Fannie Mae 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FRANKLIN D. RAINES

Chairman and

Chief Executive Officer

3

LETTER TO SHAREHOLDERS

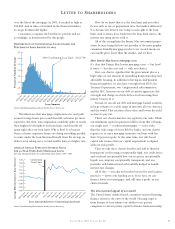

Over the past few years, when workers faced massive layoffs,

and the U.S. financial markets lost much of their value, housing

not only survived the recession, it softened its effect. Housing

construction stayed strong, offsetting job losses in other sectors.

Families were able to access the wealth in their homes to see

themselves through tough times, which boosted consumer

spending and supported the economy.

Consumers were able to cut hundreds of dollars from their

monthly payments and lock into the cheapest mortgage

money we have seen in decades. They also readjusted their

personal balance sheets by cashing out some of the home

equity wealth they built up as the value of their homes

increased to pay down other higher cost debt.

Since the beginning of 2000, the residential mortgage market

(measured by total residential mortgage debt outstanding) has

expanded by over 50 percent. At the same time, homeowners

have gained $2.6 trillion in home equity wealth — a gain that

helped to offset the $3.2 trillion equity loss in the stock market.

In 2003 alone, homeowners tapped into about $130 billion of

their home equity wealth. They plowed 60 percent of it —

about $80 billion — back into the economy by fixing up their

homes and spending on other goods and services.

What has made this massive refinance boom possible? The

secondary mortgage market in America and its power to provide

low-cost housing finance to consumers in all places, at all

times, under all economic circumstances. Everyone involved in

Fannie Mae’s success — including you — should be justly proud

of this accomplishment, helping put the power of housing to

work for both homeowners and the American economy.

The First Principles of Fannie Mae and our mission

Given Fannie Mae’s unique role in the U.S. housing sector, the

mortgage industry, the financial markets, and in the plans of

American home buyers, it is important for us to return from

time to time to what I call the First Principles of Fannie Mae:

to describe to the world who we are, what we do, how we do

it, what are the results, and why they are important — to you

and to the country.

This back-to-basics approach is particularly relevant and

useful right now as Congress considers legislation to strengthen

the financial regulator of Fannie Mae and our competitors,

Freddie Mac and the Federal Home Loan Banks.

Fannie Mae has made clear that we support having a strong,

credible, well-funded regulator because it is in the best interests

of housing, home buyers, and our company. At this writing,

Congress is still working on legislation. I believe any remaining

issues regarding our new regulator are bridgeable. I also believe

that the best way to build that bridge (and avoid harmful

unintended consequences) is to make sure that all of us —

investors, regulators, legislators, and employees — have a

sound understanding of the fundamentals of the secondary

mortgage market.

My goal is to give you, our investors, a greater understanding

of the Fannie Mae investment proposition — and to give

you a framework for understanding — and explaining — the

Fannie Mae public policy proposition.

Principle I: Fannie Mae is a private company

with a public mission

Fannie Mae is a purpose-driven company. All that we are, all

that we do, and all that we seek to become revolves around

an elementary proposition: that owning a home is a defining

element of the American Dream.