Fannie Mae 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

FANNIE MAE 2003 ANNUAL REPORT

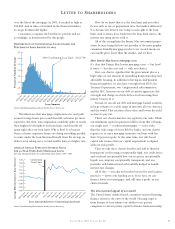

over the life of the mortgage. In 2003, it reached as high as

$26,800. And in times of turmoil in the financial markets,

it can go dramatically higher.

Consumers recognize the benefits we provide and act

accordingly, as demonstrated by this graph:

This illustrates that mortgage originations rise and peak

around average home prices and then fall, as homes get more

expensive. But then, loan originations suddenly spike to nearly

their highest levels right at our loan limit, and then fall off

again right after our loan limit. Why is that? It is because

buyers of more expensive homes are doing everything possible

to come under the loan limit and benefit from the savings we

deliver, even taking out a second smaller loan at a higher rate.

How do we know that it is the loan limit and not other

factors such as size or prepayment rates that make a difference?

It is because the interest rate jump occurs right at the loan

limit. And it always does. Each time the loan limit moves, the

interest rate jump moves with it.

All of this strengthens the Fannie Mae investment propo-

sition, because being the low-cost provider of the most popular,

consumer-friendly mortgage product ever created means we

can usually grow faster than the market, and we have.

How Fannie Mae lowers mortgage costs

It’s clear that Fannie Mae lowers mortgage rates — but how?

It starts — but does not end — with our charter.

First, our charter signifies that the government places a

high value on our mission of expanding homeownership and

affordable housing. In addition to having an independent

financial regulator, we also have oversight from HUD, the

Treasury Department, two Congressional subcommittees,

and the SEC. Investors in our debt securities appreciate this

oversight and charge us a little bit less for borrowing their

money because of it.

Second, we can sell our debt and mortgage-backed securities

in large volumes to a wide range of investors all over America

and the world. That increases their value and lowers the yield

we have to pay out.

Third, our charter matches our capital to our risks. While

our minimum capital requirement differs from that of banks,

our single asset — residential mortgages — is less risky

than the wide range of assets held by banks, and our charter

requires us to carry mortgage insurance on loans with less

than 20 percent equity. At the same time, our risk-based

capital rule insures that our capital requirement is aligned

with our risk profile.

Then we take these charter benefits and add to them by

keeping our credit ratings exceptionally high; our credit losses

and overhead exceptionally low; our securities exceptionally

liquid; our company exceptionally transparent; and our

portfolio well-balanced and substantially hedged to handle

interest rate changes.

All of this — our charter benefits boosted by our business

practices — lowers our funding costs. So in turn, we can

finance lower-cost mortgages, and still turn a profit, as our

charter intends.

The international appeal of our model

The United States’ market-based, consumer-oriented housing

finance system is the envy of the world. Housing experts

from Europe to Asia admire our ability to use private

companies to attract private capital to finance homeownership.

LETTER TO SHAREHOLDERS

2003 Conforming Loan Limit - $322,700

Source: Federal Housing Finance Board, Monthly Interest Rate Survey

Source: Federal Housing Finance Board, Monthly Interest Rate Survey