First Data 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain of our borrowings, including borrowings under our senior secured credit facilities to the extent the interest rate is not fixed by an interest rate swap,

are at variable rates of interest. An increase in interest rates would have a negative impact on our results of operations by causing an increase in interest

expense.

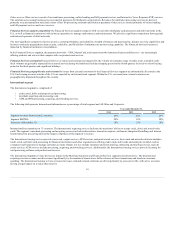

As of December 31, 2014, we had $8.6 billion aggregate principal amount of variable rate long-term indebtedness, of which interest rate swaps fix the interest

rate on $5.0 billion in notional amount. We also had a $750 million fixed to floating swap to preserve the ratio of fixed and floating rate debt that we had

prior to the April 2011 debt modification and amendment. As a result, as of December 31, 2014, the impact of a 100 basis point increase in interest rates

would increase our annual interest expense by approximately $44 million. See the discussion of our interest rate swap transactions in Note 5 "Derivative

Financial Instruments" to our Consolidated Financial Statements in Part II, Item 8 of this Form 10-K.

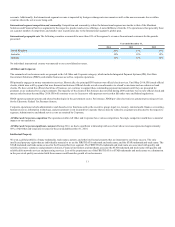

Our balance sheet includes goodwill and intangible assets that represent approximately 60% of our total assets at December 31, 2014. These assets consist

primarily of goodwill and customer relationship intangible assets associated with our acquisitions. We also expect to engage in additional acquisitions,

which may result in our recognition of additional goodwill and intangible assets. Under current accounting standards, we are required to amortize certain

intangible assets over the useful life of the asset, while goodwill and certain other intangible assets are not amortized. On a regular basis we assess whether

there have been impairments in the carrying value of goodwill and certain intangible assets. If the carrying value of the asset is determined to be impaired,

then it is written down to fair value by a charge to operating earnings. An impairment of a significant portion of goodwill or intangible assets could have a

material adverse effect on our business, financial condition, and results of operations.

Our tax returns and positions are subject to review and audit by federal, state, local, and international taxing authorities. An unfavorable outcome to a tax

audit could result in higher tax expense, thereby negatively impacting our results of operations. We have established contingency reserves for material,

known tax exposures relating to deductions, transactions, and other matters involving some uncertainty as to the proper tax treatment of the item. These

reserves reflect what we believe to be reasonable assumptions as to the likely final resolution of each issue if raised by a taxing authority. While we believe

that the reserves are adequate to cover reasonably expected tax risks, there is no assurance that, in all instances, an issue raised by a tax authority will be

finally resolved at a financial cost not in excess of any related reserve. An unfavorable resolution, therefore, could negatively impact our effective tax rate,

financial position, results of operations, and cash flows in the current and/or future periods. Refer to Note 15 "Income Taxes" to our Consolidated Financial

Statements included in Part II, Item 8 of this Form 10-K for more information.

We are currently a voluntary filer and not subject to the periodic reporting requirements of the SEC. While we are required to provide certain information,

including financial information, about our company to holders of our indebtedness pursuant to the agreements governing such indebtedness and our parent

company is required to provide certain information to its shareholders, we may discontinue filing periodic reports with the SEC at any time. As a voluntary

filer, our periodic reports will be subject to less oversight and regulatory scrutiny than those subject to the periodic reporting requirements of the SEC. In

addition, even if we file a registration statement that is declared effective during the year and we become subject to the periodic reporting requirements of the

SEC, any of our periodic reporting responsibilities will automatically terminate in the event that we have less than 300 shareholders after the year in which

any registration statement that we file with the SEC becomes effective.

We, and our customers, are subject to laws and regulations that affect the electronic payments industry in the many countries in which our services are used.

In particular, our customers are subject to numerous laws and regulations applicable to banks, financial institutions and card issuers in the United States and

abroad, and, consequently, we are at times affected by these

20