Food Lion 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

|71

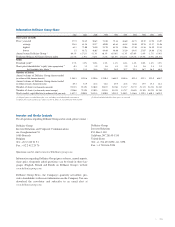

For fiscal year 2002, the Board of Directors of Delhaize Group will

propose at the annual shareholders meeting of May 22, 2003 that the

aggregate directors’ share of profit be fixed at EUR 600,683. The direc-

tors have voluntarily decided to propose a decrease of their individual

director fee by 38.9% compared to 2001. Directors who serve as exec-

utives are compensated for their service as executives. An aggregate

amount of EUR 135,462 is paid for fiscal year 2002 by subsidiaries of

Delhaize Group to Delhaize Group directors who serve on the board of

wholly owned subsidiaries. No other remuneration or advantage in

their capacity of Board member is associated with the directors’

appointments. No loans or guarantees have been extended by Delhaize

Group to members of the Board or the Executive Committee.

At the May 23, 2002 General Shareholders’ Meeting, Raymond-Max

Boon retired from the Board after serving on it for 34 years. In grati-

tude for his dedication and contribution to Delhaize Group, he was

granted the title of Honorary Director. At the same meeting, Count

Arnoud de Pret Roose de Calesberg was elected Director for a three-

year term. In June 2002, Director Marcel Degroof resigned from the

Board of Directors after serving 17 years as a member.

Committees of the Board

After the General Shareholders’ Meeting on May 23, 2001, Audit,

Governance and Compensation Committees were established by the

Board of Directors.

Audit Committee

The Audit Committee, which is composed solely of non-executive

directors, assists the Board of Directors in fulfilling its responsibili-

ties relating to accounting and reporting practices. Specifically, the

Audit Committee assists the Board of Directors in its oversight respon-

sibility by reviewing financial information provided by Delhaize

Group to shareholders and others and by reviewing Delhaize Group’s

auditing, accounting and financial processes generally. The Audit

Committee reviews, with the assistance of the Statutory Auditor and

the internal audit department, Delhaize Group’s financial reporting

procedures and internal financial control systems. The Audit

Committee also reviews the activities and independence of the

Statutory Auditor and the internal audit department. In 2002, the

Audit Committee met seven times.

Governance Committee

The Governance Committee submits proposals to the Board of

Directors regarding new directors to be nominated for election, or

appointed in the case of a vacancy. The Governance Committee eval-

uates the qualifications of any new director nominee with respect to

the needs of the Board of Directors. The Governance Committee

reviews the size, structure and organization of the Board and its

Committees and evaluates the performance and effectiveness of the

Board and each of its members. The Governance Committee oversees

planning for the succession of the Chief Executive Officer, evaluates

his or her performance and recommends to the Board the selection or

replacement, if necessary, of the Chief Executive Officer. The

Governance Committee met two times in 2002.

Compensation Committee

The Compensation Committee reviews, analyzes and makes recom-

mendations to the Board of Directors concerning the compensation

for Delhaize Group’s executive directors and executive officers. The

Compensation Committee also reviews general compensation policy,

any stock option or other profit-sharing programs for the associates of

the Company and other compensation issues. In 2002, the

Compensation Committee met five times.

General Meeting of Shareholders

The General Meeting of Shareholders of Delhaize Group is held at

least once a year, called by the Board of Directors. The notice of the

meeting mentions the items on the agenda and complies with the form

and timing requirements of Belgian law. Among the items included in

the agenda given in the notice of the annual General Meeting are

consideration of the Directors’ report and Auditors’ report, as well as

consideration of the annual accounts. The future prospects for the

Company are presented by the Chairman and the Chief Executive

Officer at the General Meeting.

Executive Committee

The Chief Executive Officer is in charge of the day-to-day manage-

ment of the Company with the assistance of the Executive

Committee. The Executive Committee, chaired by the Chief

Executive Officer, prepares the strategy proposals for the Board of

Directors, oversees the operational activities and analyzes the busi-

ness performance of the Company. In 2002, the Office of the CEO

merged into the Executive Committee.

The Chief Executive Officer, the Secretary of the Board and the mem-

bers of the Executive Committee are appointed by the Board of

Directors. The non-executive Board members decide, based on the

recommendations by the Compensation Committee, on the compen-

sation of the members of the Executive Committee.

Acommon philosophy and methodology increasingly drives the

executives’ remuneration program design throughout all regions

while the appropriate remuneration levels are determined on the basis

of relevant regional and local standards. Compensation consists of

fixed and variable elements and is linked to the performance of

Delhaize Group. Like a very large segment of management, the exec-

utives also benefit from stock option plans.

For the year ended December 31, 2002, the aggregate amount of base

salary, bonus payments and other direct cash compensation attributed

by Delhaize Group and its subsidiaries to the members of the

Executive Committee as a group for services in all executive capacities

was EUR 17.0 million. Excluding the cost related to the management

change at Delhaize America (see page 67), the aggregate amount of

compensation was EUR 8.9 million, including 68% aggregate base pay

and 32% variable compensation, compared to EUR 6.7 million in

2001, the increase being due to the appointment of two new members

in 2002 and the recording of a full-year compensation of one member

in 2002 compared to the recording of four months in 2001. Restricted