Fannie Mae 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREHOLDER VALUE

14 FANNIE MAE 2003 ANNUAL REPORT

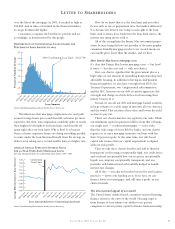

Our strong capital position is a function of our core capital,

allowance for losses, and outstanding subordinated debt.

Core capital, which excludes the accumulated other compre-

hensive income component of stockholders’ equity, rose to

$34.4 billion at December 31, 2003. Core capital is the basis for

the company’s statutory minimum capital requirement. In 2003,

Fannie Mae fulfilled its Voluntary Initiative to strengthen the

company’s capital adequacy and further assure investors that

Fannie Mae is one of the best-capitalized financial institutions

in the world relative to the risks we take, by completing the

issuance of $12.5 billion of subordinated debt. Subordinated

debt serves as an important supplement to Fannie Mae’s

equity capital, although it is not a component of core capital.

Our Strengthened Capital Position

Fostering Shareholder Returns

Continuing our record of annual dividend increases, Fannie Mae

increased the dividend on its common stock by 27.3 percent,

from $1.32 in 2002 to $1.68 in 2003. This marks the 19th

consecutive year in which we have increased our dividend

and reflects the Board of Directors’ confidence in the

strength and sustainability of Fannie Mae’s business

performance.

Fannie Mae’s Board of Directors authorized the repurchase

of up to 5 percent of the total shares of common stock

outstanding as of December 31, 2002. In 2003, we repurchased

21.3 million shares of common stock and expect to complete

the balance of the repurchase authorization within the

next two years.

*Includes net unamortized outstanding subordinated debt associated with October 2000

Voluntary Initiative. Issuances prior to 2001 have been excluded.

Our first priority is to reinvest earnings so we can fulfill our mission

to provide liquidity to the residential mortgage market. We also maintain

a healthy cushion of capital above our minimum and risk-based capital

requirements. Once those priorities are met we return capital to our

shareholders through a combination of dividends and share repurchases.