Food Lion 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

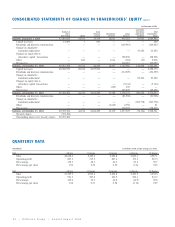

52 |Delhaize Group |Annual Report 2002

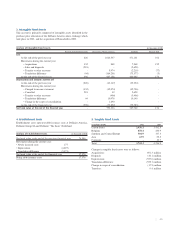

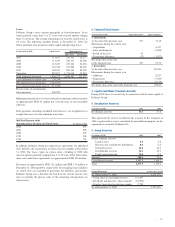

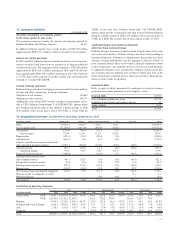

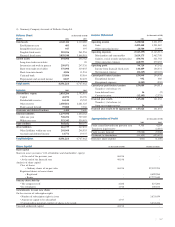

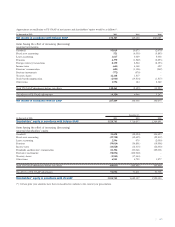

19. Organic Sales Growth Reconciliation

(in millions of EUR) 2002 2001 %

Sales 20,688.4 21,395.9 -3.3%

Effect of foreign exchange 866.8 --

Sales at identical exchange rates 21,555.2 21,395.9 +0.7%

Less Super Discount Markets -(278.8) -

Organic sales growth 21,555.2 21,117.1 +2.1%

20. Salaries

(in millions of EUR) 2002 2001

United States 2,116.2 2,228.9

Belgium 455.4 422.1

Southern and Central Europe 112.9 104.0

Asia 15.2 13.5

Corporate 12.6 14.5

Total 2,712.3 2,783.0

At identical exchange rates, salaries and social security of the Group

would have represented an amount of EUR 2,828.9 million, an increase

of 1.6%.

Average workforce 140,314

• Hourly paid workers 14,622

• Salaried staff 120,084

• Management personnel 5,608

(in thousands of EUR)

Employment costs 2,712,294

a) Salaries and other direct benefits 2,232,090

b) Employer’s social security contributions 245,912

c) Employer’s premiums for supplementary

insurance 163,568

d) Other personnel expenses 8,651

e) Pensions 62,073

An aggregate amount of EUR 10.2 million has been paid to the executive

directors of Delhaize Group for the financial year ended December 31,

2002, including an amount of EUR 7.1 million related to the senior ma-

nagement reorganization at Delhaize America. This amount is included in

the aggregate compensation of the members of the Executive Committee

as stated in the corporate governance section of this report on page 71.

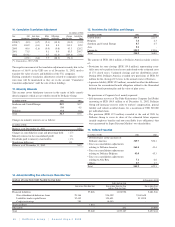

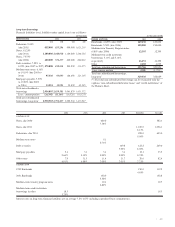

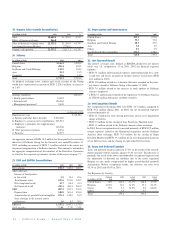

21. EBIT and EBITDA Reconciliation

(in millions of EUR) 2002 2001 2000

Net earnings 178.3 149.4 160.7

Add (substract) :

Interest of third parties

in the result 1.5 19.4 95.6

Total income taxes 159.6 191.8 145.7

Net exceptional result 12.7 96.4 41.3

Net financial result 455.1 464.3 296.2

EBIT 807.2 921.3 739.5

Depreciation 548.8 561.4 454.0

Amortization of goodwill and intangibles 176.2 158.0 51.5

Store closings in the normal course

of business 3.0 8.5 29.5

EBITDA 1,535.2 1,649.2 1,274.5

As % of sales 7.4% 7.7% 7.0%

22. Depreciation and Amortization

(in millions of EUR) 2002 2001

United States 459.1 475.6

Belgium 55.3 53.0

Southern and Central Europe 28.5 27.0

Asia 5.8 4.9

Others 0.1 0.9

Goodwill and other intangibles 176.2 158.0

Total 725.0 719.4

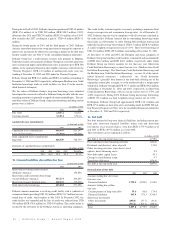

23. Net Financial Result

The interest coverage ratio, defined as EBITDA divided by net interest

result, was 3.8, compared to 3.8 in 2001. 2002 net financial expenses

includes :

• EUR 53.1 million other financial expenses representing bank fees, cred-

it card fees and losses incurred on foreign currency transactions (EUR

44.1 million in 2001)

• EUR 12.6 million related to a valuation allowance recorded on the treas-

ury shares owned by Delhaize Group at December 31, 2002

• EUR 7.6 million related to the exercise of stock options by Delhaize

America employees

• a EUR 5.1 million gain realized on the repurchase by Delhaize America

of USD 69 million debentures and debt securities

24. Net Exceptional Result

Net exceptional result during 2002 were EUR -12.7 million, compared to

EUR -96.4 million during 2001. In 2002, the net exceptional expenses

consisted primarily of :

• EUR 10.1 million for store closing provisions and an asset impairment

charge at Delvita

• EUR 2.5 million for the closing of four Food Lion Thailand stores

• EUR 1.1 million related to the Delhaize America share exchange

In 2001, the net exceptional result consisted primarily of EUR 42.2 million

merger expenses related to the Hannaford acquisition and the Delhaize

America share exchange, EUR 34.5 million for the closing of Super

Discount Markets and EUR 19.1 million for an asset impairment charge on

seven Delvita stores and the closing of eight other Delvita stores.

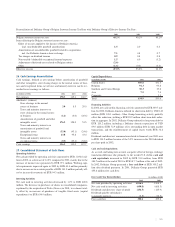

25. Taxes and Deferred Taxation

Taxes and deferred taxation represent 47.0% of the profit of the consoli-

dated companies before taxation, against 53.2% last year. This decrease is

primarily the result of the lower non-deductible exceptional expenses and

the adjustment of deferred tax liabilities due to the newly legislated

Belgian tax rate, partly compensated by higher non-deductible goodwill

amortization. Before exceptional results, the effective tax rates were

45.3% in 2002 and 45.6% in 2001.

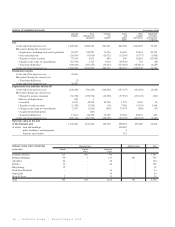

Tax Expenses by Country:

Statutory 2002 Actual 2001 Actual

(in millions of EUR) Rate Rate Rate

United States 38% 143.0 41.3% 168.8 47.3%

Belgium 40.2% 10.1 16.6% 15.3 23.4%

Greece 35% 5.1 78.2% 5.0 86.8%

Others - 1.4 - 2.7 -

Total - 159.6 - 191.8 -