First Data 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

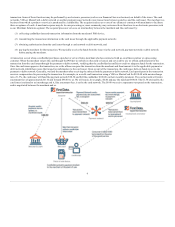

We and our alliances, as merchant acquirers/processors, have certain contingent liabilities for the transactions acquired from merchants. This contingent

liability arises in the event of a billing dispute between the merchant and a cardholder that is ultimately resolved in the cardholder’s favor. In such a case, the

transaction is “charged back” to the merchant and the disputed amount is credited or otherwise refunded to the cardholder. We may, however, collect this

amount from the card network if the amount was disputed in error. If we or the alliance is unable to collect this amount from the merchant, due to the

merchant’s insolvency or other reasons, we or the alliance will bear the loss for the amount of the refund paid to the cardholder. In most cases, this contingent

liability situation is unlikely to arise because most products or services are delivered when purchased, and credits are issued on returned items. However,

where the product or service is not provided until sometime following the purchase (e.g., airline or cruise ship tickets), the risk is greater. We often mitigate

our risk by obtaining collateral from merchants that are considered higher risk because they have a time delay in the delivery of services, operate in industries

that experience chargebacks or are less creditworthy.

Prepaid services First Data Prepaid Services manages prepaid stored-value card issuance and processing services (i.e. gift cards) for retailers and others. The

full-service stored-value/gift card program offers transaction processing services, card issuance, and customer service for over 200 national brands and several

thousand small and mid-tier merchants. We also provide program management and processing services for association-branded, bank-issued, open loop (a

card that can be used at multiple merchants), stored-value, reloadable, and one time prepaid card products. Revenues are generated from a variety of sources

including processing fees for transactions processed and fees for card production and shipments.

Money Network offers prepaid products to address the needs of employers, employees, merchants, and unbanked individuals. Money Network provides open

loop electronic payroll distribution solutions that reduce or eliminate an employer’s expense associated with traditional paper paychecks as well as other

prepaid retail solutions. Revenues are generated from a variety of sources including network interchange revenue from use of cards and certain cardholder

transaction fees.

Check verification, settlement, and guarantee services TeleCheck offers check verification, settlement, and guarantee services using our proprietary database

system to assist merchants in deciding whether accepting checks at the POS is a reasonable risk, or, further, to guarantee checks presented to merchants if they

are approved. These services include risk management services, which utilize software, information, and analysis to assist the merchant in the decision

process and include identity fraud prevention and reduction. Revenues are earned by charging merchant fees for check verification or guarantee services.

The majority of our services involve providing check guarantee services for checks received by merchants. Under the guarantee service, when a merchant

receives a check as payment for goods and services, the transaction is submitted to and analyzed by us. We either accept or decline the check for warranty

coverage under our guarantee service. If we approve the check for warranty coverage and the merchant accepts the check, the merchant will either deposit the

check in its bank account or process it for settlement through our Electronic Check Acceptance service. If the check is returned unpaid by the merchant’s

bank and the returned check meets the requirements for warranty coverage, we are required to purchase the check from the merchant at its face value. We then

own the purchased check and pursue collection of the check from the check writer. As a result, we bear the risk of loss if we are unable to collect the returned

check from the check writer. We earn a fee for each check we guarantee, which generally is determined as a percentage of the check amount.

Electronic Check Acceptance service converts a paper check written at the POS into an electronic item and enables funds to be deposited electronically to the

merchant’s account and deducted electronically from the check writer’s account.

Under the verification service, when a merchant receives a check in payment for goods or services, the transaction is submitted to and analyzed by us. We will

either recommend the merchant accept or decline the check. If the merchant accepts the check, the merchant will deposit the check in its bank account. If the

check is returned unpaid by the merchant’s bank, we are not required to purchase the check from the merchant and the merchant bears all risk of loss on the

check. We earn a fee for each check submitted for verification, which is generally a fixed amount per check.

Our Merchant Solutions business competes with several third-party processors and financial institutions that

provide these services to their merchant customers in the U.S. In many cases, our merchant alliances also compete against each other for the same business.

The check guarantee and verification products compete principally with the products of one other national competitor as well as the migration to other non-

check products.

The most significant competitive factors relate to price, brand, strength of financial institution partnership, breadth of features and functionality, scalability,

and servicing capability. The Merchant Solutions segment is further impacted by large merchant and large bank consolidation, card network business model

expansion, and the creation of new payment methods and devices.

7