First Data 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

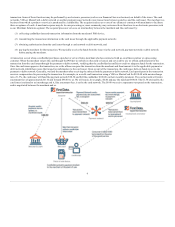

We are subject to rules of MasterCard, Visa, INTERAC, PULSE, and other payment networks. In order to provide processing

services, a number of our subsidiaries are registered with Visa and/or MasterCard as service providers for member institutions. Various subsidiaries of ours are

also processor level members of numerous debit and electronic benefits transaction (EBT) networks or are otherwise subject to various network rules in

connection with processing services and other services we provide. As such, we are subject to applicable card association, network, and national scheme rules

that could subject us to fines or penalties. We are also subject to network operating rules promulgated by the National Automated Clearing House

Association (NACHA) relating to payment transactions processed by us using the Automated Clearing House (ACH) Network and to various state and Federal

laws regarding such operations, including laws pertaining to EBT.

Cashcard Australia Limited (Cashcard) is a member of the Australian Consumer Electronic Clearing System (CECS), which is a debit payment system

regulated by network operating rules established and administered by Australian Payments Clearing Association Limited, and is a member of the ATM

Access Australia Limited and the eftpos® Access Australia Limited that respectively administers reciprocal access and interchange arrangements for ATMs

and Electronic Funds Transfer at Point of Sale (eftpos®) in Australia. The network operating rules, ATM Access Code and eftpos® Access Code impose a

variety of sanctions, including suspension or termination of membership and fines for non-compliance. Cashcard also operates its own network of members,

regulated by rules promulgated by Cashcard. To enable Cashcard to settle in CECS direct with banks and financial institutions, Cashcard maintains an

Exchange Settlement Account (ESA) which is supervised by the Reserve Bank of Australia (RBA), and that requires Cashcard to adhere to conditions

imposed by RBA.

Our subsidiary in Germany, TeleCash GmbH & Co. KG, is certified and regulated as a processor for domestic German debit card transactions by the Deutsche

Kreditwirtschaft (DK), the German banking association. Failure to comply with the technical requirements set forth by the DK may result in suspension or

termination of services.

Because a number of our subsidiary businesses provide data processing services for financial institutions, we are subject to examination

by the Federal Financial Institutions Examination Council (FFIEC). The FFIEC examines large data processors in order to identify and mitigate risks

associated with significant service providers.

FDR Limited (FDRL) in the United Kingdom is authorized and regulated by the Financial Conduct Authority (FCA), the regulatory authority for the full

range of financial services in the United Kingdom. FDRL is authorized by the FCA to carry on an insurance mediation business for the purpose of arranging

insurance to its issuer customers’ cardholders and is required to meet certain prudential and conduct of business requirements.

As a result of the implementation of the Payment Services Directive 2007/60 EC in the European Union, a number of our subsidiaries in the International

segment hold Payment Institution Licenses in the countries where such subsidiaries do business. As Payment Institutions, we are subject to regulation and

oversight in the applicable member state, which includes amongst other things, the requirement to maintain specified regulatory capital.

First Data Trust Company, LLC (FDTC) engages in trust activities previously conducted by the trust department of a former banking subsidiary of ours and is

subject to regulation, examination, and oversight by the Division of Banking of the Colorado Department of Regulatory Agencies. Since FDTC is not a

“bank” under the Bank Holding Company Act of 1956, as amended (BHCA), our affiliation with FDTC does not cause us to be regulated as a bank holding

company or financial holding company under the BHCA.

TeleCheck Payment Systems Limited (TPSL) in Australia holds an Australian Financial Services License under Chapter 7 of the Australian Corporations Act

2001, which regulates the provision of a broad range of financial services in Australia. The license, issued by the Australian Securities and Investments

Commission, entitles the Australian operations of TPSL to deal in and provide general financial product advice about its check guarantee and check

verification product and requires that TPSL’s Australian operations issue product documents that comply with specific content requirements and follow

prescribed procedures.

Further, in our International segment, several subsidiaries provide services such as factoring or settlement that make them subject to regulation by local

banking agencies, including the National Bank of Slovakia, the National Bank of Poland and the German Federal Financial Supervision Agency.

We provide services that may be subject to various state, federal, and foreign privacy laws and regulations,

including Gramm-Leach-Bliley Act and Directive 95/46/EC, the Australian Privacy Act, the Personal Information Protection and Electronic Documents Act

in Canada, the Personal Data (Privacy) Ordinance in Hong Kong, the Malaysian Data Protection Act 2010, and the Singapore Data Protection Act 2012.

These laws and their

13