Fannie Mae 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREHOLDER VALUE

12 FANNIE MAE 2003 ANNUAL REPORT

Powered by the unprecedented demand for housing credit in America,

Fannie Mae delivered exceptional growth and financial performance in

2003, while taking significant steps to further strengthen our financial

and risk disciplines and to position our company for the future. Our

2003 financial results, and our performance during the past decade that

you see reflected in the following exhibits, clearly demonstrate the

disciplined approach to growth that continues to define our company.

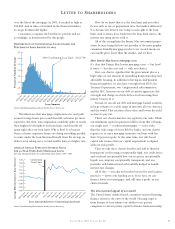

Our Outstanding Mortgage-Backed Securities (MBS) balance

has grown at an annualized rate of nearly 11 percent during

the past decade, to approximately $1.3 trillion at year-end

2003. In recent years, our balance of Outstanding MBS

has grown rapidly as lower mortgage rates have spurred a

tremendous wave of mortgage refinancings. In 2003,

outstanding MBS grew by 26.3 percent.

*MBS held by investors other than Fannie Mae.

The tangible benefits that we deliver to the nation’s home-

owners have translated into strong and consistent growth in

our book of business — gross mortgage portfolio plus

outstanding mortgage-backed securities we guarantee that

are held by other investors. During the past decade, our book

of business has grown from $661 billion to nearly $2.2 trillion

— representing a compound annual growth rate of

approximately 13 percent. In 2003, our total book of business

grew by 20.6 percent, as historically low mortgage rates

spurred record refinancing activity.

The Growth of Our Business

Our gross mortgage portfolio has grown at an annualized

rate of nearly 17 percent during the past decade, to approxi-

mately $898 billion at year-end 2003. We follow a disciplined

approach to growing our portfolio — purchasing mortgage

assets when supply is available in the market and when the

spreads between mortgage yields and our funding costs are

favorable. In 2003, our portfolio grew by 13.1 percent.