Fannie Mae 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER TO SHAREHOLDERS

2FANNIE MAE 2003 ANNUAL REPORT

Dear Fellow Shareholder: 2003 was the best year ever for the

American housing market and for the nation’s number one

source of mortgage funds to buy or refinance a home.

I want to review Fannie Mae’s 2003 accomplishments with

you, and also share with you how we go about delivering results

— to you and to the American home buyer.

An outstanding year for Fannie Mae and its mission

Here are some of the highlights of Fannie Mae’s core business

results for 2003:1

3Total business volume grew by 68 percent for another

new record of $1.423 trillion.

3Total book of business grew by over 20 percent

to $2.199 trillion.

3Core taxable-equivalent revenue grew to $14.8 billion,

up over 24 percent.

3Record core net interest income grew to $10.5 billion,

up almost 20 percent.

3Record guaranty fee income grew to $2.4 billion, up

nearly 33 percent.

3Core business earnings grew to $7.3 billion, up over 14 percent.

3Credit-related expenses totaled $112 million

compared with $92 million in 2002.

3Core business diluted earnings per share grew by

over 15 percent — our 17th consecutive year of

double-digit growth.

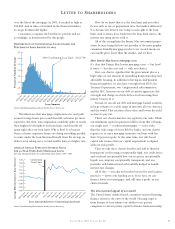

As these numbers indicate, 2003 was a very good year for

the financial bottom line at Fannie Mae. The strength of our

financial results is especially gratifying given the extreme

financial market volatility over the past year, with interest

rates declining to 45-year lows in mid-June before rebounding

sharply over the balance of the summer.

For Fannie Mae, however, our business success derives

solely from our success in achieving our mission of expanding

homeownership and affordable housing. By this measure as

well, 2003 was an extraordinary year:

3We achieved the top-line goals for our ten-year American

Dream Commitment plan by reaching over $2 trillion in

financing to serve over 18 million underserved families

since 2000. We also made significant progress on the

wide range of goals within the plan.

3We provided $1.4 trillion in financing to help a record

10.4 million families, including over $246 billion to serve

more than 1.6 million minority families. This brought

us over 70 percent of the way toward our $700 billion

commitment to the Bush Administration’s Minority

Homeownership Initiative.

3For the tenth consecutive year we met our affordable

housing goals, as set by the U.S. Department of Housing and

Urban Development (HUD), even though the record wave

of home refinancing in America produced a high volume

of business that included fewer underserved families.

The power of housing in the American economy

Our record-breaking business and mission performance was

driven by the strongest housing and mortgage markets in

U.S. history. Housing sales hit record levels; mortgage interest

rates fell to 45-year lows, fueling a flurry of refinancing; and

mortgage originations hit a stunning $3.7 trillion, more than

a 40 percent increase from 2002. Thanks in great part to

Fannie Mae’s technology-driven innovations, our industry

handled this unprecedented surge in business with aplomb

and housing continued to be the star of the national economy.

Fannie Mae is at the center of a vital sector of the nation’s

economy, and the sector is growing. Thanks in large part to

the growth of the secondary mortgage market over the past

20 years, housing has not only maintained its equilibrium

through a series of economic downturns, it has become the

economy’s ballast.

During times of economic stress, such as the global credit

crunch of 1998 and just after the terrorist attacks of

September 11, 2001, Fannie Mae was able to boost the flow of

capital, keeping the mortgage market going, and making

housing finance a force for stability and liquidity.

1Our core business measures are non-GAAP (generally accepted accounting principles) financial measures

we use to evaluate our performance. See “Management’s Discussion and Analysis of Financial Condition

and Results of Operations — Core Business Earnings and Business Segment Results” in the Form 10-K

included in this report for more information about these measures.