First Data 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

unauthorized entry, power loss, telecommunications failure, computer viruses, terrorist acts, and war. Although we have taken steps to protect against data

loss and system failures, there is still risk that we may lose critical data or experience system failures. We perform the vast majority of disaster recovery

operations ourselves, though we utilize select third parties for some aspects of recovery, particularly internationally. To the extent we outsource our disaster

recovery, we are at risk of the vendor’s unresponsiveness in the event of breakdowns in our systems. In addition, our property and business interruption

insurance may not be adequate to compensate us for all losses or failures that may occur.

Our products are based on sophisticated software and computing systems that often encounter development delays, and the underlying software may contain

undetected errors, viruses or defects. Defects in our software products and errors or delays in our processing of electronic transactions could result in

additional development costs, diversion of technical and other resources from our other development efforts, loss of credibility with current or potential

customers, harm to our reputation, or exposure to liability claims. In addition, we rely on technologies supplied to us by third parties that may also contain

undetected errors, viruses or defects that could have a material adverse effect on our business, financial condition and results of operations. Although we

attempt to limit our potential liability for warranty claims through disclaimers in our software documentation and limitation-of-liability provisions in our

license and customer agreements, we cannot assure that these measures will be successful in limiting our liability.

We have experienced the negative impact of the substantial bank industry consolidation in recent years. Bank industry consolidation impacts existing and

potential clients in our service areas, primarily in Financial Services and Merchant Solutions. Our alliance strategy could be negatively impacted as a result

of consolidations, especially where the banks involved are committed to their internal merchant processing businesses that compete with us. Bank

consolidation has led to an increasingly concentrated client base, resulting in a changing client mix for Financial Services as well as increased price

compression. Further consolidation in the bank industry or other client base could have a negative impact on us, including a loss of revenue and price

compression.

We have been an active business acquirer and may continue to be active in the future. The acquisition and integration of businesses involves a number of

risks. The core risks are in the areas of valuation (negotiating a fair price for the business) and integration (managing the complex process of integrating the

acquired company’s people, products, technology, and other assets to realize the projected value of the acquired company and the synergies projected to be

realized in connection with the acquisition).

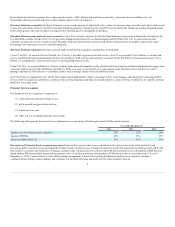

In addition, international acquisitions often involve additional or increased risks including, for example:

• managing geographically separated organizations, systems and facilities;

• integrating personnel with diverse business backgrounds and organizational cultures;

• complying with foreign regulatory requirements;

• fluctuations in currency exchange rates;

• enforcement of intellectual property rights in some foreign countries;

• difficulty entering new foreign markets due to, among other things, customer acceptance and business knowledge of these new markets; and

• general economic and political conditions.

The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of one or more of our combined businesses and

the possible loss of key personnel. The diversion of management’s attention and any delays or difficulties encountered in connection with acquisitions and

the integration of the two companies’ operations could have an adverse effect on our business, results of operations, financial condition or prospects.

18