Food Lion 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|47

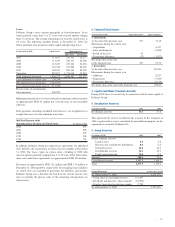

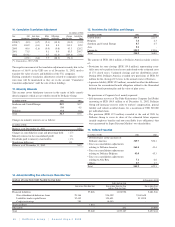

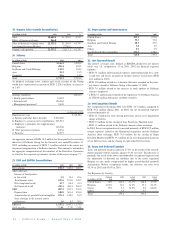

Leases

Delhaize Group’s stores operate principally in leased premises. Lease

terms generally range from 3 to 27 years with renewal options ranging

from 3 to 20 years. The average remaining lease term for closed stores is

6.9 years. The following schedule details, at December 31, 2002, the

future minimum lease payments under capital and operating leases:

(in thousands of EUR) Capital Leases Operating Leases

Open Stores Closed Stores

2003 113,831 238,392 26,217

2004 113,439 232,391 25,028

2005 112,047 227,240 23,854

2006 110,745 217,228 22,603

2007 109,109 208,168 20,792

Thereafter 889,201 1,735,048 93,083

Total minimum payments 1,448,372 2,858,467 211,577

Less estimated executory costs (36,354)

Net minimum lease payments 1,412,018

Less amount representing interest (713,059)

Present value of net minimum

lease payments 698,959

Minimum payments have not been reduced by minimum sublease income

of approximately EUR 47 million due over the term of non-cancelable

subleases.

Rent payments, including scheduled rent increases, are recognized on a

straight-line basis over the minimum lease term.

Total Rent Expense under

Operating Leases for Open and Closed Stores

(in millions of EUR)

2002 291

2001 298

2000 257

1999 203

1998 191

In addition, Delhaize Group has signed lease agreements for additional

store facilities, the construction of which was not complete at December

31, 2002. The leases expire on various dates extending to 2030 with

renewal options generally ranging from 3 to 20 years. Total future mini-

mum rents under these agreements are approximately EUR 156 million.

Provisions of approximately EUR 122 million and EUR 176 million at

December 31, 2002 and 2001, respectively, for remaining lease liabilities

on closed stores are included in provisions for liabilities and charges.

Delhaize Group uses a discount rate based on the current treasury note

rates to calculate the present value of the remaining rent payments on

closed stores.

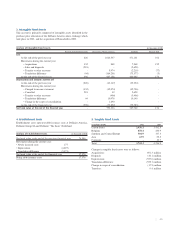

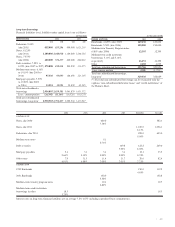

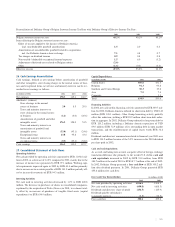

6. Financial Fixed Assets

(in thousands of EUR) Equity Investments Other Companies

1. Investments

At the end of the previous year 531 7,115

Movements during the current year:

• Acquisitions - 6,357

• Sales and disposals - (3,269)

• Result of the year 43 -

• Translation difference (17) (1,027)

Net book value at the end

of the financial year 557 9,176

2. Receivables

At the end of the previous year 26,769

Movements during the current year:

• Additions 8,227

• Repayments (7,043)

• Translation difference (2,119)

Net book value at the end of the financial year 25,834

7. Capital and Share Premium Account

During 2002, there was no activity in connection with the share capital of

Delhaize Group.

8. Revaluation Reserves

(in millions of EUR) 2002 2001

Revaluation reserves 15.1 17.8

This represents the reserve recorded in the accounts of the Company in

1981, together with a reserve calculated for consolidation purposes on the

supermarkets owned by Delimmo SA.

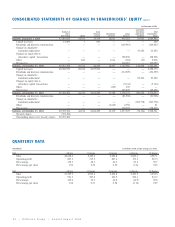

9. Group Reserves

(in millions of EUR) 2002 2001

Parent company reserves :

Legal reserve 4.6 4.6

Reserves not available for distribution 0.4 0.4

Untaxed reserves 44.0 44.0

Distributable reserves 16.1 15.7

Profit carried forward 75.0 9.3

Subtotal 140.1 74.0

Consolidated reserves 1,137.2 1,104.2

Total 1,277.3 1,178.2

Group Reserves (in thousands of EUR)

As of December 31, 2001 1,178,174

• Group share in consolidated results 178,307

• Dividends and directors’ share of profit (81,906)

• Transfer from taxed revaluation surplus 2,750

As of December 31, 2002 1,277,325