First Data 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 First Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

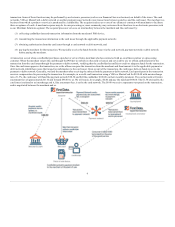

transaction. Some of these functions may be performed by an electronic processor (such as our Financial Services business) on behalf of the issuer. The card

networks, VISA or MasterCard, a debit network or another payment issuer/network route transactions between ourselves and the card issuer. The merchant is a

business from which a product or service is purchased by a cardholder. The acquirer (such as us or one of our alliances) contracts with merchants to facilitate

their acceptance of cards. A merchant acquirer may do its own processing or, more commonly, may outsource those functions to an electronic processor such

as our Merchant Solutions segment. The acquirer/processor serves as an intermediary between the merchant and the card issuer by:

(1) collecting cardholder data and transaction information from the merchant's POS device;

(2) transmitting the transaction information to the card issuer through the applicable payment network;

(3) obtaining authorization from the card issuer through a card network or debit network; and

(4) paying the merchant for the transaction. We typically receive the funds from the issuer via the card network, payment network or debit network

before paying the merchant.

A transaction occurs when a cardholder purchases a product or service from a merchant who has contracted with us, an alliance partner or a processing

customer. When the merchant swipes the card through the POS device (which is often sold or leased, and serviced by us), we obtain authorization for the

transaction from the card issuer through the payment or debit network, verifying that the cardholder has sufficient credit or adequate funds for the transaction.

Once the card issuer approves the transaction, we or the alliance acquire the transaction from the merchant and then transmit it to the applicable payment or

debit network, which then routes the transaction information to the card issuer. Upon receipt of the transaction, the card issuer delivers funds to us via the

payment or debit network. Generally, we fund the merchant after receiving the money from the payment or debit network. Each participant in the transaction

receives compensation for processing the transaction. For example, in a credit card transaction using a VISA or MasterCard for $100.00 with an interchange

rate of 1.5%, the card issuer will fund the payment network $98.50 and bill the cardholder $100.00 on their monthly statement. The card network will retain

assessment fees of approximately $0.10 and forward $98.40 to us. We will retain, for example, $0.40 and pay the merchant $98.00. The $1.50 retained by the

card issuer is referred to as interchange and it, like assessment fees, is set by the card network. The $0.40 we receive represents our spread on the transaction,

and is negotiated between the merchant and us.

6