2003, the Belgian Banking and Finance Commission

authorized Delhaize Group to use the present annual report as a ref-

erence document each time it solicits funds from the public in the

context of Title II of the Belgian Royal Decree n° 185 of July 9, 1935,

through the procedure of dissociated information, and this until pub-

lication of its next annual report.

In the context of this procedure, a transaction note needs to be attached

to the annual report. The annual report together with the transaction

note constitute the prospectus pursuant to the requirements of article

29 of the Belgian Royal Decree n° 185 of July 9, 1935.

In accordance with article 29ter, §1, par. 1 of the Belgian Royal

Decree of July 9, 1935, this prospectus must be submitted to the

Banking and Finance Commission for its approval.

Company Statute

Delhaize Brothers and Co. “The Lion” (Delhaize Group) SA is a

Belgian company incorporated in 1867 and converted into a limited

company on February 22, 1962.

Corporate Purpose

Article Two of the Articles of Association :

The corporate purpose of the Company is the trade of durable or non-

durable merchandise and commodities, of wine and spirits, the manu-

facture and sale of all articles of mass consumption, household arti-

cles, and others, as well as all service activities.

The Company may carry out in Belgium or abroad all industrial, com-

mercial, movable, real estate or financial transactions that favor or

expand directly or indirectly its industry and trade.

It may acquire an interest, by any means whatsoever, in all business-

es, corporations, or enterprises with an identical, similar or related cor-

porate purpose or which favor the development of its enterprise,

acquire raw materials for it, or facilitate the distribution of its products.

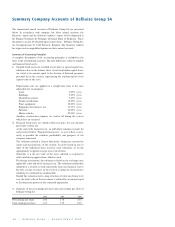

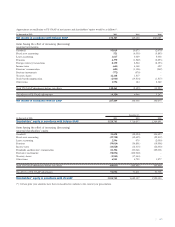

Appropriation of Available Profit for Fiscal Year 2002

The breakdown of the available profit of EUR 147.6 million of the

Company is as follows: EUR 65.7 million will be carried forward;

EUR 81.3 million represents the proposed dividend to shareholders; and

EUR 0.6 million represents the directors’ share of profit (see page 57).

Capital

As of December 31, 2002, Delhaize Group SA had capital of

EUR 46,196,352, represented by 92,392,704 shares with no nominal

value. At the end of 2001, the capital of Delhaize Group SA was

EUR 46,196,352, represented by 92,392,704 shares.

In 2002, the number of outstanding Delhaize Group shares, including

the treasury shares, remained stable at 92,392,704. The weighted

average number of Delhaize Group shares outstanding, excluding the

treasury shares, was 92,068,177 in 2002.

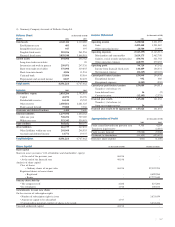

In April 2002, Delhaize Group's Board of Directors adopted the

Delhaize Group 2002 Stock Incentive Plan (the "2002 Incentive

Plan"), an incentive plan that is primarily targeted to the management

of Delhaize America and its subsidiaries. The 2002 Incentive Plan was

approved by Delhaize Group's shareholders at the May 2002 Annual

General Meeting. On May 22, 2002, the Board of Directors

issued

3,853,578 warrants to the beneficiaries of the newly adopted 2002

Incentive Plan, with 1,793,825 of those warrants representing newly

issued warrants and 2,059,753 of those warrants representing previ-

ously outstanding options transferred from Delhaize America's 2000

Stock Incentive Plan to the 2002 Incentive Plan. The 2002 Incentive

Plan replaced the Delhaize America Stock Incentive Plan and allowed

Delhaize Group to satisfy option exercises in a more cost effective

manner. Warrants issued under the 2002 Incentive Plan become exer-

cisable as determined by the Board of Directors or a committee of the

Board of Directors on the date of grant, provided that no warrant may

be exercised more than ten years after the date of grant. Warrants may

be either non-qualified stock options or incentive stock options. The

warrants issued in 2002 will be exercisable until 2012. As of

December 31, 2002, there were 3,719,254 warrants outstanding under

the 2002 Incentive Plan, 134,324 warrants having been forfeited.

In June 2002, the Delhaize Group Board of Directors launched a stock

option plan for its management employees of non-U.S. operating com-

panies. The Board of Directors authorized the offer of a maximum of

220,000 options to acquire 220,000 Delhaize Group ordinary shares

as incentive compensation to approximately 540 managers in

Belgium and other executives in non-U.S. operating companies of

Delhaize Group. The recipients of the options are able to exercise the

options from January 1, 2006 through June 5, 2009. The exercise

price of each option is EUR 54.30. As of August 3, 2002, the closing

date of the offer, 158,300 options to acquire Delhaize Group ordinary

shares were accepted. As of December 31, 2002, 155,300 options

were outstanding under this plan.

In June 2001, the Delhaize Group Board of Directors launched a

stock option plan for its management employees of non-U.S. operating

companies. The Board of Directors authorized the offer of a max-

imum of 150,000 options to acquire 150,000 Delhaize Group ordinary

shares as incentive compensation to approximately 480 managers in

Belgium and other executives in non-U.S. operating companies of

Delhaize Group. The recipients of the options are able to exercise the

options from January 1, 2005 through June 4, 2008. The exercise

price of each option is EUR 64.16. As of August 3, 2001, the closing

date of the offer, 134,900 options to acquire Delhaize Group ordinary

shares were accepted. As of December 31, 2002, 132,900 options

were outstanding under this plan.

In May 2000, the Delhaize Group Board of Directors authorized the

grant of warrants to subscribe to a maximum of 130,000 Delhaize

Group ordinary shares during various exercise periods between June

2004 and December 2006. Delhaize Group had issued 115,000 war-

rants entitling beneficiaries to subscribe to 115,000 ordinary shares.

As of December 31, 2002, 114,200 of these warrants were outstand-

ing at an exercise price of EUR 63.10 per warrant.

Prior to the adoption of the 2002 Incentive Plan, Delhaize America

sponsored a stock incentive plan under which options to purchase

Delhaize Group ADRs were primarily granted to officers and

employees. With the adoption of the 2002 Incentive Plan no further

options will be granted under Delhaize America's stock incentive

plan. As of December 31, 2002, there were outstanding options to

acquire 691,413 ADRs under this plan.