Food Lion 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|51

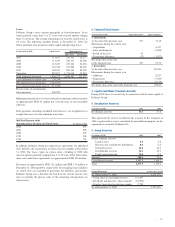

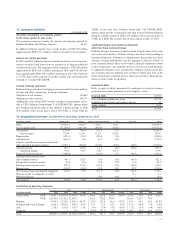

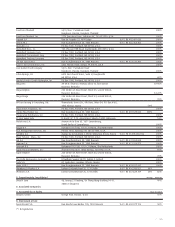

17. Contingent Liabilities

(in thousands of EUR)

Guarantees constituted or irrevocably granted

by the Group against its own assets

The guarantees represent mainly the amount of mortgages granted by

Delhaize Belgium and Delhaize America: 68,533

In addition, Delhaize America has a credit facility of USD 350 million

(approximately EUR 333.7 million), which is secured by its inventories.

Interest rate related operations

In 2001 and 2002, Delhaize America entered into interest rate swap agree-

ments to swap the fixed interest rate on a portion of its long-term debt for

variable interest rates. The aggregate notional amount is USD 300 million

(approximately EUR 286.1 million) maturing in 2006 and USD 200 mil-

lion (approximately EUR 190.7 million) maturing in 2011. The fixed rate

is 7.375% and 8.125% respectively and the variable rates are based on the

6 month or 3 month USD LIBOR.

Forward exchange agreement

Delhaize Group entered into hedging agreements related to loans and bor-

rowings and other engagements in foreign currencies.

Obligation to sell currency: 110,669

Obligation to buy currency: 109,377

Additionally, at the end of 2002, in order to hedge an intercompany receiv-

able in USD, Delhaize Group bought “Call EUR/Put USD” options which

give Delhaize Group the right to sell USD for a global amount of USD

114.8 million, with exercise prices from 1.0376 USD to 1.0422 USD for

1EUR. At the same time, Delhaize Group sold “Call USD/Put EUR”

options which give the counterparties the right to buy USD from Delhaize

group for a global amount of USD 114.8 million, with an exercise price of

1 USD for 1 EUR. The exercise date of these options is May 23, 2003.

Significant litigation and significant obligations

other than those mentioned above

Delhaize Group is from time to time involved in legal actions in the ordi-

nary course of its business. Delhaize Group is not aware of any pending or

threatened litigation, arbitration or administrative proceedings the likely

outcome of which (individually or in the aggregate) it believes is likely to

have a material adverse effect on its business, financial condition or future

results of operations. Any litigation, however, involves risk and potential-

ly significant litigation costs, and therefore Delhaize Group cannot give

any assurance that any litigation now existing or which may arise in the

future will not have a material adverse effect on its business, financial con-

dition or future results of operations.

Guaranteed debts

Debts (or parts of debts) guaranteed by mortgages or securities charges

granted or irrevocably promised on the Company’s assets

Financial debts 60,592

Non-subordinated debenture loans 60,578

Liabilities under leasing and similar contracts 14

Trade creditors 1,814

Total 62,406

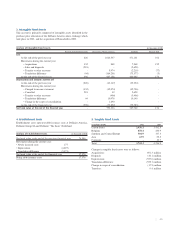

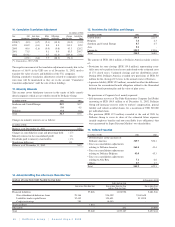

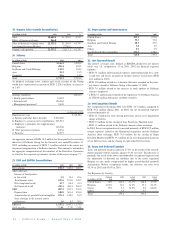

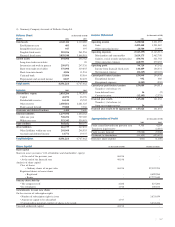

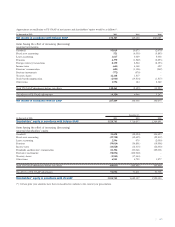

18. Geographical Overview: Contribution of Operating Companies in 2002

(in millions of EUR) United States Belgium Southern and Central Europe Asia Corporate Total

Sales 15,883.7 3,420.3 1,166.3 218.1 - 20,688.4

Cost of goods sold (11,505.7) (2,671.9) (955.0) (190.6) - (15,323.2)

Gross profit 4,378.0 748.4 211.3 27.5 - 5,365.2

Gross margin 27.6% 21.9% 18.1% 12.6% - 25.9%

Depreciation (459.1) (55.3) (28.6) (5.8) - (548.8)

Amortization (166.7) (2.6) (6.1) (0.8) - (176.2)

Salaries, miscellaneous goods and services,

other operating income/(expense) (3,053.1) (568.0) (162.5) (25.4) (24.0) (3,833.0)

Operating profit 699.1 122.5 14.1 (4.5) (24.0) 807.2

Operating margin 4.4% 3.6% 1.2% -2.1% 3.9%

Financial income/(expense) (399.0) - (16.5) 0.7 (40.3) (455.1)

Earnings before income taxes

and exceptional items 300.1 122.5 (2.4) (3.8) (64.3) 352.1

Exceptional income/(expense) (0.4) (0.6) (7.9) (2.7) (1.1) (12.7)

Earnings before income taxes 299.7 121.9 (10.3) (6.5) (65.4) 339.4

Income taxes (144.9) (30.0) (5.8) (0.1) 21.2 (159.6)

Net earnings from consolidated companies 154.8 91.9 (16.1) (6.6) (44.2) 179.8

Share in results of companies at equity - - - - 0.1 0.1

Minority interests - - (1.0) (0.6) - (1.6)

Net earnings 154.8 91.9 (17.1) (7.2) (44.1) 178.3

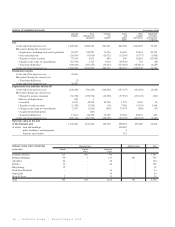

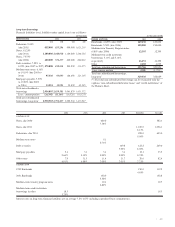

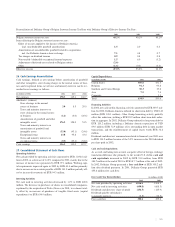

Contribution of Operating Companies

Sales Operating Profit Net Earnings

(in millions of EUR) 2002 2001 2000 %2002 2002 2001 2000 %2002 2002 2001 2000 %2002

United States EUR 15,883.7 16,905.0 14,069.5 76.8% 699.1 810.8 635.2 86.6% 154.8 137.0 84.9 86.8%

USD 15,019.6 15,140.2 12,967.3 661.1 726.2 585.5 146.4 122.7 78.4

Belgium 3,420.3 3,212.9 2,983.5 16.5% 122.5 121.5 88.4 15.2% 91.9 85.3 62.4 51.5%

Southern and Central Europe 1,166.3 1,091.0 959.4 5.6% 14.1 13.5 23.3 1.8% (17.1) (30.0) 4.0 -9.6%

Asia 218.1 187.0 155.3 1.1% (4.5) (3.4) (5.7) -0.6% (7.2) (4.3) (5.4) -4.0%

Corporate - - 0.5 - (24.0) (21.1) (1.7) -3.0% (44.1) (38.6) 14.8 -24.7%

Total 20,688.4 21,395.9 18,168.2 100.0% 807.2 921.3 739.5 100.0% 178.3 149.4 160.7 100.0%